Taiwan: GDP riding global growth trend but prone to trade threat

The narrowly-focused economy is prone to trade hurdles in 2018 while low manufacturing wages could hurt retail sales. As such, we don't expect rate hikes this year but the Taiwan dollar could still strengthen

Trade is just too important to Taiwan growth

Slower growth for Taiwan due to high base effect

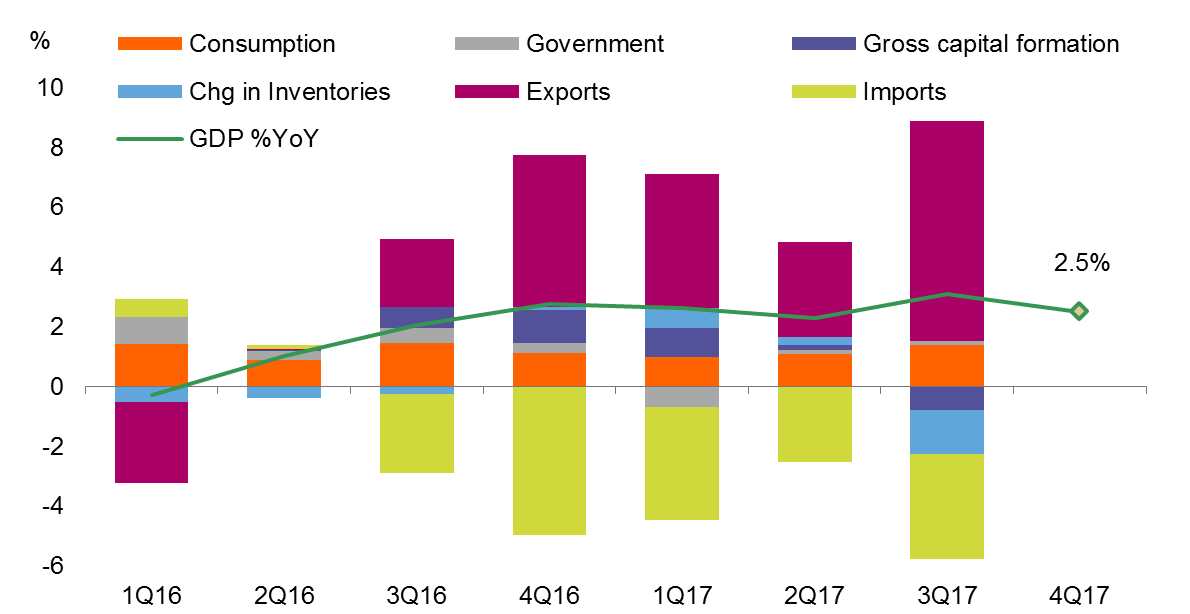

We expect economic growth in Taiwan to slow from 3Q's 3.1% YoY to 2.5% in 4Q, leading to a full-year growth rate of 2.6% for 2017. The slower pace of growth in 4Q is a result of a high base in 2016.

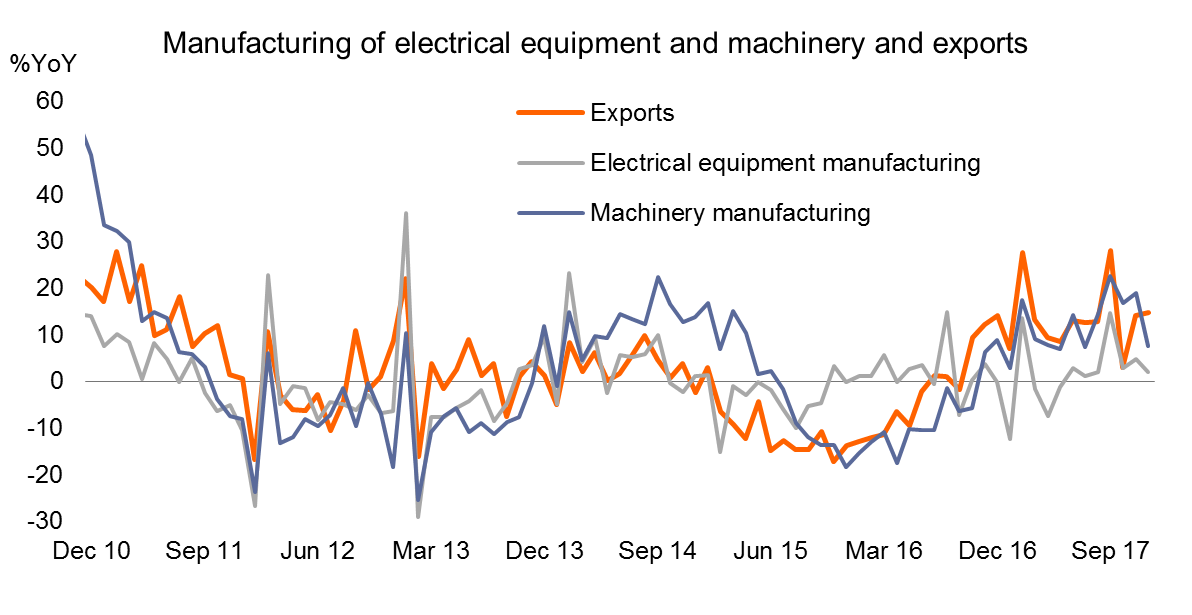

The engines of growth are manufacturing and trade of machinery, which has almost replaced the growth engine of electrical equipment manufacturing in 2016. That is not a bad sign for Taiwan. The two manufacturing industries seem to be able to compliment each other to sustain economic growth.

As we expect global growth to continue to rise in 2018, Taiwan's electronic-related products should continue to lead the Taiwan economy, growing at 2.1% in 2018.

| 2.1% |

GDP growth in 2018 (forecast)2.6% in 2017 (forecast) |

It has been manufacturing of machinery leading export growth

Narrowly-focused economy prone to trade hurdles

With a strong economic focus on electronics-related industries, Taiwan is prone to competition from peer countries, including South Korea, and Mainland China. Taiwan President Tsai Ing-wen has hinted at a military threat from the mainland so it's not difficult to imagine that Mainland China could impose some trade barriers. In fact, Mainland China has already moved in this direction by taking away Taiwan's diplomatic relations. The obvious one is Panama. We are highly aware that the risks of more trade hurdles from Mainland China would increase if Taiwan continued to avoid discussions with China about the One China policy.

Low unemployment but also low wage growth won't change in 2018

Domestically, although the unemployment rate is reasonably low and stable around 3.7%, wage growth was negligible at 1.4% in 2017 vs 2016 gauging from the labour cost index from Taiwan Directorate General of Budget Accounting and Statistics.

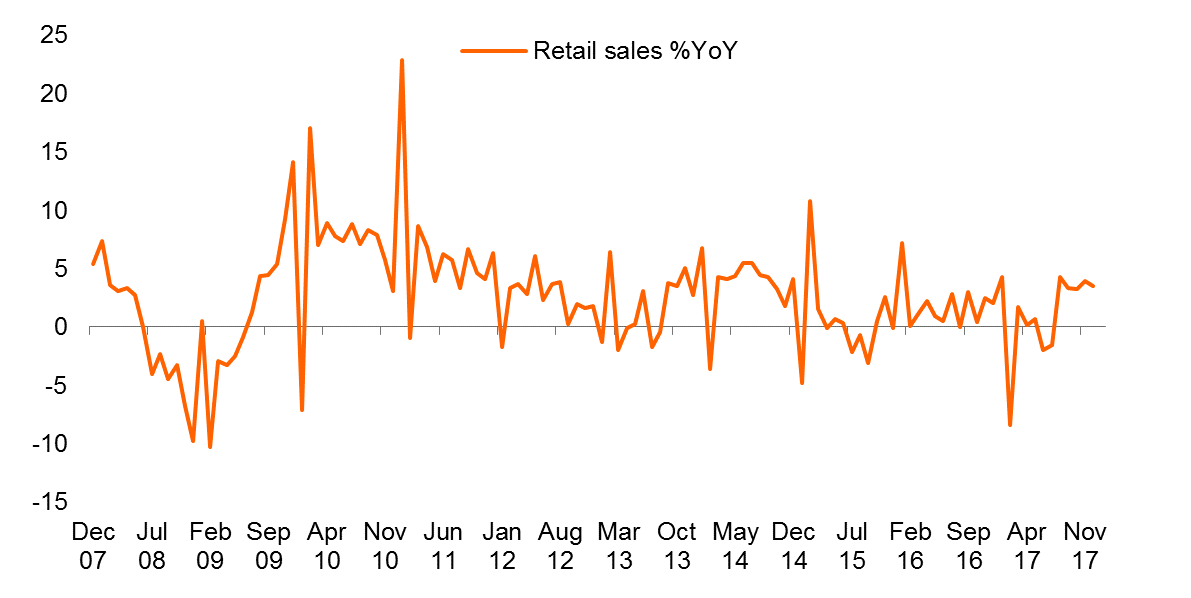

According to the Ministry of Finance of Taiwan, manufacturing is the sector that offers low wages. This explains the dim retail sales trend, as manufacturing contributes a large part of GDP. If the retail sector relies merely on locals, the growth trend is likely to be mild in 2018. Low manufacturing wages are not likely to increase anytime soon, suggesting consumers will not be able to ramp up spending in 2018.

In our view, retail sales are unlikely to support the economy if Taiwan were to be hit with more trade hurdles in coming months.

Dim retail sales signals that consumption could not be the support of the economy if there is trade hurdle

No change in interest rate expected

Although the economy is growing, it's just too fragile- relying largely on the manufacturing of machinery and electrical equipment. Some of these products are in competition with Mainland China and could face trade hurdles. In addition, wage growth is low and can't support a meaningful upward retail sales trend.

All this suggests that the central bank of Taiwan will not follow the global trend of raising interest rates.

What about lower interest rates to support the economy? The timing isn't quite right because economic growth is not as bad as in times of crisis. The already low level of policy rate at 1.375% would be the last lifeline for Taiwan when there is an unexpected event or crisis, which is not our base case in 2018.

But strong TWD to continue

Even without central bank rate hike, we expect that the Taiwan dollar would strengthen against the dollar. This is partly because of the weak dollar trend, and partly because of foreign investors chasing after Taiwan stocks.

Though strong TWD may not hurt trade it could hurt profit margins of exporters.

We expect USD/TWD to reach 27.80 at the end of 2018.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).