The Bank of England’s December dashboard

We expect the Bank of England to remain fairly cautious this week, despite the more positive short-term outlook for Brexit. We're not expecting any change in BoE policy in 2020, and alongside some lingering Brexit uncertainty, this suggests GBP gains could be muted from here

Expect a cautious Bank of England despite landslide election outcome

The Bank of England has stuck to a fairly cautious mantra over recent meetings. Economic sentiment and activity deteriorated as the Brexit uncertainty intensified through the autumn.

But in the wake of last week’s landslide election victory for the Conservative Party, markets will be on the lookout for hints that the committee is turning more hawkish.

After all, the Bank’s November projections predicted that some excess demand would emerge in 2021/22 – and those numbers accounted for the fact that the UK would leave the EU smoothly in January.

Theoretically at least, that implies that rates may need to rise to a higher level than markets anticipate over coming months.

In reality, we think that’s unlikely – at least in the first half of 2020. We are wary that the election result may not bring about a significant, or at least imminent, recovery in investment and hiring appetite – more on our thinking on that below.

We expect the Bank to retain a relatively cautious bias this week. The two committee members that voted for easing at the last meeting are likely to do so again, although we’re not expecting this consensus to build. Barring a significant deterioration in either the global backdrop or jobs market, we aren’t expecting rate cuts in 2020.

Investment - Unlikely to stage a steep rebound

With the UK set to leave the EU smoothly in January, averting a chaotic 'no deal' exit, it's tempting to assume that investment will rebound in 2020 after two years of modest decline. That may be true to some extent, but there are five reasons why we may not see a sizable turnaround:

- The persistent lack of new orders and the resulting dip in capacity utilisation across the economy suggests little immediate impetus to expand.

- In the goods sector – the stockpiling process ahead of the 2019 Brexit deadlines will have been costly, and we suspect in some cases it will have been tricky to shift the extra inventory amid fewer new orders. All of this is expensive, drawing resources away from investment.

- Without an extension to the transition beyond December 2020, firms are again at a risk of an abrupt single market/customs union exit at the start of 2021. The 11-month standstill period is unlikely to be long enough to both negotiate and implement a trade deal with the EU. An extension is likely, but until there's clarity (which may not come until June), investment may be kept under some pressure.

- While a longer transition would be positive, it does mean that it could be some time until there's clarity on the sector-specific ramifications of the UK's future EU trading relationship. The jury is still out on whether the Johnson administration will stick to a fairly limited free-trade agreement, or whether it will pivot to something 'softer' with half an eye on the 2024 election. Until we know more, firms may remain wary about making significant, longer-term investment decisions.

- Global growth is set for another disappointing year. While the agreement of a phase-one trade deal is positive, the risks related to protectionism are here to stay and we're expecting sub-consensus growth in both the US and Eurozone in 2020.

Investment intentions have been relatively low

The jobs market - faltering?

Cracks are forming in the UK jobs market, and this was a key reason why two MPC members voters for a rate cut at the last meeting. And with the growth numbers so volatile over recent months, our sense is that the Bank as a whole will be placing greater emphasis on jobs data over the next few months.

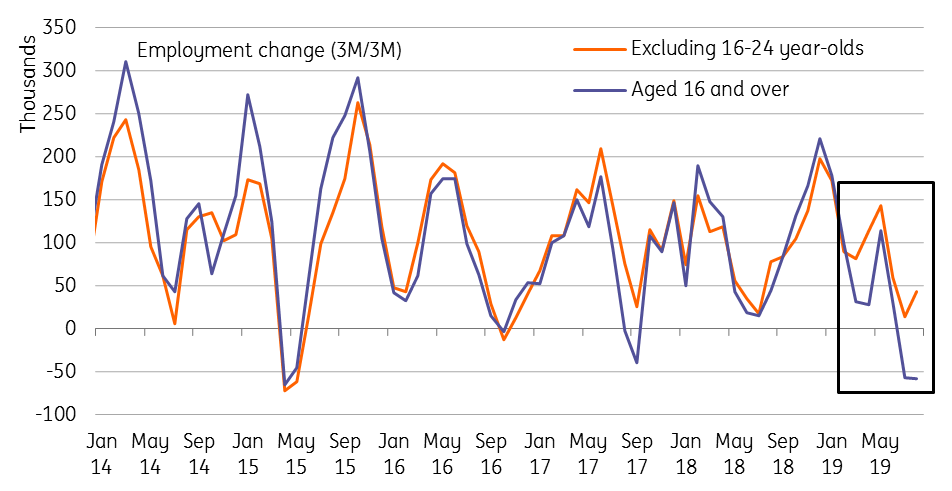

Forward-looking indicators of hiring appetite have been deteriorating over recent months. The number of vacancies has consistently fallen this year, while some of the recent PMIs have hinted at non-replacement of staff and in some cases redundancies. We have also seen employment fall in the official data, although this seems to be almost solely attributable to young and part-time workers, both fairly volatile parts of the jobs data. Once 18-24 year-olds are removed, employment growth is still just about positive.

In other words it's still early days, but the risk is that the ongoing weakness in investment also hits hiring demand further. At the very least, the Bank of England will want more time to see how this story pans out.

A deteriorating jobs market would be bad news for consumer spending, which has been surprisingly stable through the twists-and-turns of Brexit during 2019. The Bank of England is already penciling in a slower pace of wage growth next year, although it's worth remembering that structural skill shortages (exacerbated by demographic factors and a slowdown in EU immigration) are likely to keep some upward pressure on pay even if cyclical forces become more muted.

UK employment still growing (just) excluding 18-24 year-olds

Thursday's Bank of England meeting to have muted impact on GBP

We expect the BoE meeting to have a limited impact on GBP this week. The orderly resolution of the Brexit situation already became the Bank's base case in the November policy report, and the economic forecasts (and thus the odds of policy tightening) are unlikely to have changed much following the UK election result. Instead, the more important driver of GBP will continue to be the Brexit path. Here, the initial stages of the Withdrawal Agreement Bill (this Friday) should keep GBP supported, with a bias for modest GBP gains. EUR/GBP to possibly drop below 0.8300 level and GBP/USD to rise towards 1.3500.

Still, we don’t expect fireworks and we'd expect GBP gains to be fairly muted. The market-friendly election outcome is already priced in (and worth of 4% GBP gains based on our estimates – see Stalling GBP gains and implications for European FX) while the uninspiring UK economic data, ongoing BoE caution and the possible uncertainty surrounding the extension of the transition period next year, all suggest the potential for GBP appreciation is limited.

Speculative short GBP positioning is also no longer as short (see FX Positioning: Sterling heading to the neutral zone) and front-end implied volatility should continue to remain muted/declining (chart below).

Front-end GBP implied volatility to remain muted for now

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more