Thailand: Weak activity leads GDP forecast downgrade

Following weak September manufacturing activity, we have cut our 3Q18 GDP growth forecast to 3.7% from 4.1%, and full-year 2018 growth forecast to 4.2% from 4.3%. Recent data weakness not only undermines the government’s optimism on the economy's growth this year but also dampens the prospects of the central bank tightening policy anytime soon

| -2.6% |

September manufacturing growth |

| Worse than expected | |

Exports dent manufacturing

Consistent with the consensus view, manufacturing output contracted on a year-on-year basis in September. However, the 2.6% fall was much steeper than the consensus median of only a 0.5% fall. Coming on the heels of unexpectedly weak exports (-5.2% YoY), the steeper manufacturing fall isn’t a complete surprise.

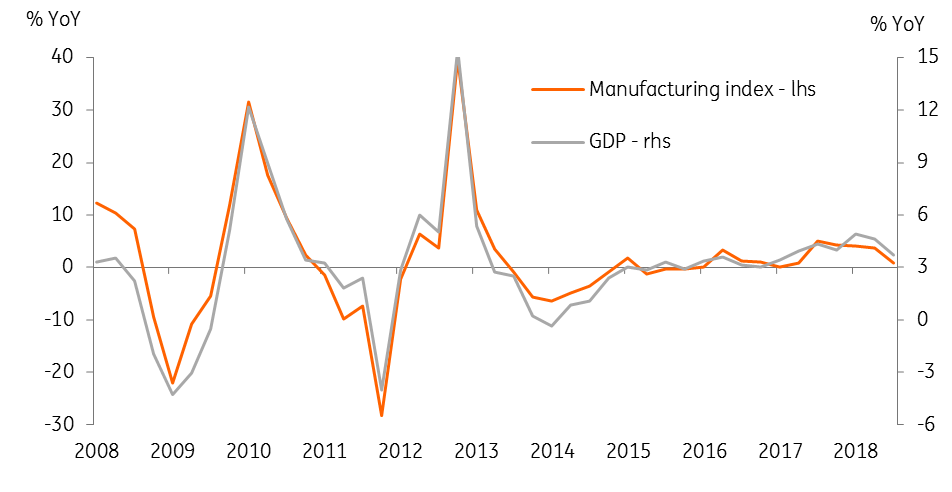

The decline in exports and manufacturing in recent months has been partly the result of high base effects; growth was accelerating during the same period of 2017. A sharp slowdown in manufacturing in 3Q18 to 0.9% YoY from 3.7% in 2Q18, will have undoubtedly pulled GDP growth lower (see figure). It’s not only manufacturing though. Service sector activity has also started to take a hit from falling tourist arrivals, especially visitors from China.

Manufacturing drives GDP

GDP forecast downgrade

We now estimate 3Q18 GDP growth of 3.7%, slower than our earlier 4.1% estimate and down from 4.6% in 2Q (Bloomberg consensus 4.2%, data due on 19th November). This pushes our full-year growth forecast down to 4.2% from 4.3%. The fourth quarter is typically a strong growth quarter, which will soften the impact on full-year growth.

Yesterday the finance ministry reaffirmed its 2018 GDP growth forecast of 4.5% but cut its export growth forecast to 8% from 9.7% projected three months ago, citing the US-China trade conflict as the reason for the cut. We consider the official projection optimistic. With 8.1% growth in the first nine months, exports will have to continue growing at this pace over the remainder of the year. The risk is squarely on the downside, with export growth likely remaining negative in the final three months. The ministry also revised its forecast of tourism revenue this year to 2.01tr Thai baht from 2.08tr.

However, we agree with the finance ministry’s view that there will be no change in Bank of Thailand policy in the rest of the year. The BoT policy rhetoric lately has been flitting between dovish and hawkish, driven by factors of potential downside growth risks and the need to create policy space for the future. The latest data empowers the doves.

Download

Download article

31 October 2018

Good MornING Asia - 31 October 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).