Switzerland: Dynamic growth

The Swiss economy grew at a fast pace in the first half of 2018, boosted by income from world cup licenses, robust foreign demand and the Swiss franc's depreciation. For the second half of the year, we expect robust growth, but at a slightly lower pace because of the challenging international environment

Strong GDP growth in 2Q18

Switzerland’s GDP grew by 0.7% quarter-on-quarter in 2Q18, a dynamic and above-average growth rate. Moreover, 1Q18 growth figures were strongly revised upwards to 1% qoq, from a previously estimated 0.6%. Annual GDP growth reached 3.2% year-on-year in both the first and second quarter. The Swiss economy has recorded an above 0.7% qoq growth rate for the fifth quarter in a row. This has not been the case since the beginning of 2015 when the exchange rate floor against the euro was abolished.

The main driver of growth in 2Q18 was manufacturing (+1.5% qoq), which benefited from robust foreign demand and the depreciation of the Swiss franc in the second quarter. Indeed, in April, the EUR/CHF exchange rate hit its highest level since 2015. The energy sector also recorded a positive quarterly result (+4.8% qoq). Exports of goods grew by a strong 2.6% qoq, after two weak quarters, which illustrates the favourable international conditions. This was accompanied by a fall in imports of goods and services (-0.7 % qoq). The contribution of domestic demand to growth was weaker, despite strong growth in investments in construction (+0.8%).

World cup boosted growth by 0.2 percentage points

The world cup had a strong influence on the GDP growth rate in 2Q18. This was not due to a sudden popular fever for football in Switzerland, but to international sports associations such as FIFA that are based in Switzerland. Indeed, Swiss GDP is influenced by the value added creation of these companies and license income generated by the marketing of major international sporting events. They are a type of calendar effect, increasing GDP growth during years of sport events and disappearing thereafter. Given that the World Cup took place this year in June and July, it had an effect on GDP data for the second quarter of 2018. According to the Swiss administration, the Swiss economy grew by 0.5% qoq in 2Q18 adjusted for sporting events, compared to 0.7% qoq without the adjustment.

We expect robust GDP growth in 2H18

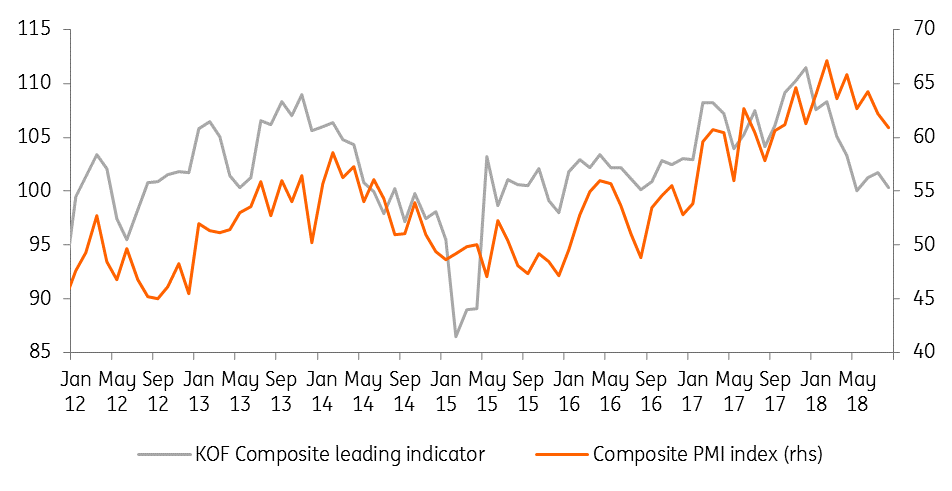

Switzerland’s leading indicator, the KOF economic barometer, fell in August to 100.3 from 101.7 in July, far from its peak level of 108 in February. The level of 100 indicates that the economy is expected to grow at the average pace of the last 10 years. PMI indicators are also on a downward trend as the composite index reached 60.9 in August versus 62.1 in July. However, it remains at a historically high level. Moreover, with the increase of global risks and uncertainty and given its status as a safe-haven asset, the Swiss franc has been appreciating since this summer. This is likely to drag down exports growth in the coming months. All in all, we believe GDP will stay robust but won’t grow faster in the following months. After a strong first half of 2018, GDP growth is likely to approach 3% this year.

Leading indicators on a downward trend but still at high level

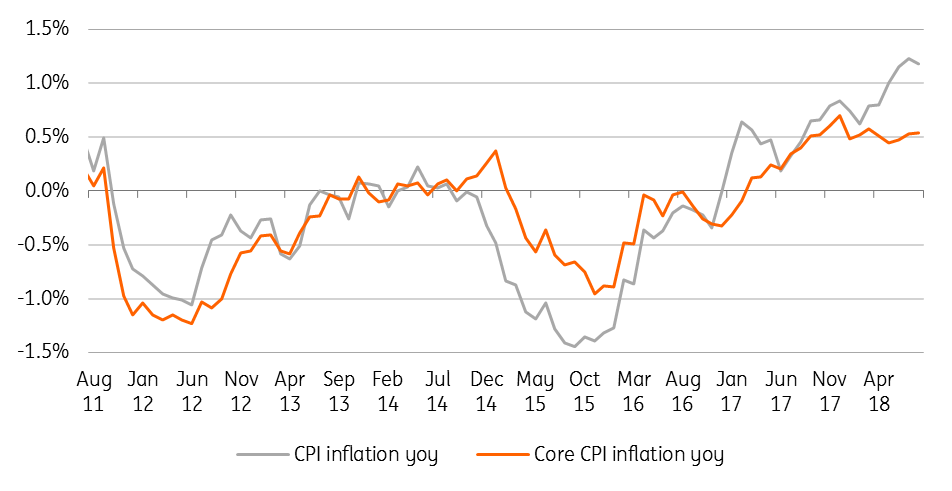

Inflation remains stable

After a long deflationary period, CPI inflation has been in positive territory since January 2017. From 0.6% yoy in February 2018, inflation has gradually increased and reached 1.2% in July and August. At the same time, core inflation which excludes prices of volatile components, remained low and stable at around 0.5% showing the impact of higher oil prices. For the rest of year, a lower VAT rate, adjusted medical service prices and diminishing rents could put downward pressure on inflation. Moreover, the relative appreciation of the Swiss Franc since May is likely to diminish imports prices, adding to downward pressures. However, at the same time, oil prices and higher American and European tariffs on global imported goods could push up import prices. In addition, given the relatively favourable economic situation, domestic inflationary pressures should gradually increase as companies gain pricing power. All in all, after having reached a level of 0.5% in 2017, CPI inflation is expected to climb to a modest 0.9% in 2018 and 1% in 2019.

SNB’s ultra-loose monetary policy is likely to continue

The Swiss National Bank maintains ultra-loose monetary policy. At its June meeting, the SNB left its main policy rates unchanged in negative territory, the target range for the three-month Libor was maintained at between -1.25% and -0.25% and the interest rate on sight deposits remained set at -0.75%. The SNB also reiterated “its willingness to intervene in the foreign exchange market as necessary”.

Since inflation is still low, this ultra-loose monetary policy is likely to continue for at least another year. Given the openness of the Swiss economy and its dependence on the EU for trade, the SNB’s worst nightmare is too strong an appreciation of the franc. The SNB believes the Swiss franc is “highly valued” and that the currency is still considered to be a safe-haven asset by investors. Indeed, when global risks increase, the Swiss franc’s value tends to increase drastically, especially against the euro. Turkey’s crisis illustrated this tendency clearly: the EUR/CHF exchange rate went from 1.17 on 13th July to 1.12 on 15th August, its peak since the summer of 2017. Consequently, we do not expect anything new from the SNB at its September meeting, apart from a strong emphasis on the Swiss franc’s valuation. We don’t expect any rate hike before the ECB starts raising its own rates. Given that the ECB is not expecting to hike before the end of the summer of 2019, we think the SNB won’t hike interest rates before December 2019.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more