Swiss GDP moderately impacted by the pandemic

In Switzerland, GDP grew more than expected in 4Q 2020 (+0.3% quarter-on-quarter) despite the restrictions imposed. For 2020 as a whole, the fall in Swiss GDP is much smaller than that of its European neighbours. The outlook for 2021 is moderate in the very short term but more optimistic for the rest of the year

Better result than expected

Swiss GDP grew by 0.3% in the fourth quarter of 2020, following a 7.6% increase in the third quarter. This increase was better than expected, as the impact of the second wave of the coronavirus was much lower than the impact of the first wave. Household consumption fell sharply, by 1.5% over the quarter, due in particular to a drop in spending on catering and leisure activities as a result of the restrictions imposed to limit the spread of the disease. However, the other categories of expenditure performed well, with a rise in investment (+1.9% QoQ for capital goods, +0.1% QoQ for construction), an increase in public consumption (+1.3%) and a rise in exports of goods (without valuables or transit trade, +3% QoQ).

Better than European neighbours

On average over the year 2020, Swiss GDP decreased by 2.9%. This is a major shock, greater than that of the 2009 financial crisis (-2.1%). However, the fall in Swiss GDP is small in comparison with that observed in 2020 in neighbouring European countries: -5.3% in Germany, -8.2% in France, -8.8% in Italy, -7.5% in Austria. This more favourable development than in neighbouring countries is due to the comparatively moderate restrictions in Switzerland, the probably more favourable sectoral composition of the Swiss economy and the rapid Asian recovery, which is very beneficial to Swiss export industries.

Moderate short-term prospects

The outlook for the first quarter of 2021 is not very bright. Indeed, since January, restrictions to curb the spread of the pandemic have intensified. In particular, a closure of shops, bars, restaurants, sports facilities and leisure places is in force, which will weigh on economic activity in January and February. The Federal Council announced this week that certain restrictions, including the closure of shops, will be lifted on 1 March, but other restrictions, including the closure of bars and restaurants, will remain in place until at least 22 March. This will probably allow economic activity to pick up a bit in March. Even though ski resorts are open in Switzerland, unlike in other European countries, many tourists are unable to visit the country. Tourism is therefore expected to decline in 1Q compared to other years.

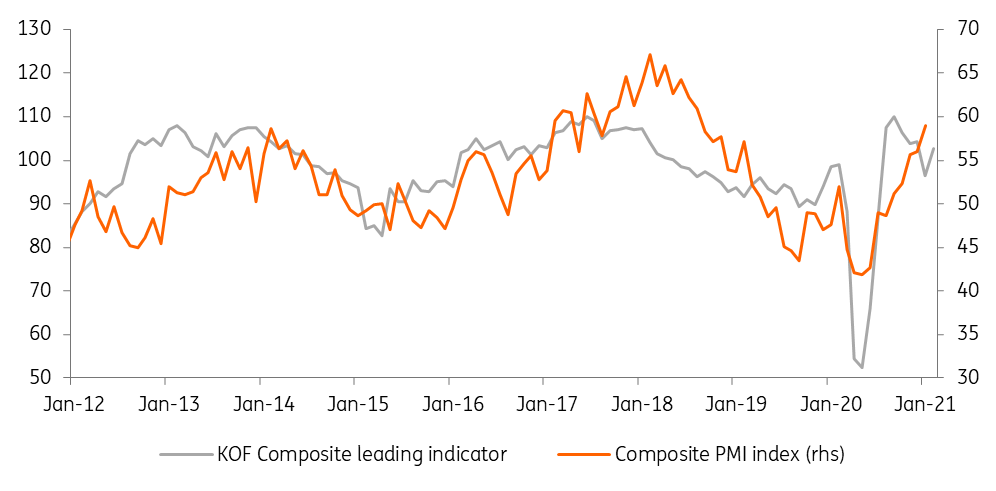

At the same time, confidence indicators are doing rather well. The KOF leading indicator exceeded its long-term average in February, reaching 103 against 96 in January. The PMI indices are also at very high levels, boosted by the very good health of the manufacturing sector.

Given the severe restrictions in force, we expect GDP to decline in 1Q 2021, mainly due to a sharp fall in consumption and tourism. Nevertheless, the decrease in GDP should be much smaller than those recorded during the first wave of the coronavirus in 1Q and 2Q 2020 (-1.9% and -7.2% QoQ), mainly due to the manufacturing sector and to the adaptability to health regulations shown by companies that are not obliged to close down.

Confidence indicators are moving in the right direction

Planned recovery from 2Q

From the second quarter onwards, thanks to the progress of the vaccination campaign and the gradual lifting of restrictions, GDP growth should resume. We expect growth of around 3% for the whole of 2020, which implies a return to the level of activity that prevailed before the crisis at the end of 2021. This is again much better than most European countries, which would only reach their pre-crisis levels by the end of 2022 or even 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more