The US economy is storming ahead

The ISM non-manufacturing figures are astonishing and we reckon not much will stop a December rate hike

| 59.8 |

ISM non-manufacturing indexHighest for 12 years |

| Better than expected | |

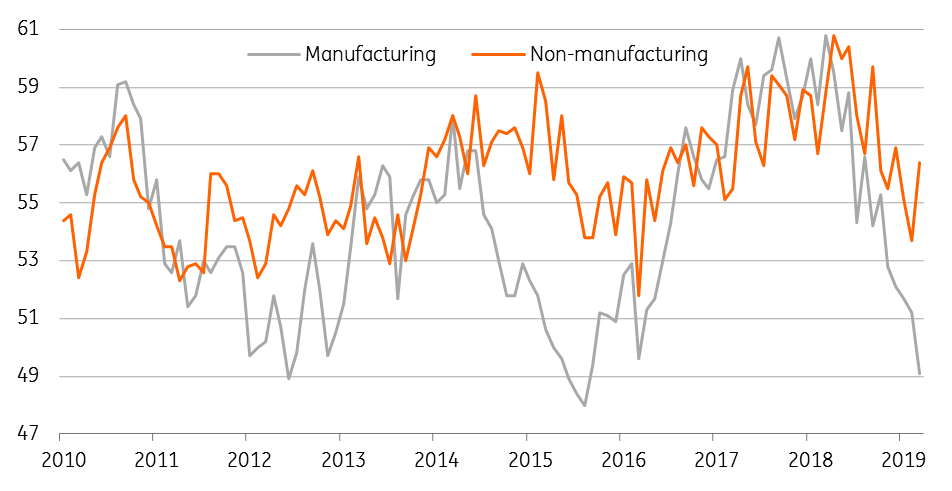

Monday’s ISM manufacturing index was fantastic – the highest reading for 13 years - and the non-manufacturing ISM index isn't far behind. It has jumped from 55.3 to 59.8 – the strongest reading in 12 years. Admittedly this jump is partly down to a rebound from the recent hurricanes, but the strength clearly evident in the details of the report underlines the point that the US corporate sector is in great shape. A strong domestic economy is driving output and new orders while a fairly soft dollar and strong global demand are boosting exports.

The non-manufacturing survey shows business activity jumping five points while new orders jumped six points – the index has only been higher on two occasions in the past twelve years. Employment is also looking very strong at 56.8 versus the 50 break even level, which gives us confidence to assert that any softness in Friday’s payrolls report relating to hurricane effects will be swiftly reversed in coming months.

As such today’s report reinforces our view that the only thing stopping a December Federal Reserve interest rate hike is the potential for debt ceiling issues coming to a head, risking a government shutdown around year-end. Inflation wise, the price paid component indicates that the decline in inflation rates seen through this year will soon come to an end and the Fed is right to assert that disinflation was merely transitory.

ISM surveys show strngth of the economy

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more