The Bank of England’s May dashboard

We expect the Bank of England to keep the door ajar to further tightening on Thursday, and there's a chance that one or two committee members vote for a rate hike this week. In reality though, we think the chances of a rate hike this year have receded, with growth set to remain capped by ongoing Brexit uncertainty

Four Bank of England scenarios for the May meeting

In a nutshell: Brexit delay unlikely to spur the BoE into action just yet

We expect the Bank of England to keep the door ajar to further tightening at its meeting on Thursday, although in reality the chances of a rate hike this year have receded.

The six-month Brexit delay means the threat of a ‘no deal’ has been postponed, but will come back into focus as the new October deadline approaches. With the chances of a summer Conservative Party leadership contest rising - which could present a more eurosceptic leader - the six-month extension is unlikely to be long enough to generate fresh Brexit progress.

This uncertainty looks set to keep a lid on growth, as firms maintain preparations for a possible cliff-edge scenario, and we therefore think it's unlikely that there'll be any dramatic upward revisions to the Bank’s economic outlook this week.

That said, skill shortages in the jobs market are continuing to drive wage growth higher. On that basis, we wouldn’t rule out one or two policymakers voting for an immediate rate hike at this meeting.

But for the committee as a whole, the Brexit delay is likely to reaffirm the concerns it expressed through the substantial growth forecast downgrade made back in February. Investment looks set to stay under pressure, and we suspect this will stop the Bank from hiking rates in 2019.

Growth: No big rethink as Brexit uncertainty set to drag on investment

Back in February, the Bank of England slashed its growth forecasts for 2019, amid growing concerns about a ‘no deal’ Brexit. Since then, the Article 50 negotiating period has been extended, taking some of the immediate heat off the situation. So will this be enough to spark a more positive outlook in the Bank’s new set of forecasts this week?

In theory, the temporary removal of the ‘no deal’ risk could unlock a modest amount of pent-up hiring/investment. But having come so close to the cliff-edge twice now, we think firms are more likely to use the extra time to continue insulating themselves against a possible ‘no deal’ outcome in October. For many companies, this process will be very costly, and it will continue to act as a drag on capital spending.

This may be partially offset by some better news on consumer spending, given that real wage growth has recently improved. First quarter growth may also have come in a touch higher than the committee thought back in February, and the flatter yield curve will add a slight boost to medium-term activity. These factors may see a few positive tweaks to 2019/20 growth, but overall we think the underlying story will be little changed and the Bank will opt against making any major wholesale changes at this meeting.

Inflation: Continued focus on wage growth as skill shortages bite

The outlook for consumer price inflation looks fairly benign for the rest of 2019, with a combination of higher oil and household energy prices set to keep the headline rate close to the 2% target for the time being. But as ever, wage growth remains a much bigger consideration for the Bank of England. At 3.4%, regular pay growth is running close to a post-crisis high, on the back of skill shortages in various sectors.

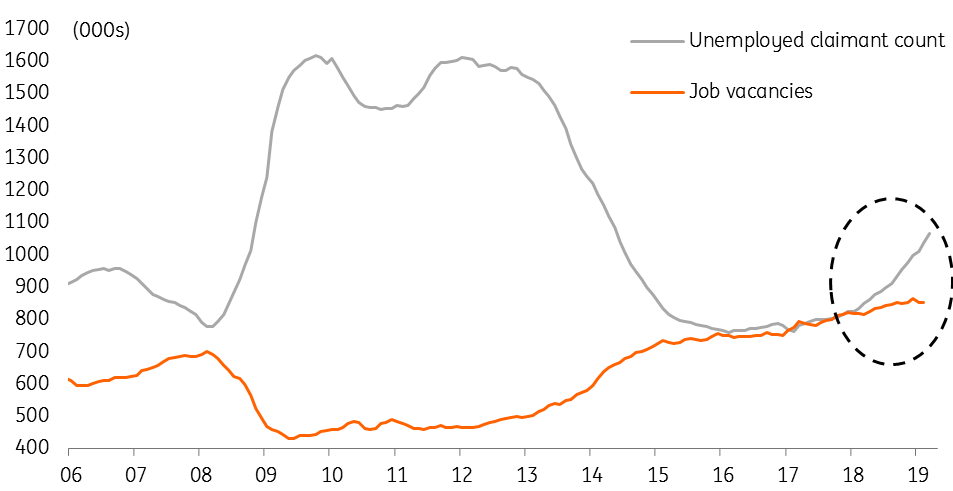

There are few reasons to expect this trend to fade imminently, although there are a couple of reasons for caution. Some of the survey-based measures of hiring have dipped recently, while the number of people on the unemployed claimant count has begun to exceed the number of job vacancies - perhaps a sign of some weakness ahead. There are also some tentative signs that momentum has begun to fade from the more recent wage numbers. The three-month annualised rate of growth in regular pay - arguably a better measure of momentum than the year-on-year growth numbers - has slipped from close to 5% last summer, to just below 2% now.

That said, we don't expect the Bank's stance on wage growth to shift substantially at this week's meeting. Policymakers look for pay growth to inch closer to 3.5-4% YoY over the forecast period.

The claimant count is beginning to outstrip the number of vacancies

Policy signal: Committee to keep door ajar to further tightening

One of the key things to watch on Thursday will be the voter split. Ever since the committee decided to raise rates last August, policymakers have unanimously opted to keep policy unchanged at every meeting since. We expect a similar outcome this time, but it's certainly possible that one or more committee members vote for an immediate rate hike this week.

Following a recent Telegraph article, there has been some discussion about whether Brexit will gradually assume a lower weight in the Bank's decision-making process. After all, there is every chance that the Article 50 negotiating period could end up being extended beyond October if no progress has been made. In the meantime, if the economic data begins to turn upwards, then we may begin to see some members become more vocal about the cost of keeping rates lower for a prolonged period of time.

We doubt that will become a majority view though, and for the committee as a whole, we think Brexit will remain front-and-centre for the time being. While the Bank's forecast for excess demand implies policymakers think rates will ultimately need to rise faster than markets currently expect, we doubt they'll actively try and prime investors for earlier rate hikes at this stage.

Unless the Brexit deadlock is broken much earlier than many expect, we think it's unlikely that the BoE will hike interest rates this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more