Switzerland: Feet firmly on the brakes

After a strong 2018, economic activity in Switzerland is expected to slow down this year. With low inflation and risks of deflation, expect the extremely dovish central bank to keep rates unchanged for a while to come

A hot and cold 2018

The small yet open Swiss economy is dependent on the rest of the world and was strongly impacted by the slowdown in Europe in the second half of 2018.

Over 2018 as a whole, GDP increased by 2.5% - the best result since 2014 but was mainly driven by foreign trade. Domestic demand remained weak, particularly with private consumption held back by a weak trend in purchasing power.

After the good momentum in late 2017, the promising 2.5% growth rate in 2018 came after a fluctuating year with an exceptional first half with 0.9% and 0.7% QoQ growth in Q1 and Q2, but the second part of the year disappointing considerably.

Slowing GDP growth

Expect the Swiss economy to slow down in 2019

For 2019, we expect Swiss growth to continue to slow down to a rate of around 1.1%, well below the performance of 2018.

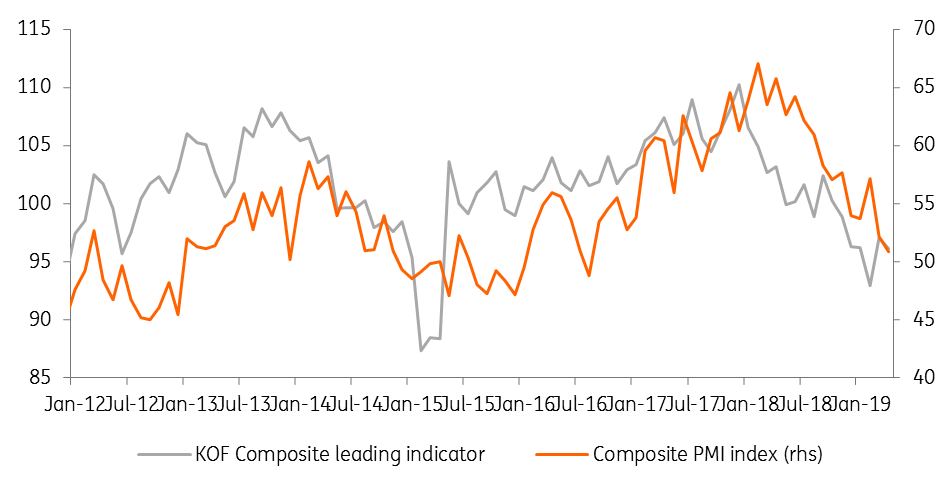

There are numerous risks weighing on the global economy, some of which are already affecting confidence at Swiss companies, which is likely to lead to a slowdown in investments in 2019. PMI indicators have been on a downward trend since July 2018. In January the manufacturing index touched 48.52, substantially below the threshold of 50 and its lowest level since September 2015, while the composite index stood at 50.83, far below the 67 level observed in February 2018. The KOF index - the leading indicator of the Swiss economy is now at 96.1, which is above its February level, but still well below its long-term average. Global growth and trade deceleration will probably be a drag on Swiss exports too.

For 2019, we expect Swiss growth to continue to slow down to a rate of around 1.1%, well below the performance of 2018

We believe that private consumption will continue to grow at a slower pace in 2019. Nominal wage growth is expected to remain weak, but lower inflation should allow real wages to rise more than in 2018 and enable consumption growth to remain above 1% in 2019, contributing half of GDP growth.

But having said that, like the eurozone, we can't rule out that growth in Q1 might actually end up being better than what confidence indicators suggest.

Leading indicators are trending down

Risks to the growth outlook are titled to the downside

The risks remain tilted to the downside for the Swiss economy. The trade war that has kicked off again between China and the US could lead to a slowdown in world trade, negatively impacting Switzerland, which is a very small yet open economy. If trade tensions were to spread and impact the EU, for example via an increase in customs duties on European cars, Switzerland would be seriously impacted because EU countries and especially Germany are its main trading partners. The political uncertainty that remains in Europe, in particular, linked to Brexit and the situation in Italy, could impact European growth with a contagion effect on Swiss growth.

The risks remain tilted to the downside for the Swiss economy

Another risk weighing on the economy concerns the negotiations on the framework agreement with the EU. As a reminder, Switzerland and the EU have been trying to negotiate an institutional agreement to regulate their relations for years. In order to put pressure on Switzerland, European negotiators link the fact of advancing in the negotiations with the granting of a stock exchange equivalence to Switzerland as this allows European traders to trade on the Swiss stock market.

At the end of 2018, the Swiss negotiators asked for an extension of the negotiation period to start consultations in Switzerland on the draft framework agreement. The EU had finally agreed, but only for a time, until the end of June 2019. The stock exchange equivalence was therefore granted until that time. If the consultations in Switzerland were to lead to a rejection of the framework agreement, the stock exchange equivalence might not be extended, which would severely hamper relations between the EU and Switzerland and have negative trade and economic consequences.

The low inflation situation isn't about to change

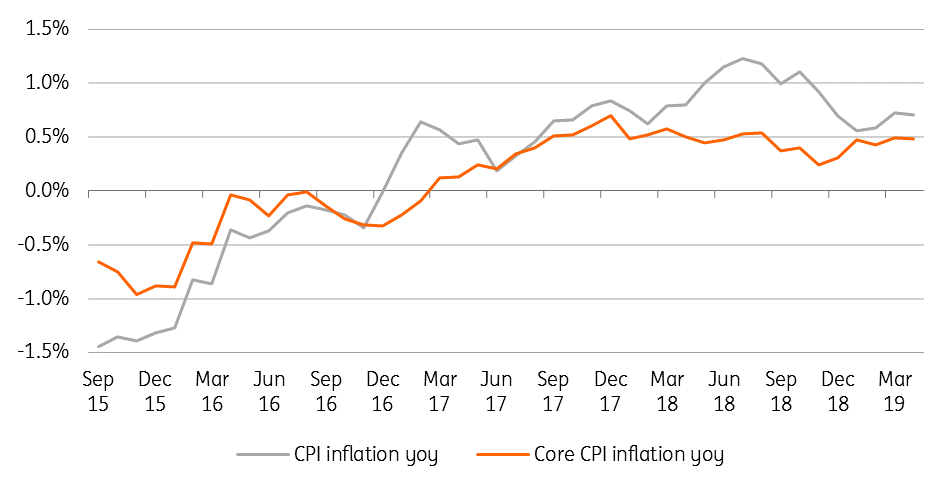

Inflation in Switzerland remains low and the situation isn't about to change. Inflation rose to 0.9% in 2018 - the highest level since 2008, but this was mainly due to the evolution of oil prices and other volatile elements, underlying inflation remained stuck at 0.4% over the whole year. Inflationary pressures remain low for 2019 due to the slowdown in expected growth. Nominal wages aren't showing any signs of rising and the oversupply of apartments for rent pushes the price of housing rentals down, which tends to lower inflation given the weight of the component in the CPI index (18%).

This low inflation problem doesn't make it any easier for the Swiss national bank to avoid deflation with its already very accommodating monetary policy

Therefore, we think that only a sharp rise in energy prices could push inflation to rise above 0.5% in 2019. This low inflation problem doesn't make it any easier for the Swiss national bank to avoid deflation with its already very accommodating monetary policy.

Inflation is still pretty low

The central bank has never been more dovish

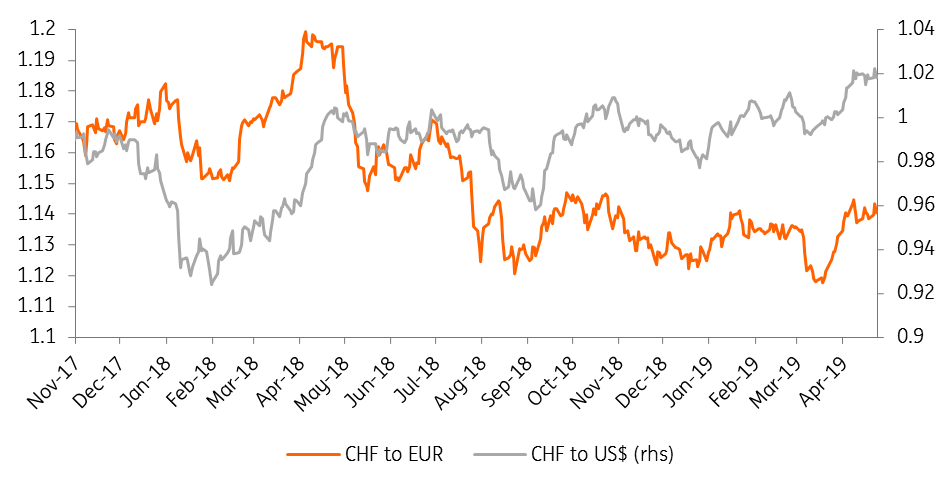

At the March meeting, the central bank maintained its ultra-loose monetary policy with policy rates unchanged in the negative territory and as always willing to intervene in the foreign exchange market if needed. The central bank has also reduced its conditional inflation forecast (i.e. assuming an unchanged policy rate) and now expects an inflation rate of 0.3% in 2019 and 0.6% in 2020. This downward revision is the result of lower growth prospects in Switzerland, weaker inflation and a revision of expectations concerning the monetary policies in the world. We believe that this downward revision is a sign that the central bank is more dovish than ever before and does not plan for monetary tightening over the forecast period. The first interest rate increase will not, in our view, be considered before the next economic cycle.

We're not expecting rate increases for the next two years, and probably even longer. While another rate cut cannot be ruled out, this is not our baseline scenario at the moment

Moreover, the chairman of the governing board, Thomas Jordan recently said that it's still possible to reduce rates even more. We think this isn't on the agenda yet but the central bank wants to allow itself the possibility of lowering rates in the future if it wishes. In Switzerland, a tiering system is in place and negative rates are only applied to a portion of the banks' deposits, the other part being exempt from negative rates. This tends to reduce the impact of negative rates on the profitability of banks.

For the moment, we believe policy rates will remain at their current levels for many months. We're not expecting rate increases for the next two years, and probably even longer. While another rate cut cannot be ruled out, this is not our baseline scenario at the moment, and we expect stable policy rates, with the SNB intervening in the foreign exchange market when it deems it necessary.

The central bank thinks the franc is still "highly valued"

The search for an effective policy mix

The question of even lower interest rates is part of a general reflection on the effectiveness of economic policy tools available in the case of another recession. With such low rates, monetary policy alone will probably not be enough to stimulate the economy and avoid deflation, which brings us to the role of fiscal policy, which is hardly used in Switzerland. In fact, Switzerland has put in place a debt brake mechanism that has led the country to accumulate budget surpluses over the last few years, leading to high levels of deleveraging.

With such low rates, monetary policy alone will probably not be enough to stimulate the economy and avoid deflation, which brings us to the role of fiscal policy, which is hardly used in Switzerland

Some economists and international organisations believe that deleveraging is going too far, especially in the context of incredibly low interest rates that the Swiss confederation goes into debt for up to 15 years at negative rates. For example, in its Article IV report, the IMF again this year emphasised the importance of a more expansionary fiscal policy in order to stimulate the economy and avoid over-reliance on monetary policy.

The attitudes in Switzerland don't look as if they're about to change just yet, so the search for an effective policy mix continues to drive the debate in the coming quarters.

Swiss economy in a nutshell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more