Thermal coal heats up

Since April, the seaborne thermal coal market has seen quite the move, with Newcastle rallying 16% back towards US$110/t with stronger Chinese demand being a key driver. However, with Chinese production growth expected over the latter part of the year, we believe the upside is limited

China drives the market higher (again!)

Stronger Chinese demand has been behind the recent strength that we have seen in the seaborne market, with warmer than usual weather, and so the need for increased cooling demand. This strong demand, along with the Chinese government's steps to limit imports in mid-April, was bullish for domestic coal prices. These import restrictions were meant to drive a divergence between the domestic market and the Asian seaborne market, and this is initially what happened. Imports over April also fell 10% year on year to 22.3mt. However, since the end of April, the seaborne market has followed the Chinese market higher, and this suggests that these import restrictions have already been relaxed.

The Chinese government continues to target a price range of CNY 500-570/t, and currently, domestic prices are trading well above this level. So it's no surprise that we have seen an easing in import restrictions, with the aim of improving domestic supply.

China is set to take a step back from the seaborne market, which should put pressure on Newcastle

The Chinese government has also taken other steps, in the hope of bringing domestic prices lower. These include putting pressure on buyers not to purchase in the spot market, and instead move towards long-term contracts, increase domestic production by releasing high-quality capacity, improve rail logistics, and lower coal consumption. The aim over 2018 is to increase domestic production by 300mt, supported largely by new capacity in Inner Mongolia and Shaanxi. Meanwhile, the government continues to work towards its plan of replacing coal-powered home heating with natural gas, along with small industrials moving away from coal-powered boilers to either the power grid or gas.

As a result of these steps, particularly the expected increase in production means that China is set to take a step back from the seaborne market, which should put pressure on Newcastle, while also leading to a narrowing in the Newcastle-API2 spread.

The government has blamed much of the recent rally on speculation, rather than fundamentals. But speculators have stepped in because of the positive fundamentals and have likely exaggerated the move higher.

The daily volumes on the Chinese domestic thermal coal futures (ZCE) have picked up significantly recently, suggesting an increase in the number of active day traders in the market. Daily average volumes have increased from less than 400,000 lots at the end of April to more than 800,000 lots currently.

ZCE thermal coal contract (volume vs. price)

Indian imports grow

It’s not just China. There are concerns, power generators in India are facing acute shortages, with Coal India output continuing to fall short of targets.

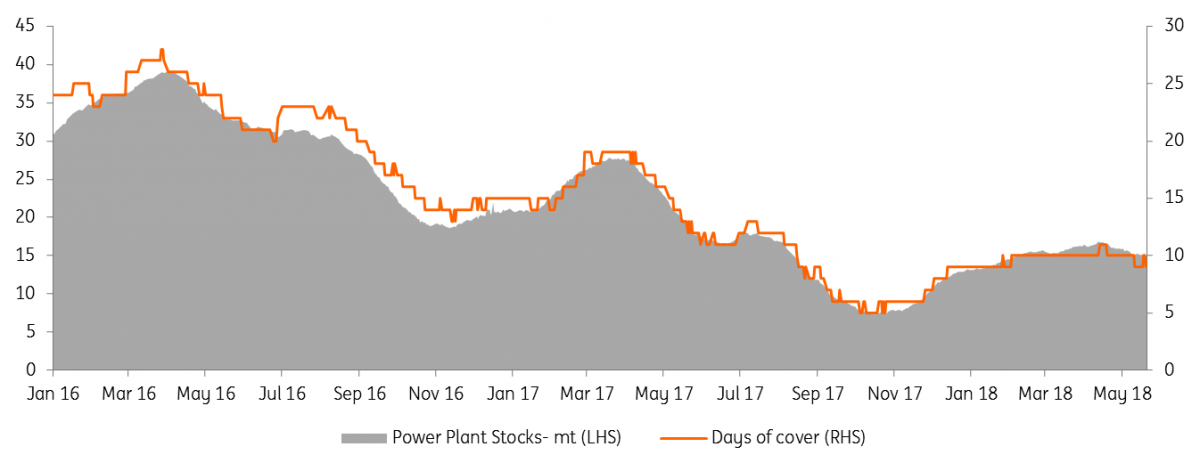

Stocks at power plants stand at 15mt, which covers just ten days of demand, and down 45% from April 2017. India this year has had to turn more to the seaborne market. Imports increased 15% YoY over 1Q18 to around 40mt. However India, which usually takes South African coal has had to look elsewhere for supplies, with South African power generator, Eskom having faced its own shortages, with issues at the Gupta family-owned mines (Tegeta). This domestic disruption in South Africa is why we have seen a strengthening in the API4-API2 spread.

Therefore India has had to turn increasingly to Australia as well as the US for its thermal coal needs.

India power plant coal inventories

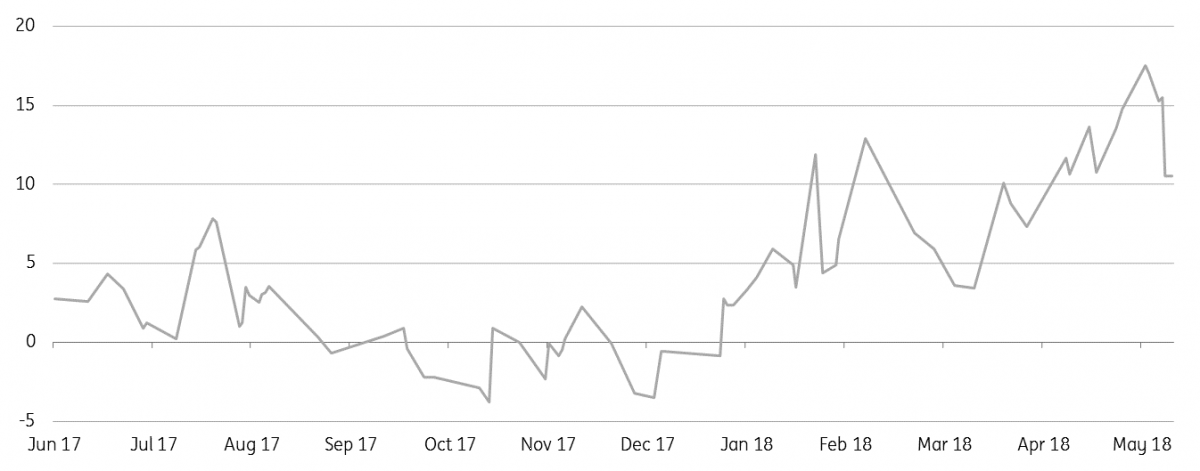

API4-API2 spread (US$/t)

Stronger EU carbon price poses downside risk to coal

It’s not all Asia driven, API2 has also received some support from lower Colombian output. Over 1Q18 output from the country fell 11.7% to 19.6mt, on the back of weather-related reductions, reducing flows for Europe. Furthermore, with the spot Newcastle-API2 spread at US$14/t, there should be an incentive to increasingly direct Colombian flows to Asia rather than Europe. South Korea imported 468kt of Colombian coal in April, up from less than 2kt in the same month last year.

While strength in European natural gas prices has also helped API2 out, this was particularly the case earlier in the year, however as we move through summer, natural gas prices in Europe should fall with lower heating demand, and inventory refills. This should mean natural gas offers less support to coal prices moving forward.

Additionally, we continue to see a strengthening in European carbon prices, and this is making it increasingly more expensive for power generators to burn coal. For now in most markets (except the UK) the clean dark spreads are still more attractive than the clean spark spreads, however, with natural gas prices expected to weaken over the summer, this could very well change.

Dutch dark-spark spread (EUR/MWh)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more