Green bonds fade while social bonds blaze

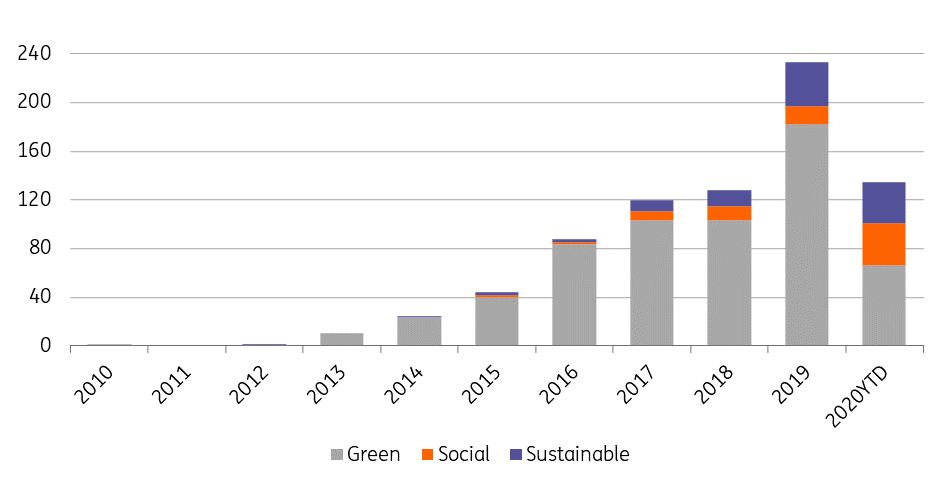

We estimate sustainability bond issuance to have reached the equivalent of €135bn in the first six months of 2020. While the issuance of green bonds has slowed down, social and sustainable bonds have shown strong growth, driven by the Covid-19 pandemic and its impact on society and business

With an equivalent of €135bn in the first six months of 2020, the sustainability bond market recorded another strong expansion. However, the picture has been less rosy for green bonds. This asset class was expected to continue growing at a robust pace but the first six months of the year proved disappointing. Is the Covid-19 pandemic playing a role?

We think so.

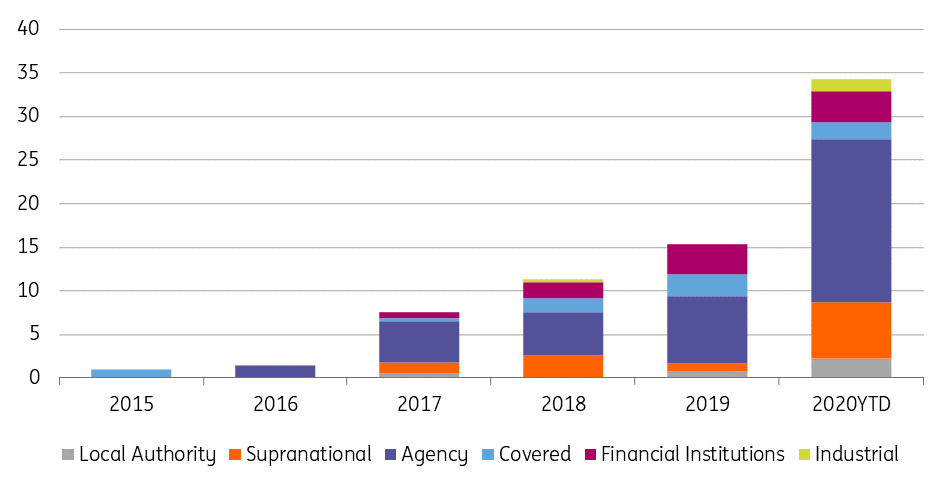

With lockdowns across the globe, some green projects have been put on hold, but Covid-19 has shifted a number of issuers’ attention towards the pandemic and its social, health and economic consequences. Social bond supply reached €34bn in the first six months 2020 compared with €15bn for the full year 2019. The surge comes from new issuers as well as issuers generally active on the green bond market. Mostly, these issuers are agencies and local authorities.

Total sustainability bonds issuance (in €bn equivalent)

Pandemic bonds break through

Since February 2020, "pandemic bonds" emerged on the bond markets in several regions. However, the pandemic label follows a very simple definition as it merely pertains to a term-sheet, making reference to the proceeds being used to fund Covid-19 relief efforts and no particular underlying framework.

| €237bn |

Pandemic bonds issued in 1H20 |

Pandemic bonds

The China Merchants Bank was the first to print a pandemic bond in February 2020, followed by the Bank of China and other Chinese institutions and agencies in March.

Among the biggest issuers is the Spanish government with a €15bn 10-year bond that was later topped up to over €21bn. Also, the Indonesian government issued a pandemic bond in three tranches worth around a total of US$4.3bn in April 2020. These government issues highlight the very broad definition, which does not even capture the entire effort to stem the pandemic. One could argue that most countries’ funding plan revisions since March represent some effort to finance the crisis response.

With that caveat in mind, we can say, pandemic bond issuances reached an equivalent €237bn.

Social and sustainable bonds favoured over green bonds

With €237bn of pandemic bonds issued in the first six months of 2020, not all pandemic bonds fall under the category of social or sustainable bonds. Actually, only about 15% of these bonds have a social or sustainable framework. According to the ICMA, all types of issuers in debt capital markets can issue a social or sustainable bond related to Covid-19, as long as all the four core components of the Bond principles are addressed.

The issuance of sustainable bonds reached €34bn in 1H20 compared with €35bn for the full year 2020. Social bonds put in an even stronger performance, with supply more than doubling. In the first six month of 2020, issuers printed €34.3bn in social bonds compared with €15.4bn in 2019.

Social bonds issuance (in €bn equivalent)

Agencies and supranationals were behind the social bonds’ strong progress.

Actually, in the first half of 2020, a number of these issuers did not approach the green bond market at all despite the fact they were regular issuers in the past few years. For entities such as the Korean Development Bank, Instituto de Credito, the African Development Bank or the Caisse Française de Financement Local, their attention focused mainly on the Covid-19 pandemic and the financing needs to mitigate its impact.

We estimate that about €8bn of social bonds were issued by entities usually active in the green bond market.

We believe that the social and sustainable bond supply will continue its expansion in the second half of 2020 and maybe beyond as the pandemic is not yet under control.

The European Stability Mechanism announced it could provide up to €240bn in pandemic crisis credit lines, although we think that about €80bn is more realistic if not still on the high side. Green bonds issuance may lose some steam in 2020 but we think this is a temporary slowdown. Investments in renewables, electricity grids, electric cars and charging stations, as well as the construction and renovation of buildings and infrastructure, will continue to be strongly supported by governments and corporates’ engagement towards energy transition.

Download

Download article10 July 2020

In case you missed it: How green is your recovery? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more