The China-US trade war is hurting the Taiwan dollar

The ongoing trade war between the US and China has led to a sell-off in the equities market by foreign investors weakening the Taiwan dollar. The inflation release today won't lead to a central bank hike, but combining the two factors means the currency is likely to weaken further to 31.0 by the end of the year

Trade war woes

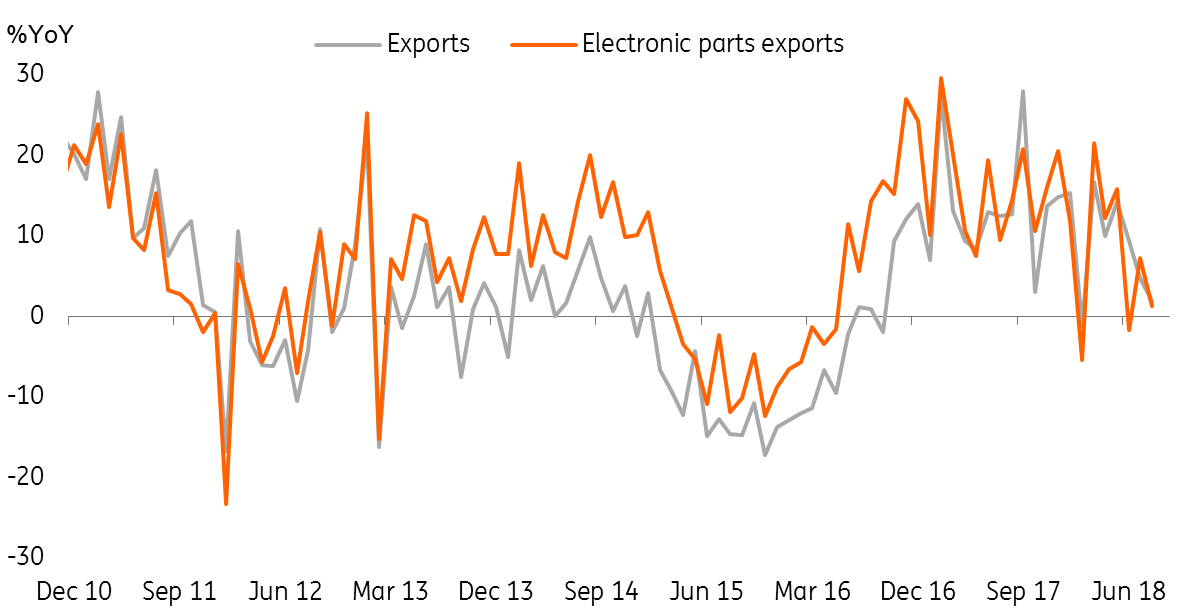

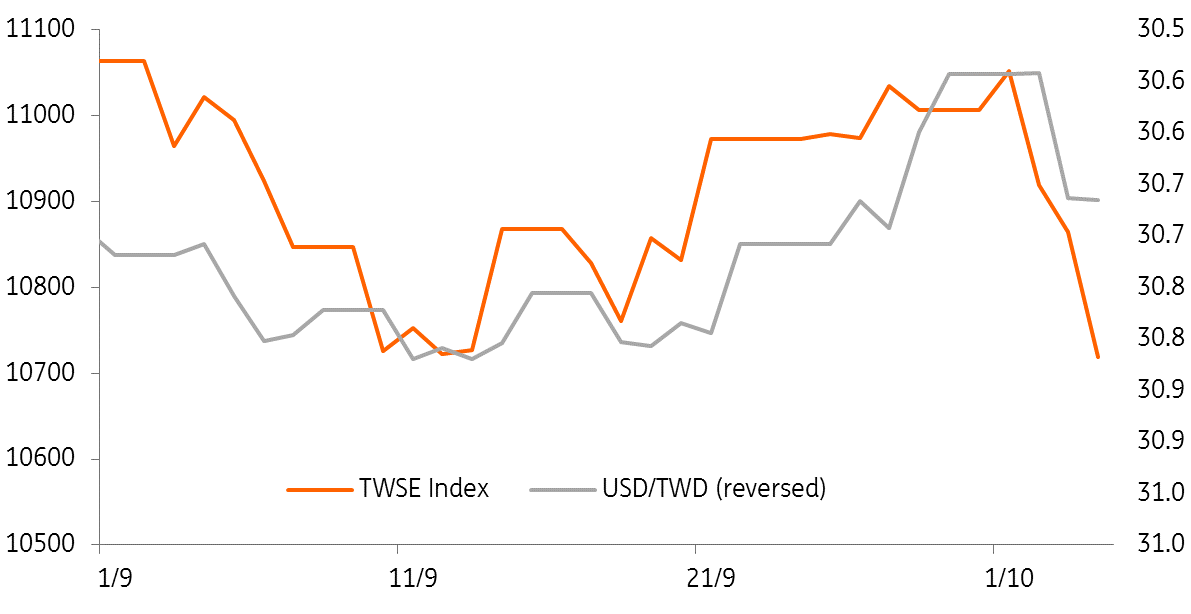

Taiwan's exports grew at a mere 1.9% year on year, and electronic parts were even slower at 1.3% - and this could potentially be a direct result of the supply chain damage caused by the bilateral trade war between the US and China. This has led to a sell of equities (as Taiwan's stock market has fallen by 4.84% since 1 October) by foreign investors and pushed the Taiwan dollar against the USD weaker by 0.96% since the end of September 2018 (Spot 30.835).

Trade war losers: Taiwan's exports

The central bank won't help

The central bank of Taiwan can do very little to help the currency. Inflation in terms of CPI was mild at 1.72%YoY but higher from last month's 1.5% - mainly a result of higher energy prices. The same was the case for wholesale price index but manufacturing fatigue lead WPI inflation lower to 6.55%YoY from 6.83%.

The chance of a rate hike is small with such mild consumer inflation, which means the currency is likely to continue to weaken against the US dollar.

The policy rate at 1.375% and it would be too early to slash rates just yet. The central bank needs to save that option in case the economy weakens further.

Our USD/TWD forecast remains unchanged

This is only the beginning of the China-US trade war, and as we can see, Taiwanese companies providing supply chain products and services are likely to get hurt, and the Taiwan dollar could continue to weaken. Taking into account the trade war impact, we maintain our forecast of 31.0 by the end of the year.

Sell off in the stock exchange has caused currency depreciation

Download

Download article5 October 2018

In case you missed it: Finding the silver lining This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).