Strong US inflation keeps the Fed on a hawkish track

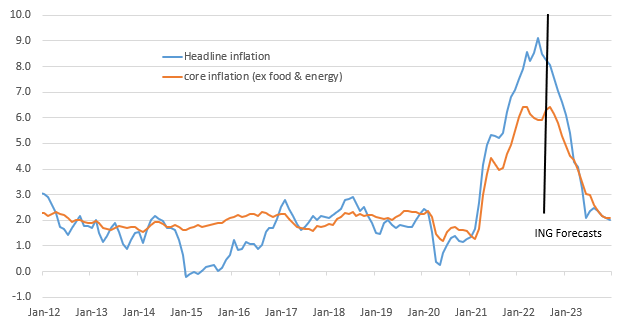

Gasoline prices pulled headline inflation down to 8.3% YoY, but it was a smaller decline than hoped as housing, medical costs and vehicle prices lifted the core rate to 6.3% from 5.9%. This firmly backs a 75bp rate hike next week and the market now anticipate a terminal rate in the 4-4.25% range, but there are still strong reasons for inflation to fall sharply

| 8.3% |

Annual US inflation |

Housing, medical and autos keep core pressures elevated

US consumer price inflation has certainly surprised on the upside and heighted the chances of the Federal Reserve hiking to an even higher terminal interest rate. The market (and ourselves to be fair) were looking for headline inflation to slow from 8.5% to 8%, but for lagged effects of house price gains to push up rents and move core inflation to 6.1% from 5.9%. Instead we got readings of 8.3% and 6.3% respectively.

Housing costs were indeed strong with the rental components rising 0.7%, but utility payments also increased 1.5% while new car prices rose 0.8% and used car prices fell “only” 0.1%. There had been some talk that new models and promotions would have generated a lower figure while second-hand auction prices had pointed to a larger decline. Other goods and services were also firmer than anticipated, rising 0.7% month-on-month with medical care services rising 0.8%. The 4.6% month-on-month decline in airline fares and the 10.6% drop in gasoline prices were the main area of softness, reflecting broader energy cost declines.

US consumer price inflation with ING's forecasts

The Fed has more work to do

Clearly this outcome throws out any talk of the Fed potentially surprising with a 50bp hike next week, but it isn't calamitous enough to see a big push for 100bp – at the time of writing the market is pricing 80bp, up from around 72bp before the report’s publication. We are sticking with the 75bp call.

It also means the Fed won't be particularly explicit in any guidance following next week's Federal Open Market Committee (FOMC) meeting. Nonetheless, the breadth and stickiness of inflation pressures has seen the market shift its expectations for the terminal rate up to 4-4.25% from the 3.75-4% range before the release. We are going to stick with the 3.75-4% call for December – a 50bp hike in November and a final 25bp move in December.

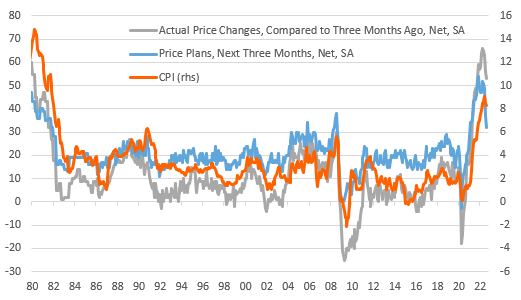

But price pressures will subside

On the activity side the external environment of a European energy crisis, a China slowdown and a strong dollar combined with ongoing interest rate hikes domestically and a slower housing market raise concerns about the growth story heading into year end. On the inflation side we feel that the weaker activity backdrop will dampen corporate pricing power and lead to a squeeze on profit margins. Indeed, the National Federation of Independent Businesses (NFIB) survey released this morning suggests, in the small business sector, that inflation pressures are already softening with a clear drop in the proportion of companies looking to raise their prices further.

NFIB prices and price plans point to lower CPI readings ahead

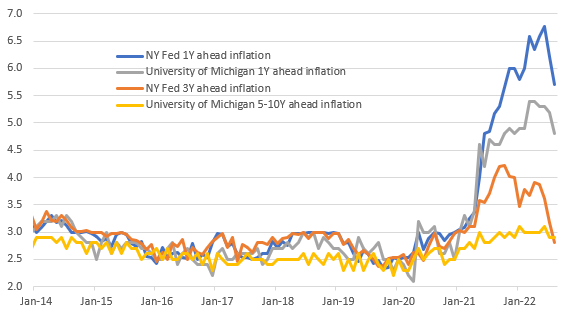

Furthermore, the drop in both market and consumer inflation expectations is clearly a positive development as it suggests confidence in the Federal Reserve’s ability to get inflation back to target next year and helps to diminish fears of a 1970s style wage-price spiral. Officials repeatedly state that expectations remain anchored and there are clear signs of success here.

Inflation expectations are normalising

Still targeting 2% CPI by end-2023

With the outlook for the housing market deteriorating, we expect to see home prices move lower over the next 6-12 months, which will help to depress the rental components (that make up a third of the inflation basket). Meanwhile, supply chain improvements and lower used car prices will also be key factors that contribute to slower inflation next year. Add in weaker commodity prices, squeezed margins and the effects of dollar strength and we still see a strong chance that inflation hits 2% by the end of 2023.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more