The battered Scandies

A mix of disappointing domestic data, a stronger EUR and concerns about the local housing market, all suggest the NOK and SEK will remain lower for longer

The Swedish and Norwegian Krona (SEK and NOK) are going through significant weakness, with both currencies down against the EUR by around 2% over the past two days.

This is due to a mix of disappointing domestic data, a stronger EUR and sharply rising local housing market concerns. The latter in particular and its implications for the central banks’ stances suggests lower NOK and SEK for longer versus our current forecasts.

Both NOK and SEK will struggle to fully recover after the sell-off in the upcoming months. Into the year end, we prefer NOK over SEK, given the likely less dovish December Norges Bank meeting versus a more dovish Riksbank meeting.

EUR strength and disappointing domestic data

The recent EUR strength is indeed a part of the story. The EUR is up against other G10 European currencies as well as CE3 FX ( Czech, Hungary and Poland) over the past two days but the bad domestic news underpinned the Scandinavian currencies underperformance. That is largely due to the disappointing break-down of the Norway Q3 GDP (soft domestic consumption and investment) and lower than expected Swedish CPI. This turned NOK and SEK into the European FX underperformers.

The housing market conundrum

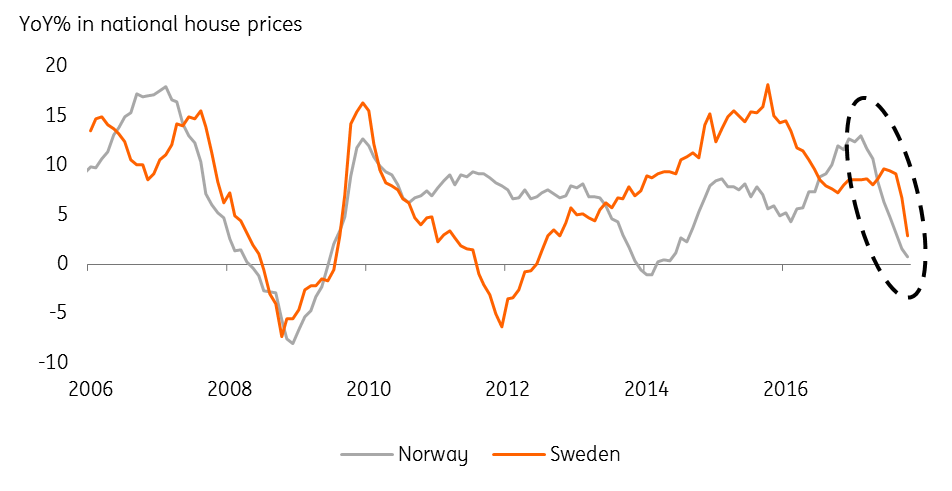

Adding to this, we observe a theme of falling house prices emerging in both Norway and Sweden, with the October Swedish house price data recording the largest month-on-month decline since 2008. This raises not only macro-prudential risks and concerns about the long observed and well-flagged Scandinavian housing bubble but also has important implications for domestic monetary policy – raising the probability of a further delay in the eventual policy normalisation.

The main reason for the decline in Sweden and Norway's house prices appears to be the fact that supply has finally caught up with demand

Over the past five years, new housing completions have roughly doubled in both markets, and new housing starts are up nearly 300% in Sweden. At the same time, macro-prudential measures are constraining buyers. The Swedish housing market, in particular, looks wobbly, with prices falling nearly 5% in the last two months.

For the Riksbank, and given the lower for longer open-ended European Central Bank QE, this suggests a materially lower likelihood of a deposit rate hike in 2018. In turn, this limits the SEK upside potential as the market will push out expectations for the first rate hike. The lower for longer Riksbank’s negative deposit rate means that SEK will retain the cheapest funding cost, after the safe-haven CHF in the G10 FX space, which again does not bode overly well for the currency’s prospects.

Synchronised decline in house prices

Concerns in place, but Scandies look to have overshot

As we write our 2018 FX Outlook, we put our Scandinavian FX forecasts under revision following the recent moves. While at this point further weakness cannot be ruled out we don’t want to pencil in further and persistent SEK and NOK declines.

This is partly because the scale of the recent fall looks like an overshoot, suggesting a fair degree of bad news already priced. As shown below, EUR/SEK is now trading meaningfully above the levels deemed as fair by our short-term financial fair value model. In terms of NOK, the cross materially decoupled from the oil price.

Attractive SEK funding costs

SEK and NOK outlook: Lower for longer

Given the central banks, are unlikely to provide a catalyst for a monetary policy induced FX strength while the current concerns about the local housing market should remain in place, the scope for a meaningful SEK rebound over the next six months may be limited. The cross looks unlikely to break below 9.70 level this year, particularly if the Riksbank further flattens out its interest rate forecast at the December meeting and delays the start of the hiking cycle. The EUR/SEK 9.50 level should act as a solid and persistent support for most of 2018.

For NOK, our commodities’ team view a limited upside to the oil price from here and some scope for a decline following the oil price rally of the past two months. This means that any pricing out of the EUR/NOK risk premia may be somewhat shallow, suggesting that the eventual post sell-off stability levels will be higher compared to the pre-sell-off starting point. The below EUR/NOK 9.00 levels of 1Q17 seems off the table, and EUR/NOK will most likely struggle to move below 9.20 during 1H18.

In line with the ECB lower for longer QE, both NOK and SEK, even after the likely correction higher, following the recent somewhat exaggerated sell-off, should remain low for longer (vs our current under-revision forecasts) reflecting the rise of concerns about the housing market and the idiosyncratic factors (persistently dovish Riksbank and the risk of some modest decline in the oil price in coming weeks). To be sure, we will be actively looking for short EUR/NOK and EUR/SEK entry points (as the recent sell-off looks overdone) but the target levels will be higher compared to our previous expectations.

EUR/SEK looks to have overshot

Percentage residual between EUR/SEK fair value and spot - a gauge for risk premium

Favouring NOK over SEK

On a relative basis, we see more upside to NOK during the remainder of the year as the 14th December, Norges Bank meeting is likely to deliver an upward revision to the current interest rate forecast due to the mix of NOK weakness and higher oil price.

In contrast, the Riksbank should further flatten out its interest rate forecast at the 20th December meeting, due to lower CPI and the housing market concerns.

The non-negligible likelihood of another QE extension in December should also limit the scope for SEK recovery (vs NOK). The relative NOK vs SEK outperformance should be supported by the somewhat better housing market in Norway vs Sweden – there may well be more bad news to come in Sweden, while the decline in Norwegian prices has been gentler and concentrated in the Oslo market.

We expect NOK/SEK to re-test the November high of 1.0354.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).