The UK data that will make-or-break a May rate hike

Barring unpleasant surprises in either the wage growth or service sector inflation numbers due over the next week, we think the Bank of England is more likely to keep rates on hold when it next meets on 11 May

A raft of economic data due over the next week may well decide whether the Bank of England (BoE) hikes rates by another 25 basis points in May. So far, Bank officials have largely refused to be drawn either way, and the most recent March meeting kept the range of options wide open.

Formally, the Bank has told us that any further tightening could be needed if we see fresh signs of “inflation persistence”. Officials generally felt that the test had been met by the time of the March meeting, where they hiked rates by 25bp. Nevertheless, the data is clearly moving in the right direction, and we think barring some unwelcome – and unpredicted – surprises in next week’s data, the Bank will be comfortable in keeping rates at 4.25% on 11 May.

With policymakers emphasising that much of last year's tightening is still to hit the economy, the BoE is undoubtedly one of the more likely candidates to follow central banks in Canada and Australia into a pause.

Here's what we’re looking out for in the data over the next week:

Key data due next week

Jobs and wages (Tuesday)

The UK jobs market is cooling, albeit slowly. The number of employers proposing redundancies has climbed so far this year, and vacancy numbers have fallen – though the number of vacancies per unemployed worker is not far off one-for-one and remains well above pre-Covid levels.

Admittedly, the jobs market is not the place to look for timely indications of economic weakness – the redundancy rate took around 18 months to go from trough to peak during the financial crisis. Still, the question for the Bank of England – and posed by Chief Economist Huw Pill this week – is whether wage growth will come down materially even without a marked deterioration in the jobs market.

For now, the data suggest it might. The Bank’s closely-scrutinised Decision Maker Panel survey of chief financial officers shows an easing in wage growth (as well as price) expectations, and also a marked reduction in the proportion of firms experiencing acute labour shortages. The official wage data have also finally started to turn, and regular weekly pay has increased by £1 on average over the past two months of data, compared to a rate of £3-4/month through much of 2022.

Wage growth momentum has begun to ease

Something similar next week would take the 3M/3M change (ie the average of the past three months' pay level relative to the three months before that) to roughly 4.5% on an annualised basis, down from close to 8% at the tail end of last year.

That would be a clear dovish signal for the Bank, though there’s still an open question of how quickly wage growth will ease back even if it has finally peaked. We aren't convinced that the root causes of recent worker shortages have gone away – worker inactivity remains high. While recent pay trends are at least consistent with ending the Bank's tightening cycle, a relatively glacial return of wage growth to target would argue that rate cuts may be less forthcoming.

Inflation (Wednesday)

Headline inflation looks set to dip back into single digits next week for the first time since August, and we’ll get a more pronounced decline in April as the impact of last year’s energy price hikes begins to filter out of the annual comparison. But when it comes to the BoE’s focus on “persistence”, it’s clear that services inflation is the most relevant metric for the interest rate outlook. We’ve shown in a previous article that service sector inflation is typically less volatile and exhibits more long-lasting trends than many goods categories.

The data here has been volatile over the past couple of months, but our best guess for next week is that we get a fractional increase in the rate of service sector inflation. The Bank of England has said it thinks it will stay broadly unchanged in the short term – and therefore we think it would take a material upside surprise to nudge the odds in favour of another rate hike in May.

Service sector inflation is probably close to peaking

Either way, we’re almost certainly close to a peak. The major contributor to services CPI over the past few months has been catering, but signs of reduced wage pressure and – more importantly – much lower gas prices suggest the situation should start to improve. Recent ONS surveys have shown that high energy bills were a much more commonly-cited factor behind recent service sector price rises than labour costs – and we think the same is likely to be true in reverse now gas prices have collapsed.

We think services inflation could end the year around 4.5%, down from roughly 6.5% now but still some way above pre-Covid averages of 2.5-3%. As with wage growth, this tends to suggest the BoE won't be as quick to cut rates as say the Fed, where we expect policy easing before year-end.

Retail sales/PMIs (Friday)

The Bank’s focus on inflation means activity data has assumed much less prominence in the decision-making process. And in any case, recent data have not exactly been clear on the underlying economic trend. Monthly GDP data have been unhelpfully volatile due to an eclectic mix of one-off factors ranging from strikes to the recent World Cup. In practice, the economy seems to be flatlining, and that’s also likely to be the sense from next week’s retail sales numbers.

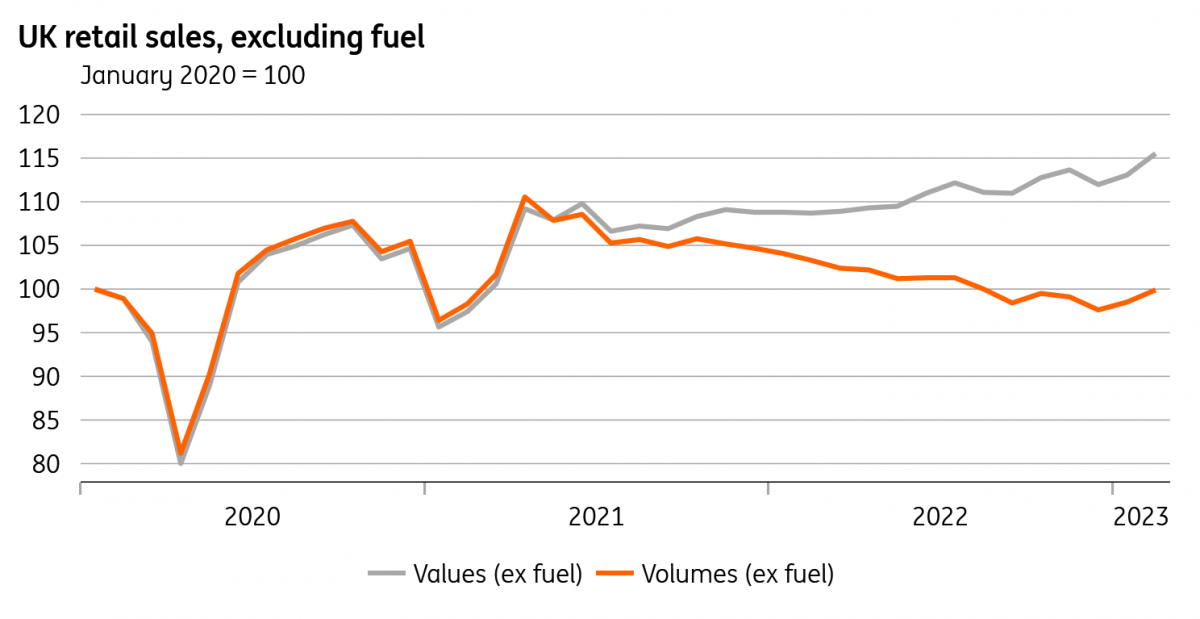

UK retail sales might be bottoming out

After a stronger run so far in 2023, we’re likely to see a modest pullback in sales, though with energy prices set to dip from the summer and consumer confidence off the lows, the worst for the retail sector is probably now behind us.

Next week’s PMIs are also likely to be consistent with the relatively stagnant economic backdrop.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more