Singapore’s GDP surprises on the upside, again

The argument for MAS tightening in April 2018 remains strong unless export-led manufacturing strength continues to wear off coming into 2018

| 3.1% YoY |

GDP growth in 4Q17 |

| Better than expected | |

Services supported GDP growth in 4Q17

A seasonal boost to the services sector kept Singapore’s economy going well in the final quarter of 2017, even as manufacturing retraced its outsized bounce of the previous quarter. Singapore GDP grew by 3.1% year-on-year and 2.8% quarter-on-quarter (annualized) in 4Q17, beating the consensus growth forecasts of 2.6% and 1.6% respectively. Not only was 4Q growth above expected but 3Q growth also was revised upward to 5.4% YoY and 9.4% QoQ, from 5.2% and 8.8% previously.

Fading manufacturing strength

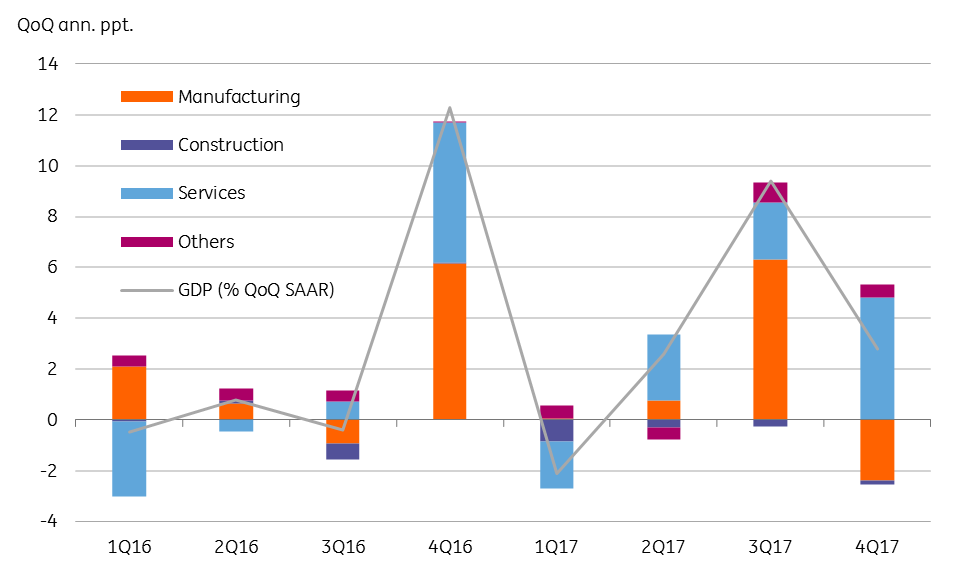

A sharp negative swing in manufacturing production - to 11.5% QoQ contraction from a 38% surge in 3Q - was responsible for all of the GDP growth slowdown in the last quarter. Services activity growth accelerated to 7.5% QoQ from 3.4% and construction activity improved to a smaller contraction of 3.6% compared to 5.5% over the same quarters.

Sources of GDP growth

| 18% |

Rise in Strait Times Index in 2018 |

2017 ended on a strong note

A better finish to 2017 puts full-year growth at 3.5% YoY, the top end of the official 3-3.5% forecast range for a year in which the local stock market returned a hefty 18% and the Singapore dollar appreciated by 8.4% against the US dollar. However, prospects for 2018 are dependent on sustainability of export-led manufacturing strength. The official growth forecast for 2018 stands at 1.5-3.5% (INGF: 3.2%, consensus: 2.8%).

Risks for 2018 are skewed on the downside

With considerable base effects at play and a tapering of world trade growth, the risk to Singapore’s growth forecast for 2018 is skewed on the downside.

On the expenditure-side inventories were the main driver of GDP growth in 2017, while private consumption remained anaemic and fixed capital formation and net trade dragged on GDP growth, the latter despite strong exports. The inventory overhang will likely weigh on production in 2018. A recovery in the property sector evident in recent price data bodes well for private consumption growth, though proposed tax hikes will keep consumers cautious on spending.

The MAS poised for tightening in April 2018

Unless the current GDP growth trend is rocked by weaker than expected activity figures over coming months, and inflation data at least holds its ground or rises slightly (headline at 0.6% YoY and core at 1.5% in January-November 2017), this should be sufficient for the Monetary Authority of Singapore (MAS) to consider a modest tightening adjustment to their monetary policy stance as early as their April 2018 policy meeting.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).