Sweden: How long can the good times last?

The Swedish economy has held up surprisingly well in the first half of 2018. We still think a slowdown is coming though

Growth has remained strong

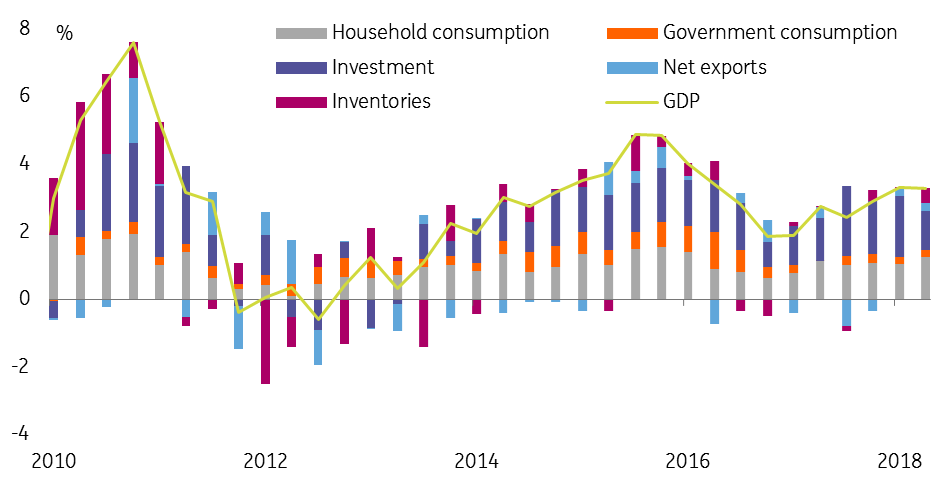

For some time now, we and most other forecasters have been expecting the Swedish economy to slow down. After several years of strong growth, driven in large part by a booming housing market and strong consumer demand, the Swedish economy seems unlikely to sustain 3%+ annual growth in output. Long-term potential growth is more like 2% per year.

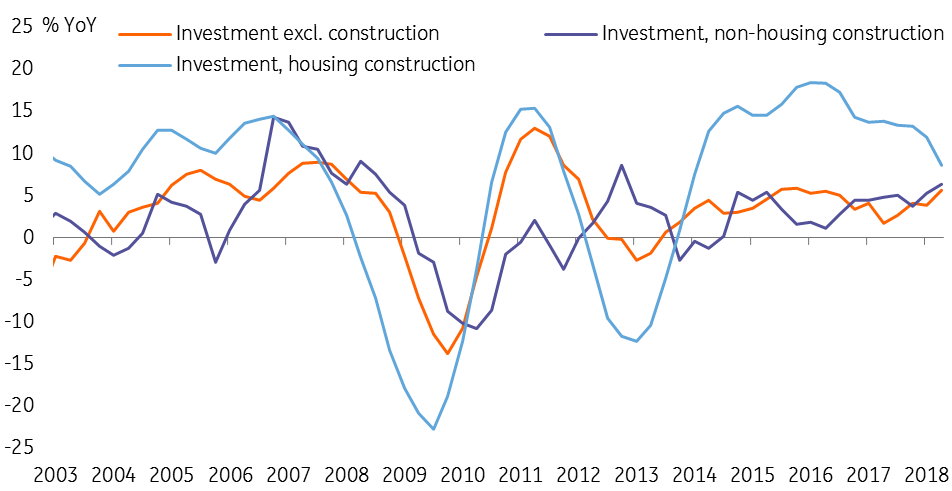

But so far this year, expectations for a slowdown have proven unfounded. GDP grew strongly in both 1Q and 2Q, with output up 3.3% compared to the middle of 2017. The housing slowdown has yet to make a major impact on growth figures. While new housing construction slowed markedly in 2Q, an increase in other investments offset this. And consumer spending, which is typically sensitive to house prices, has held up despite the sharp fall in house prices at the end of 2017.

Swedish GDP growth by component, YoY

Still, the second half of 2018 is likely to see softening growth momentum. First off, the 2Q growth figure was flattered by a build-up of inventories and strong net exports, which is likely to be partly reversed in 3Q. Household consumption may also have been flattered by changes to the taxation of new cars from the start of July, which created an incentive to bring purchases forward. Again, this may push down on the 3Q and 4Q growth figures.

High-frequency survey data also suggest momentum is faltering, with consumer confidence weakening, in particular. Housing construction will slow further, and it is not clear that investment in other sectors will continue to make up the shortfall. So growth in the second half of the year is unlikely to match the first half pace.

Housing investment is slowing down

But the housing market is still a concern

House prices have been broadly flat in 2018, stabilising after the sharp fall last autumn. The market is down around 5% nationally and around 10% in Stockholm. So far, the spillover to the rest of the economy appears limited, with household consumption holding up well in the first half of the year.

The key question now is how the market develops over the rest of the year. The signals are mixed. On the positive side, sentiment on housing seems to be turning more positive again. But at the same time, sales volumes have been extremely low over the summer, and there remains a large overhang of newly built properties coming on to the market in Stockholm and other major cities.

In our view, a further leg down in prices over the autumn, perhaps another 5-10%, is a plausible scenario. This would likely further depress new construction, and would likely start to dampen consumption to some extent as well.

And the global outlook also looks cloudy

While the deal between the US and EU to take auto tariffs off the table has reduced the immediate threat from the US administration’s aggressive tariff policies, continued tensions between the US and China are bad news for the export-dependent Swedish economy. If the global economy slows down, Sweden will slow with it. At a time when domestic momentum is already waning, this would be a double-whammy for Swedish growth.

The recent turmoil in Turkey that’s spread to other emerging markets, as well as the underlying tension between the EU and Italy’s new government around the country’s fiscal plans, also poses risks to the global outlook, and particularly the European economy.

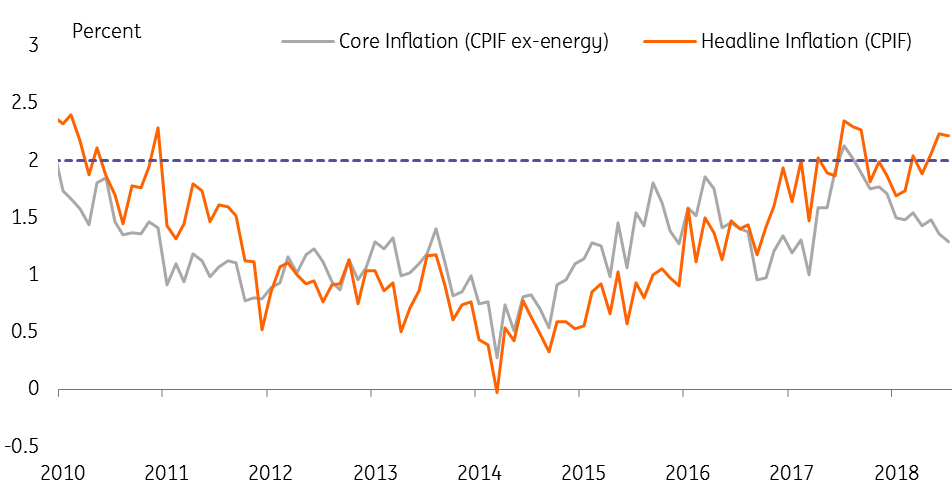

Energy prices have risen, but underlying inflation continues to disappoint

Over the summer, the headline inflation rate has risen above 2%. But this is entirely down to high energy prices: the rise in oil prices earlier this year is feeding through to consumers, and the extremely hot summer causing electricity prices to spike (the dry weather meant Sweden’s hydropower plants had to reduce output). As the energy effects start to fade, inflation is likely to fall back, unless domestic inflation starts to pick up.

But underlying, domestically-generated inflation remains weak, with core inflation at 1.3% in July and services inflation at 1.2%. And there are few signs of domestic prices picking up materially. The Riksbank’s core inflation forecast has proved too optimistic six out of seven months this year, despite a 10% depreciation of the krona since last autumn (which should be pushing up in core inflation by now).

Headline inflation rises on energy prices, but core lags behind

The Riksbank’s dilemma remains the same

For the Swedish central bank, the situation is drearily familiar. Swedish growth is strong, but risks are clearly skewed to the downside both at home and abroad. Underlying inflation remains stubbornly low, with no clear upward trend. And ECB continues to keep policy setting loose – no interest rate change is likely until the autumn of 2019.

This puts the Riksbank in a tough spot. There’s no doubt the committee would like to start raising rates, and a 10 basis point hike in December, consistent with the Riksbank’s current interest forecast, cannot be excluded. But given how adamant policymakers (at least the majority of the MPC led by Governor Stefan Ingves) have been that inflation needs to return sustainably to target before monetary stimulus is withdrawn, the likelihood is that the continued weakness in underlying inflation will cause them to delay the first rate hike into 2019.

We expect a move in that direction at the 6 September policy meeting, though divisions on the committee make it difficult to judge how the communication will play out.

Elections in September

Sweden holds elections on 9 September. Polls suggest the likely outcome is a hung parliament, where record support for the far-right, anti-EU Sweden Democrats means neither of the traditional centre-left and centre-right blocks are even close to a majority. That means messy and potential lengthy negotiations to form a new government lie ahead, which could lead to at least a short-term political risk premium being priced into the krona.

Tags

SwedenDownload

Download article24 August 2018

In case you missed it: De-throning the king This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).