Thailand: July trade signals good start for economy in 2H 2019

One month of trade outperformance doesn’t make it a trend though, especially when persistent external risks and anemic domestic demand continue to hinder the upside growth potential of the economy

| 4.3% |

July export growth |

| Higher than expected | |

Low base effect lifts annual growth

In a big upside miss, Thailand’s external trade swung back to growth in July after several months of contraction this year. Exports rose by 4.3% year-on-year and imports by 1.7%, against consensus estimates of a 2% and 6% contraction respectively.

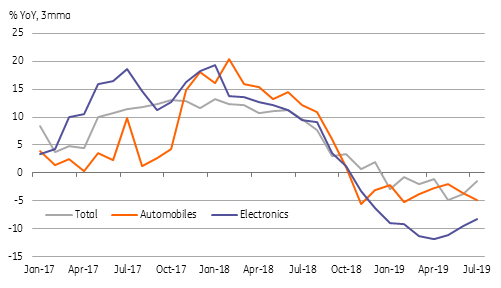

However, a positive swing in exports from 2.9% YoY fall in June rather tells us more about what happened a year ago – a low base effect from a big month-on-month (MoM) fall in July 2018, while key drivers of automobiles and electronics with a combined weight of about 30% continued to hold down the headline export growth. Electronics were down by 5% MoM and autos and parts by 2.5%.

Autos and electronics have been key export drivers

Good start for the economy in 2H19

But even bigger positive swing in import growth, to +1.7% YoY from -9.7% in June, lift hopes of some recovery in domestic demand. Growth of all key import segments – fuel, raw materials, capital goods, and consumer goods – improved, though this was also associated with a sharp narrowing of the trade surplus to $110 million in July from $3.2 billion in the previous month.

Data puts year-to-July export growth at -1.9% and import growth not far apart from that at -1.8%, down sharply from +11.1% and +9.5% in the same period of 2018. But the $4.1 billion of cumulative trade surplus through July was little changed from a year ago to sustain positive sentiment toward the Thai baht (THB).

Still, the economy is in need of more stimulus

One month of trade outperformance doesn’t make it a trend though, especially when persistent external risks and anemic domestic demand continue to hinder upside growth potential in the periods ahead. However, just as with trade growth, we see a favourable base year effect preventing further slippage in GDP growth in the rest of the year from a 5-year low of 2.3% YoY in 2Q19.

Indeed, the Bank of Thailand (BoT) minutes of the recent policy meeting on 7 August released today reinforced the need for continued policy support for the economy going forward. Supporting the decision of a 25 basis point rate cut at that meeting, the minutes noted, “Most Committee members viewed that more accommodative monetary policy would foster the continuation of economic growth and the return of headline inflation to target in the context of heightened uncertainties mainly from external factors”.

While we expect the BoT to cut rates again this year, at least by 25bp, if not more, hopes also remain pinned on fiscal stimulus. The Thai cabinet has just cleared a $10 billion stimulus package, likely lifting growth by 0.5-0.6%. Still, it seems a tough ask for the economy to outperform the 3% "new-normal" growth rate of recent years.

Download

Download article

22 August 2019

Good MornING Asia - 22 August 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).