Swedish Krona: Swimming naked?

We revise up our EUR/SEK forecast to reflect new risks from the US administration's aggressive trade policy

We turn bearish on the Swedish krona as the spectre of protectionism and the "trade war risk premia" should continue weighing on the global trade-levered krona in coming months. The SEK has all but lost its relative current account surplus advantage vs the EUR, making the currency increasingly vulnerable to global risk factors. Importantly, the recent SEK weakness is unlikely to create a significant inflation overshoot, thus not warranting a Riksbank response. We revise our EUR/SEK forecast materially higher, expecting EUR/SEK to hit 10.30 in coming months and stay above 10.00 throughout 2018.

Trade war risk premia in place and likely to remain

While concerns about the Swedish housing market appear to be diminishing, a new bogeyman has appeared in the form of the Trump administration’s aggressive tariffs on steel and aluminium.

The spectre of protectionism and trade wars could well remain until at least the November US mid-term elections. And White House economic adviser Gary Cohn’s resignation suggests to us that things will get worse before they get any better. That means that a degree of a "trade war risk premia" is warranted for SEK, given Sweden’s economy is highly exposed to global trade.

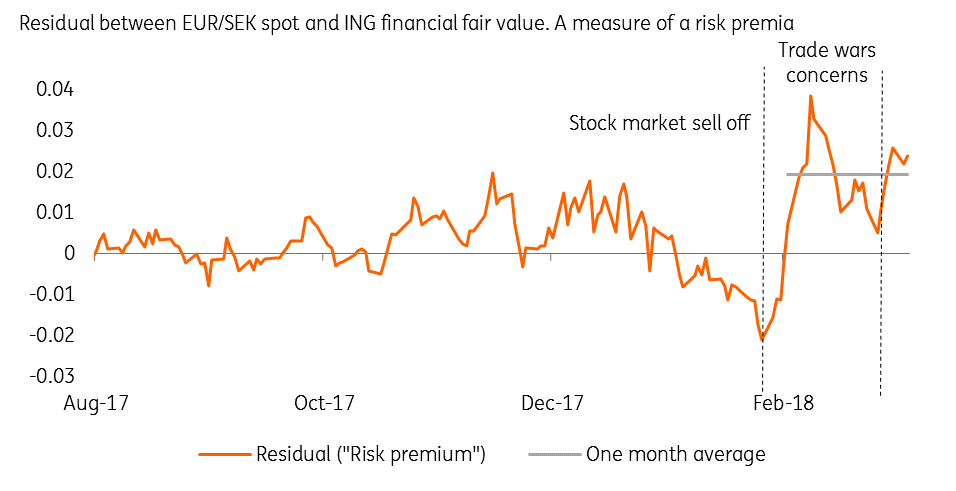

Since the stock market sell-off in early February and the recent bout of concerns about protectionism, EUR/SEK has been trading with a 2% average risk premium (Figure 1). Given the ongoing uncertainty about the US trade policy (and its implications for the global trade relations), we look for EUR/SEK to incorporate a persistent "trade war risk premium" in coming months.

We see a meaningful probability that such a risk premium widens even further in response to concrete actions from the US administration. Indeed, given that Sweden is one of the most open economies in the G10 FX space, the notion of trade wars is a clear negative for the low liquidity, high beta and global growth-levered SEK.

Figure 1: SEK Risk Premium

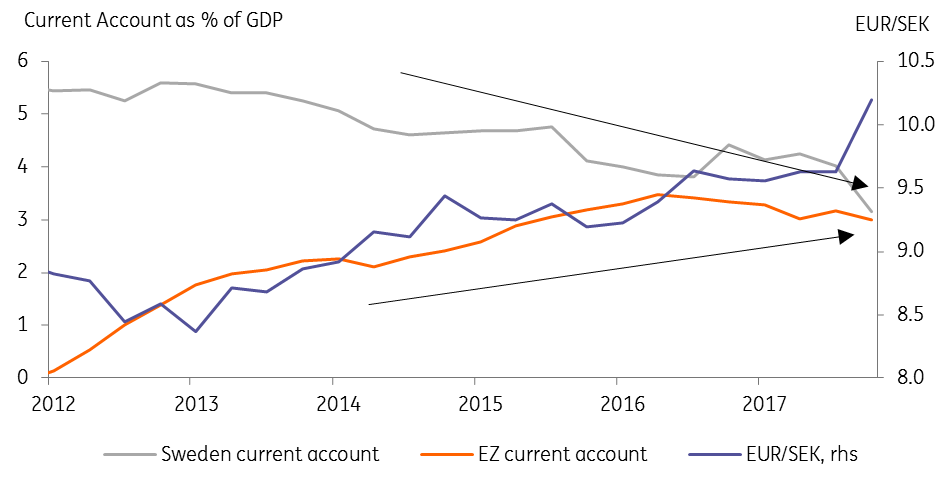

And the current account surplus cushion is all but gone

The SEK has all but lost the relative current account surplus advantage vs the EUR. The deteriorating Swedish current account surplus (from 4% of GDP early last year to a projected 2.5% by end 2018) contrasts with the Eurozone current account dynamics which remain stable at around 3% of GDP (Figure 2). As the relative current account positions converge, the krona’s cushion vs the euro fades away, making the currency more vulnerable to the direct effect of global risk sentiment or the relative monetary policy position. From the current account surplus point of view, SEK is now swimming naked. And the tide may be about to come in.

Figure 2: Sweden and EZ current accounts

Riksbank happy to tolerate weaker SEK

We don’t think the Riksbank will be in a rush to tighten monetary policy prematurely in response to currency weakness. In fact, our analysis suggests that SEK weakness is consistent with the Riksbank achieving its inflation target this year. Given the Riksbank’s current forecast has inflation at 1.7% on average for 2018 (under the assumption that KIX appreciates gradually), there is scope for SEK depreciation to push prices up without triggering a monetary response. A weaker currency would in effect offset the recent softness in Swedish core inflation and put the Riksbank more at ease (Figure 3).

That supports the current Riksbank 'wait and see' stance. Even if we see a couple of months of inflation above 2%, that is unlikely to overly worry the Riksbank, given inflation previously spent six years below target. In testimony to Parliament yesterday Governor Stefan Ingves continued to emphasise the risks posed by a rapid appreciation, while sounding intensely relaxed about SEK’s recent depreciation.

Figure 3: Core inflation vs KIX

Higher EUR/USD allows for higher EUR/SEK

Moreover, it is important to note that it is the trade-weighted SEK (the KIX index) that is relevant for the Riksbank (rather than EUR/SEK per se). With the current and expected strength in EUR/USD, krona weakness against the euro is in part offset by a higher EUR/USD (which pushes SEK higher against the USD block FX) in terms of the trade-weighted SEK.

Although the market pricing of the Riksbank path has declined in recent weeks, the 20bps currently priced in by year-end is still higher than our base case of a 10bp hike in December. This suggests limited room for Riksbank re-pricing led SEK strength and is consistent with our view that potential catalysts for material SEK strength are rather scarce.

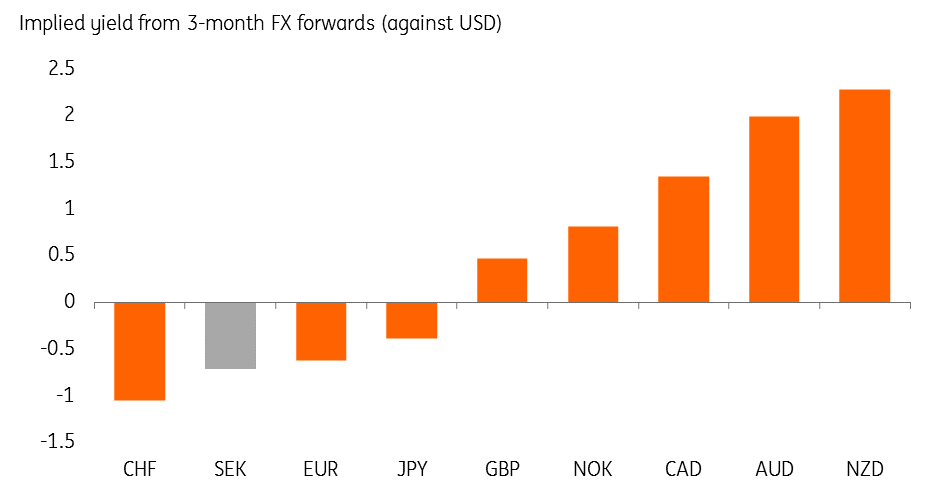

Deeply negative implied yields does not help

Due to the Riksbank’s ultra-loose policy, SEK suffers from deeply negative implied yields. Aside from the Swiss franc (CHF), SEK is the cheapest currency to short (Figure 4) but unlike CHF, it is not a safe haven. Although its negative implied yield is only marginally lower than the euro’s, unlike the euro the low-liquidity krona is not a reserve currency. All this makes SEK vulnerable to bouts of risk aversion, particularly in the context of the deteriorating current account dynamics.

Figure 4: Funding costs

EUR/SEK to trade above 10.00 in 2018

We thus revise EUR/SEK forecast materially higher, recognising the change in SEK dynamics and a lack of meaningful catalysts for SEK strength. Although SEK remains meaningfully undervalued vs the EUR (around 12% based on our medium-term BEER model) the catalysts for a sharp turnaround are simply not in place. We raise our forecast linearly, looking for EUR/SEK to hit 10.30 and trade above 10.00 for the remainder of 2018 (vs 9.50 previously, see figure 5).

We note that although the expected start of the Riksbank tightening cycle in Q4 2018 should be SEK supportive, we believe the usual year-end downward pressure on STIBOR (due to the resolution fund payments at year-end) will limit the SEK upside at that time. Given the spectre of protectionism, we see upside risks to our EUR/SEK forecasts should the global trade wars intensify.

Forecast table (Figure 5)

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).