The Bank of England’s February dashboard

Deteriorating economic data and increasing political uncertainty means we're unlikely to get a Bank of England rate hike any time soon - although the recent strength in wage growth means a move later in 2019 shouldn't be completely ruled out

When the Bank of England announces it's latest interest rate decision on Thursday, there will be just 50 days left until the UK is scheduled to leave the EU. With no clarity on whether a deal will be in place by then, or indeed if the 29 March deadline will be pushed back, there is little doubt policymakers will keep policy unchanged this week while likely striking a tone of greater caution.

Economic data is deteriorating, and it is likely growth will continue to stall (or potentially stagnate completely) through the first quarter as business and consumer caution grows.

This means a rate hike in the first half of 2019 looks very unlikely, but further tightening later in the year shouldn't be completely ruled out. With wage growth continuing to perform strongly, we sense that policymakers would like to raise rates again if they can.

Of course, whether they can or not depends almost solely on Brexit - a fact that is increasingly reflected in markets by their lower sensitivity to surprises in UK data.

Most paths now lead to an extension of the Article 50 negotiating period, which would prolong the uncertainty for longer. However if the government does gradually inch towards a cross-party solution on Brexit (for instance committing to a permanent customs union) that ultimately commands a majority for a deal, this would take 'no deal' off the table and allow the transition period to begin.

This scenario would likely see the Bank of England follow with further policy tightening, although admittedly such a solution still seems quite some way off. We very loosely have a rate hike pencilled in for August, although realistically this could easily come much later depending on which Brexit scenario materialises.

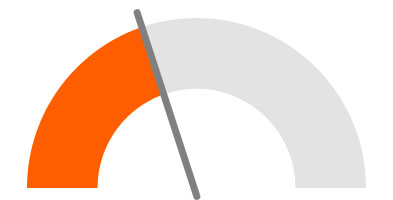

Consumer spending

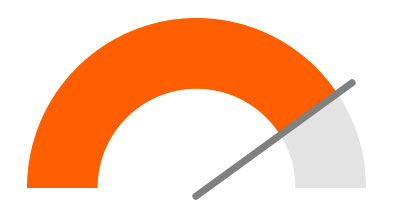

Wage growth

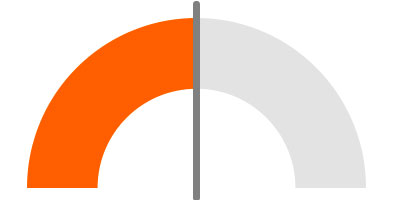

Inflation

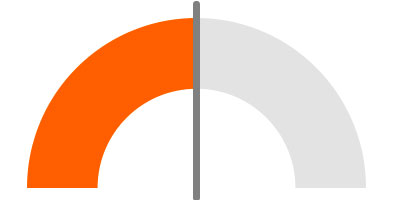

Hiring

Investment/manufacturing

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more