Soaring fuel prices complicate aviation sector’s recovery from the pandemic

The aviation and shipping sectors are among the most fuel-sensitive sectors. Airlines face challenging times and high fuel costs can influence their profitability path, while shipping companies operating vessels ‘on the spot’ are most vulnerable to rising costs

Oil prices have risen sharply over the past year, pushing up fuel costs for heavy-fuel consumers, and fuel prices are expected to stay high this year. So how is the higher fuel bill affecting the most energy-intensive transport sectors; aviation and shipping, and how do companies cope with this? It all depends on contracting and mitigating strategies. Either way, fuel efficiency pays off in terms of cost and footprint.

Fuel-sensitive airlines choose their own fuel strategy

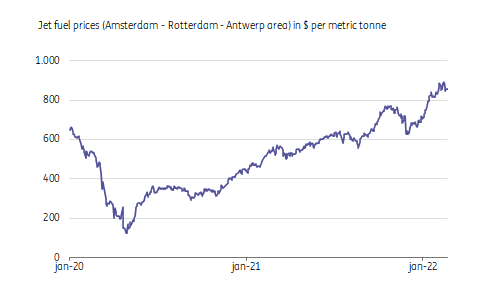

Airlines are highly sensitive to fuel price increases. Aircraft consume an average of 3-3.5 litres per 100 passenger-kilometre. Consequently, fuel costs make up 20-25% of total costs in the current market, and can sometimes exceed 30%. Combined with tiny margins, the impact on profitability can be significant. Airlines faced even higher fuel rates back in 2012 and 2013, but this time fuel prices have come a long way while recovery from the pandemic has just started. Mid-February, prices for the delivery of jet fuel traded at more than 75% higher than they did in February 2021, which means airlines now face over 15% higher total costs when fully exposed to spot rates. Remarkably, airlines all follow their own tailored hedging strategies to mitigate fuel price risks and delay impact. Forward contracts, swaps and also options strategies are used to manage fuel price volatility (whether jet fuel or crude oil).

Jet fuel prices surged in 2021 and 2022

Low-cost carriers tend to apply higher hedge ratios than traditional carriers

Generally speaking, low-cost carriers such as Ryanair and Southwest Airlines use higher hedge ratios than traditional flag carriers like United Airlines, British Airways (IAG) or SAS. As their margins are lower, low-cost carriers tend to buy short-term certainty, while traditional intercontinental hub carriers include some more flexibility to respond to the market. There are also geographical differences; for European airlines hedging is generally more common than for American airlines.

Airlines strive to pass on the bill to customers, but higher costs will weigh on results

Airlines seek to reduce and delay the impact on the profit and loss and they will try to pass on the higher costs to consumers. The hedging of fuel prices enables airlines to make better fixed offers to airline passengers upfront. A ticket surcharge can also be applied. In the current market – which still has a long way to go to recover from the pandemic – competition between airlines complicates the immediate passing on of higher costs. Nevertheless, higher fuel costs will generally weigh significantly on airlines' financial results in 2022.

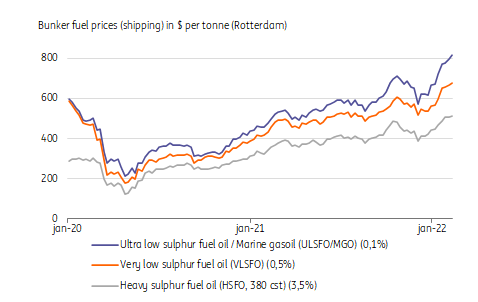

Bunker prices are significantly higher, widening fuel spreads

In shipping, the higher fuel bill is often passed on to charterers...

In shipping, vulnerability to rising fuel costs depend on the type of contract and line of business. This makes sense as fuel costs can easily run up to more than 50% of total vessel operating costs. In contrast to aviation, this is mainly a business-to-business environment. Normally charter or long-term contracts contain fuel clauses passing on the impact to the shippers (e.g. traders or industrials) hiring the vessel. This covers the largest part of the fleet and includes smaller bulk and short sea vessels. In these cases, shipping companies can periodically pass on higher fuel costs and the impact will remain limited.

…but profitability can be affected for those operating in spot markets

But when a vessel is active on the spot market (voyage charter) the owner/operator is free to accept a voyage against a certain rate and the shipping company is usually exposed to fuel prices itself. This represents roughly half of total the volume and for example this can be the case for larger dry bulk vessels like capezisers (>110.000 tonnes) or tankers operating on the spot crude market. Whether the spot rates compensate for the higher fuel price depends on the market and market power.

So the impact of higher fuel costs for shipping companies depends on contractual relations and the composition of the fleet.

Container liners carry own fuel costs, but in current markets this won’t hurt

In container shipping, the fuel cost usually weighs on the liners themselves as they serve a full range of different clients booking container slots with liners for a specific trade or sailing. The current capacity squeeze in container shipping has sent the profits of liners like Maersk and Hapag Lloyd to record highs and currently, container liners also have the market power to install bunker surcharges if necessary. As tariffs are expected to remain elevated in 2022, shipping companies in this segment are at least able to absorb higher fuel prices.

Fuel spreads are rising and strengthening the case for scrubbers

Fuel costs as a share of total costs depend on the type of fuel being used as vessels are allowed to sail either on heavy fuel oil (HFO) in combination with a scrubber or on more expensive very low sulphur fuel oil (VLSFO) or ultra low sulphur fuel oil or marine gasoil (ULSFO/MGO), which is required in specific emission control areas (ECA) including the North sea – Baltic area. In addition, prices of liquefied natural gas (LNG)-bunkers have risen even more. The spread between HFO and VLSFO has increased again from just over $90 per tonne a year ago to $160 in February this year. Fuel consumption highly depends on vessel size and speed, but can run up to 75-100 tonnes per day for larger vessels, making installed scrubbers financially more attractive in some situations.

Slow steaming to reduce fuel consumption

With soaring fuel prices, the importance of fuel efficiency generally rises even more. Shipping companies may consider reducing vessel speed (slow or super slow steaming) as this can significantly save fuel. In charter contracts, the fuel price change will be reflected in charter tariffs. More efficient (often newer) vessels will usually be offered more attractive rates. For time charters fuel efficiency is therefore also important (next to the upcoming start of the IMO energy-efficiency regulation).

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more