Trade outlook 2023: slow steaming in rough waters

After a bumpy year, 2023 could prove to be even more challenging for global goods trade with consumer demand faltering, oversupply returning, and the energy and subsequent inflation crisis persisting. But the supply chain pain is expected to ease and shipping a container will be cheaper

Global trade growth held up well in 2022, before entering the slow lane

So far this year, global merchandise trade has held up extremely well given the volatile and uncertain environment, with world goods trade standing at 4.7% year-to-date (January to July) according to CPB world trade data. Despite households worrying about the rising cost of living and the end of lockdowns, which resulted in a shift back to services and travelling, consumers’ appetite to spend on physical things was still running high in the first half of the year compared to the previous year.

Looking at the details, the eurozone and the US registered YTD growth of around 6%, while the UK figure was in double digits, thanks to an extremely low comparative base of 2021. Emerging economies registered a solid growth rate of 4.1%. Only Eastern Europe/CIS and China’s YTD growth figures were in negative territory with the former being especially hampered by the war in Ukraine and the latter suffering from Covid lockdowns. Although we expect the rest of the year to result in subdued goods trade, global trade will still likely see a growth rate of 3.8% this year, far better than we had expected back in April and much closer to our initial call of 4.1% in January.

Resolved congestion at US bottleneck port illustrative of supply chain relief

Slowing consumer demand is bringing relief to global supply chains. After an unprecedented wave of incoming containers, leading to record throughput and peaking congestion in dominant US container gateway LA-Longbeach in early 2022, volumes trended down. With operations fully resumed after Covid, the impressive backlog of waiting vessels was quickly reduced and almost cleared in September. To avoid new supply chain disruptions and build resilience, shippers in the US increased their inventories to relatively high levels in the first quarter of 2022, according to the logistics managers index. They also started ordering early for the holiday season, which flattened the traditional peak season (the third quarter). At the same time, consumers shifted back to services and started to cut spending on goods. This created a ‘Bullwhip effect’ of self-reinforcing inventory moderation across the supply chain which drove volumes down. Consequently, the 12-month rolling TEU-throughput has slipped into negative territory. And this could continue for a while. The slack in spending on goods (or normalisation) is also reflected in the parcel delivering figures of FedEx and other delivery companies. Moreover, global air cargo volume – known as an early indicator for consumer products demand – has also slumped since early 2022, showing a 5% decline YTD after an initial strong recovery in 2020 and 2021.

Container influx in the US bottleneck port of LA is over

Container throughput (TEU) in port of Los Angeles (12-month rolling average YoY)

But congestion and delays won’t completely end before 2023

Although major ports, including US-bottleneck LA-Long Beach and Shanghai, have managed to get through unprecedented backlogs, there is still a long way to go before global congestion eases. In the US, more ships are directed to the East Coast and elsewhere, diverted to smaller ports which still see more delays. This is also the reason why transatlantic container rates are at more elevated levels. Ocean timelines of cargo ex-works until the port of destination have improved since their peak at the start of 2022, but they still hover around double the pre-pandemic lead times of around 80-90 days. This also means that arrival performance has a long way to go to return to normal levels. Since May, global schedule reliability, tracked by Sea Intelligence, has embarked on a cautious recovery path, standing at 46.2% in August. However, this is still a far cry from the 2018-19 average of 74%. Some 7% of the fleet is stuck queuing up in ports around the world, with 11% of goods still being blocked on waiting container ships.

Falling container rates mark a turning point in transport and trade costs

Softening demand has sent spot rates on the major trade lanes down, ending an extraordinary two-year period in container shipping. Spot rates have been coming down for longer on the main trades from Asia, but higher contract rates and an initiated shift to longer-term contracts by container liners pushed average transport costs for larger shippers up in the first half of 2022. Mid-year, Maersk had 71% of shipments fixed in long contracts. Nevertheless renegotiated contracts have likely reached a turning point as well. And with falling average global earnings for vessels, the mixed bucket of tariffs for shippers is now beyond its peak, and with the economic headwinds, the balance could quickly shift. Smaller shippers now benefit the most from lower tariffs as they are usually dependent on the spot market. Dry bulk rates have also weakened, although they still hover above pre-pandemic levels. Yet, contrary to the container market, tanker rates have rallied after a difficult pandemic phase with lower oil demand – with the Ukraine war having severe implications for the oil and tanker market.

Container spot rates on major trade lanes have plummeted

Development port-to-port containerised freight tariffs in $ per FEU (40ft container)*

Overall, global supply chain pressures have come down from the peak registered in December 2021, but are still some way off their average level, meaning that supply chain uncertainty is still an everyday reality for the rest of 2022. Shippers have anticipated that.

| 1.2% |

Expected growth in merchandise world tradeyear-on-year, 2023 |

Our outlook for 2023: receding demand meets over-supply

The current market moderation is expected to spill over into 2023. With recessionary scenarios running high, we don’t expect world trade to exceed 2% next year and are pencilling in a subdued growth rate of 1.2% for global goods trade. This falls behind expected GDP growth. With 1) consumer demand faltering, 2) the energy and subsequent inflation crisis persisting, and 3) ongoing labour and material shortages, there are simply not enough silver linings to keep global goods trade robustly flowing. Energy prices are very likely to remain high, burdening companies’ cost competitiveness and households’ purchasing power, despite government compensation packages.

Growth in world trade will stay slightly behind world GDP in 2023

Global goods trade volume (% YoY)

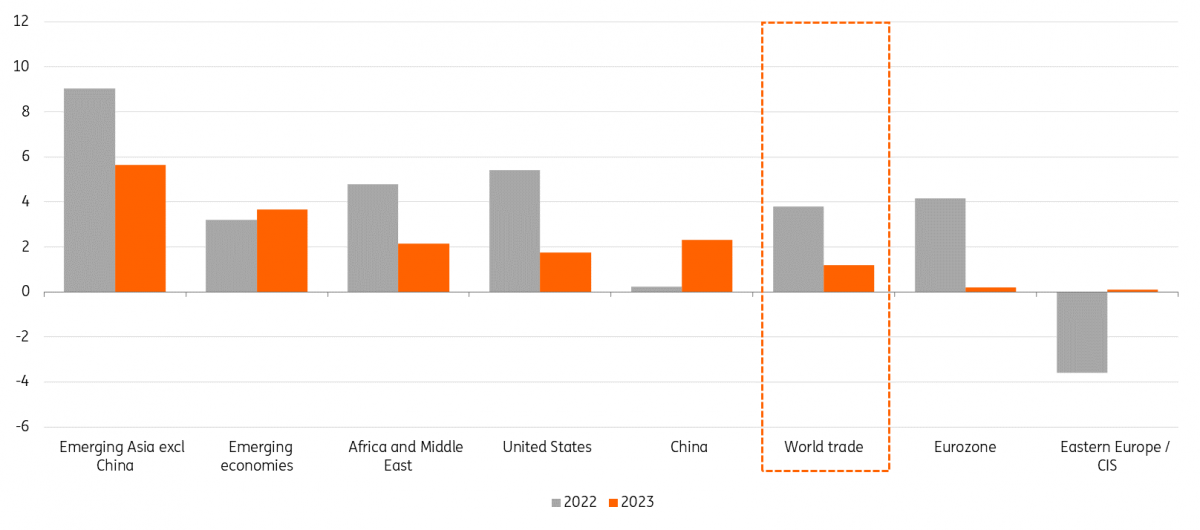

US and European demand-side weakness tempers expectations, while Asia holds up better

Although governments around the world are trying to support the demand-side with large fiscal stimulus packages, the uncertainty around the final energy bill in Europe, tightening credit conditions in the US, and a subdued growth environment in China do not speak in favour of robust demand. Consumers face economic uncertainty and the strong dollar has led to more expensive cross-border shopping in China. The European picture shows similarities, as European consumer confidence has tested new lows amid the energy crisis. While consumer spending in the US held up relatively well in 2022, we expect it to fall in 2023 due to rising interest rates resulting in ever-tighter credit conditions and rising unemployment, further weighing on demand.

Consequently, trade in consumer products is expected to stick below growth averages next year. On the industrial side, sliding new export orders (PMI) also indicate a slowdown, with Europe in the eye of the energy storm. Order books, while still reasonably filled, are declining. Meanwhile, trade in Asia might fare better than elsewhere next year with the region better able to weather disruptions. Intra-Asian trade has proved robust with many companies reorienting and diversifying their business activities towards Asia excluding China. Once again, we expect intra-Asian trade to show higher growth rates than overall trade.

Global energy supply remains tense

The winter season of 2023/24 could prove more challenging for gas supplies with minimal Russian gas flows. Therefore, building inventories will become more challenging next year, leading to gas prices rising to 200€/MWh. The EU ban on Russian oil comes into force on 5 December, followed by a refined products ban on 5 February, which might lead to a decline in the Russian oil supply. If insurance and shipping firms are stopped from providing transportation of Russian energy products above the agreed-upon cap by the G7, the international energy supply will automatically be curtailed and global trade patterns will shift. Although other large tanker ‘flag states’ like Liberia and Panama could step in by taking the leading role in transporting Russian oil around the world from Greece, Cyprus, and Malta, this shift won’t come without obstacles. In addition, China and India are wary of the risk of secondary sanctions, which might limit their appetite for Russian commodity products next year.

Ongoing labour and material shortages persist

There is a significant risk of strikes and labour negotiations in the transportation sector due to spiking inflation and eroding purchasing power. Strikes in all parts of the world this year, such as in the US, UK, Germany, South Africa and South Korea have made the transport sector hold its breath. And the war in Ukraine remains a downside risk. As we’ve written previously, 10.5% of all seafarers come from Russia and 4% from Ukraine, according to the International Chamber of Shipping. With Russia possibly announcing a full mobilisation, already persisting shortages of sailors could, in theory, intensify. Then, new Covid-19 lockdowns in China might return in 2023. Although restrictions have tended to become shorter and more focused, activity will be impacted nonetheless. As a result of the persistent zero-Covid policy, congestion in Chinese ports increased significantly this year, with container dwell times on the import-side soaring due to difficulties with inland connections and closed factories in the region. This creates production backlogs, leading to a wave of export traffic through the port later and affecting global ports and sailing schemes as well.

Expected growth of trade in goods volume by region

(% YoY)

Continued recovery of oil product flows support trade in 2023

More than 80% of world trade is seaborne. The breakdown in typical flows shows a mixed picture but is expected to sum up to just above 2% year-on-year in 2023 in terms of tonnage. This exceeds our forecast for world goods trade (in value), which can be explained by the fact that the energy crisis leads to more seaborne transport of energy carriers (like liquefied natural gas [LNG]). Next to that, airfreight carries mainly consumer goods, which has a more moderate outlook.

Demand for oil and oil products is continuing to catch up after the pandemic setback and this is expected to continue in 2023, although the economic slowdown will weigh on demand. The European urgency to replace piped natural gas is also leading to a rush for seaborne LNG flows, but in terms of trade this is mainly a replacement of piped gas.

On the container side, the inflationary environment with eroded purchasing power continues to temper demand for consumer goods in 2023, with growth sticking under 2% which is well below its long-term average. For dry bulk flows, 2023 is set to be a better year as industrial demand from China (particularly important for iron ore) is expected to catch up. On the other side, demand for coal from Europe continues to be strong and hampered grain trade due to the Black Sea blockage in 2022 is assumed to be less disturbed.

Liquid bulk container increases, containers slow, and dry bulk catches up in 2023

Forecasted seaborne trade by segment in metric tonne, YoY

2023 balance and rates: clearing backlogs and new capacity put extra pressure on container tariffs

Next year we won't see another shortage in container shipping, as subsiding backlogs will boost productivity and a flood of new vessels will come online from 2023 amid a weakened market. Twenty-eight percent of the current installed fleet capacity is on order and just under half of that is expected to be delivered over the course of next year. This obviously threatens to accelerate the downward trend in spot prices. But container rates will not go down the drain, for these three reasons (in addition to the strong dollar):

1. Better capacity management

During the pandemic, container liners and alliances learned how to better manage capacity cancelling and cooperate in alliances, by cancelling scheduled sailings (blank sailings), (super) slow steaming, and scrapping less efficient older-generation vessels. During the previous two periods, scrapping numbers were extremely low and new IMO energy efficiency and intensity standards from 2023 (also turning into a vessel rating) will have an influence on this perspective.

2. Increasing operational costs and larger capital investments

Second, costs are higher in general due to increases in compliant fuel, port and infrastructure fees (for example, the Suez Canal rate hike of 15%) and wages. Next, ordered dual fuel and new-generation vessels require larger capital investments. And alternative fuels like LNG, biofuels and methanol are more costly. Lastly, more regulation is coming: in Europe, shipping is proposed to be included in the emissions trading scheme (ETS) as part of the new climate strategy, and the FuelEU Maritime proposal prescribes an annual reduction of the carbon-intensity of existing ships by 2% in 2025 which leads to the increased use of more expensive low carbon fuels. On a global scale, collectives including the getting to zero coalition and cargo owners for zero-emission vessels are also pushing for low-carbon solutions from 2030. The bottom line is, the cost base will be higher.

3. Global supply chains are still fragile and exposed to volatility, leading to fragile supply chains

Third, the war in Ukraine has disrupted the market, leading to trade inefficiencies such as longer routes. The workforce is also still stretched and spiking inflation could lead to more strikes and interruptions at ports. Lockdowns are still a local disruptive threat in China, while extreme weather events are a bigger operational risk in shipping. This means costly frictions remain a threat.

Extreme weather is considered a bigger threat for supply chains than it used to be

For the second time in only four years, low water levels in Germany’s main rivers have seriously threatened economic activity, with most of the goods transported being intermediate goods and raw materials that are required for further processing in other industries and are preferably transported by ship, including bulk goods such as coal and steel, dangerous goods and heavy goods. In the US, falling water levels in the Mississippi River are currently log-jamming more than 100 vessels. In China, heatwaves and little rainfall have caused drought in the southwestern Chinese province of Sichuan, a hydroelectric power producer. Some factories in western China have been affected by limited-to-no-power supply, shopping malls have little air-con and lighting, and some apartments have been left without a working lift. Extreme weather events are becoming an ever-larger threat to the transportation sector, seriously affecting supply chains and hampering world trade. With extreme weather events on the rise, weather forecasts represent a disruptive threat urging resilience in global supply chains.

All-in-all, trade is slowing, and amid the volatile and fragile global environment, normality in global supply chains is still way off as we approach 2023.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more