Thailand’s low inflation trend gets traction

We are bringing forward our forecast for the next 25bp rate cut from the fourth quarter to the next BoT meeting on 25 September.

| 0.5% |

August CPI inflationYear-on-year |

| Lower than expected | |

Another downside inflation miss

Thailand's August consumer price index (CPI) rose by 0.5% year-on-year, a slowdown from the 1% inflation rate in the previous month. This was the third consecutive downside CPI miss against the consensus, which was centered on 0.7% inflation for August.

A sharp slowdown in the food component of CPI (2.6% vs. 3.5% in July) and a deeper decline in the transport component (-2.2% vs. -1.3%) were responsible for lower headline inflation. Core CPI inflation, which strips off food and fuel prices from the total, however, quickened to 0.5% from 0.4% in July.

Strong currency depresses inflation further

At 0.9% year-to-date, headline inflation in Thailand has slowed from 1.0% in the same period of 2018. The corresponding figures for core inflation are 0.5% and 0.7%. There was a significant spike in the food component this year, though that’s been offset by lower housing and transport components. And judging from the latest data the worst of the food inflation seems to be over.

However, besides housing and transport, a sustained Thai baht (THB) appreciation has also weighed on inflation, while global oil prices, often a key source of imported inflation, have also been missing this year. These trends look as if they are here to stay, thanks to Thailand’s strong external payments position and weak global demand weighing on the oil prices.

What's driving low inflation this year?

Has the BoT policy really hit its limits?

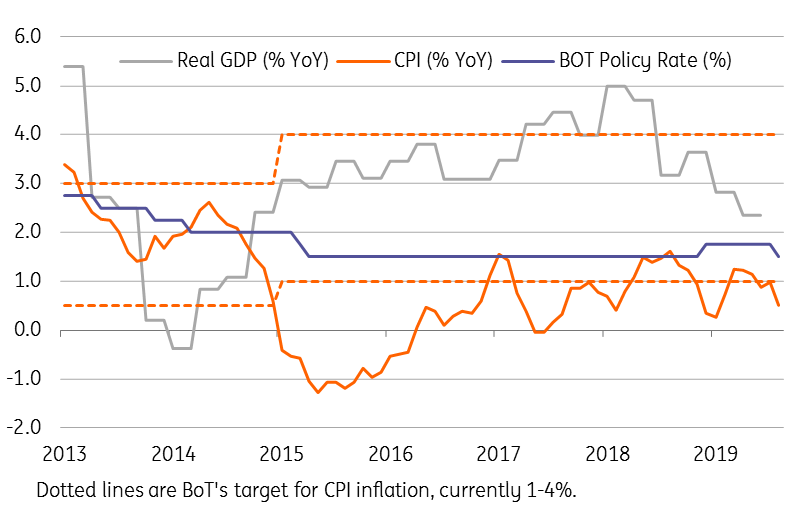

A headline in the Financial Times, “Thailand risks turning Japanese as monetary policy hits limits”, was eye-catching. Among the economy’s main woes, the underlying story pointed to low inflation, stalled growth for over a decade, and a rapidly aging population, while noting insufficient policy stimulus to turn the economy around and little policy leeway for the Bank of Thailand (BoT) with lowest policy rate among ASEAN-5.

The BoT started its easing path in August with a 25bp rate cut to 1.50%, which was merely a reversal of a 25bp rate hike in late 2018 rather than fresh stimulus. The previous low in BoT policy rates was 1.25% last reached during the 2009 global financial crisis. Given the current economic backdrop, we see that level reached as early as this month. We bring forward our forecast for next 25bp rate cut from the fourth quarter to the next BoT meeting on 25 September.

However, we believe the BoT could do more than that especially with inflation continuing to undershoot the 1-4% policy target, and with the recently announced $10 billion fiscal stimulus measures likely taking a while to pass down to the real economy. The BoT could also increase its efforts to rein in THB appreciation as other policy measures geared toward that aim have so far proved to be ineffective.

Growth, inflation, and Bank of Thailand policy rate

Download

Download article

3 September 2019

Good Morning Asia - 3 September 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).