More of the same from the Swiss central bank

As expected, the central bank left rates unchanged today and still believes the franc is “highly valued”. Given that a strong appreciation of the franc is its worst nightmare, we believe it will wait for the ECB and won't hike before December 2019

Nothing new for monetary policy

The target range for the three-month Libor was maintained between -1.25% and -0.25% and the interest rate on sight deposits with the Swiss National bank remains at -0.75%. Moreover, the central bank reiterated its willingness to intervene as required in foreign exchange markets to prevent an appreciation of the Swiss franc.

The Bank still believes the franc is “highly valued,” noting its volatility over the past three months and saying it is still considered a safe-haven asset. Indeed, according to the SNB, political factors in the euro area are the main culprits for the recent appreciation of the franc.

Swiss franc has had a volatile ride during the past three months

More cautious assessment of global growth outlook

Even though the central bank still considers the global economy will continue to grow above its potential, the growth outlook is more cautious than it was in March. Trade tensions and political developments in certain countries are risks for the Swiss economy. Nonetheless, the assessment of the domestic growth outlook is still positive. The SNB noted that 1Q18 GDP growth was above its estimated potential and that overall capacity utilisation improved further. The SNB believes GDP growth will reach 2% in 2018.

Given the increased risks and the decrease of the KOF-leading indicators, we have slightly revised our GDP forecast for 2018

On the domestic side, it noted imbalances on the mortgage and real estate markets persist. It remarked that real estate prices continue to rise and that “affordability risks for new mortgage loans in the residential investment property segment rose significantly last year.”

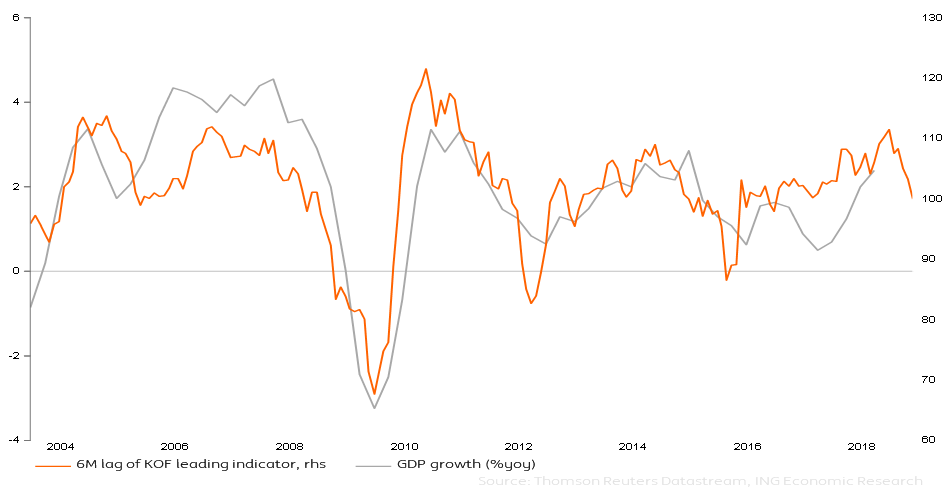

We tend to agree that global risks have increased over the last few months and that can already be seen in the fall of Switzerland's leading indicator - the KOF Economic Barometer - from 108.3 in February to 100, its long-term average, in May.

Given the increased risks and the decrease of the KOF-leading indicators, we have slightly revised our GDP forecast for 2018. GDP grew at 0.6% quarter on quarter in 1Q18, and we revise our estimates to 2.2% on average in 2018 from the previous 2.3% estimate. We expect 2.0% growth in 2019 compared to 1.1% in 2017.

A falling leading indicator

Higher inflation, but only due to external factors

The central bank noted that inflation has increased during the past few months, reaching 1% year on year in May for the first time since March 2011. It could be considered a good sign as the country has been battling with deflation and low inflation for the past seven years. However, the spike was mostly a consequence of higher oil prices and temporary weakness of the franc in late April, which together increased import prices.

The SNB revised upwards its conditional inflation estimate (i.e. based on the assumption of no change in monetary policy) for 2018 to 0.9% from 0.6% in March. However, it didn't revise its forecast for 2019 (0.9%), recognising that higher inflation is due to temporary factors. Moreover, it revised its inflation forecast for 2020 downwards from 1.9% to 1.6% which signals a rather dovish monetary policy over the next years.

Looking ahead

We believe the SNB won’t change its policy anytime soon.

Given the SNB’s worst nightmare is a strong appreciation of the franc, we believe it will wait for the ECB to start raising rates. The ECB's announcement that it would stop bond buying in December isn't enough on its own to make the SNB change its policy.

Given the ECB is not expected to hike before the end of summer 2019, we think the Swiss National bank won’t raise its rates before December 2019 either.

Download

Download article22 June 2018

In case you missed it: Divergence and divisions This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more