Russian activity: 2019 provides a low base for 2020

Russian consumers ended 2019 on a downbeat note. 2020 will be a test of the new government's ability to boost confidence amid limited room for further accumulation of consumer debt. Recent events confirm our call that budget tools are likely to be used

| 1.6% |

Russian retail trade growth in 2019down from 2.8% in 2018 |

| Worse than expected | |

Consumer activity weak despite continued loan growth

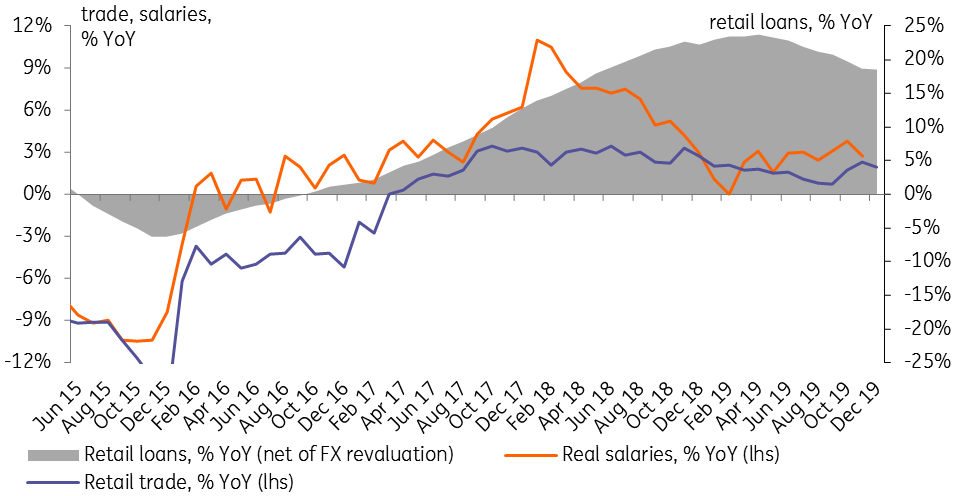

Russian household activity indicators for December came in close to our below-consensus expectations, with retail trade growth decelerating from 2.3% year on year in November to 1.9% YoY in December (see Figure 1). This growth rate is closer to the intra-year range, which confirms our take that the November spike was a temporary reaction to the Black Friday discounts. The December slowdown took place despite more-or-less stable retail loan growth of 18-19% YoY. The key obstacle to better growth seems to be on the income side, as real salary growth decelerated from 3.8% YoY in October to 2.7% YoY in Novmeber (this data comes with a one-month lag) despite a noticeable slowdown in the CPI growth at the end of 2019.

Overall, consumer trends appear to be entering 2020 on a weak note. Looking at the annual figures, retail trade growth decelerated from 2.8% YoY in 2018 to 1.6% YoY in 2019, which we attribute to the VAT rate hike, modest income growth, and increased pressure from debt interest payments.

- Retail loan portfolio increased by around 2 percentage points of GDP, representing both mortgage and non-mortgage lending (see Figure 2). The latter is approaching the historical high levels of 10% of GDP seen in 2013-14, and at this point we doubt this expansion has helped consumption growth. According to official data, households' debt interest payments totaled RUB2.0 tr in 2018, and we do not exclude that the 2019 nominal increase in households was barely enough to cover interest payments.

- Meanwhile, local bank savings of the population (according to previous statements by the Bank of Russia, around one-third of the Russian population have savings) increased by around 1 percentage point of GDP back to the high level of 28% of GDP seen in 2015-18. Moreover, FX retail deposits increased by US$9 bn in 2019 to a historical high of US$97 bn. This points to a stable income situation among the higher income strata, coupled with their low preference to increase spending.

Looking into 2020, the contribution of retail lending to 2020 consumption growth is likely to be zero to negative, as Russia has recently tightened macro prodential regulation, limiting the potential growth in consumer lending going forward. At the same time, the government has recently announced measures aimed at supporting lower income families with children, worth 0.3-0.5% of GDP, which may offer some compensation for the lower ability to borrow. We have no doubt, that the upcoming fiscal easing will support consumption of around 40% of the population, whose income directly depends on the budget (through public sector salaries, pensions and other social payments). However, the ability to materially improve overall consumer trend lies beyond the reach of fiscal tools and depends on whether the government will be able to boost confidence outside the state-driven sectors (ie, to convince higher income households to lower their savings rate).

Figure 1. Key indicators of the Russian consumer trend

Figure 2. Household debt and savings with local banks, % GDP

Corporate activity also weak but more promising

On the corporate side, the picture is more inspiring. On the one hand, construction growth continued to disappoint, posting jsut 0.4% YoY growth in December and 0.6% YoY for the year, and the local corporate loan growth remained weak (see Figure 3). On the other hand, a number of signals suggest that improvement of corporate activity in 2020 is a strong possibility:

- As we mentioned earlier, Russian industrial production, especially sectors focused on construction and other investment-heavy industries, posted improved dynamics in 2019, also triggering 4-8% YoY growth in imports of machinery, equipment and transport in October-November 2019.

- Companies, while still having no interest in increasing their debt burden, have recently started to reduce their savings (see Figure 4), with FX accounts down by US$8 bn in 2019 and overall corporate funding growth decelerating from 13% YoY in 2018 to just 1% YoY in 2019. Local corporate savings with banks have declined by 2 percentage points of GDP over 2019, and even though they are currently still at an elevated 26% of GDP, this may hint at a potentially higher preference for investments.

- The recent government reshuffle may provide reassurance to the real sector that fulfillment of the National Projects (state spending on hard infrastructure and human capital) will gain traction after lagging in 2019. To remind, the federal budget underspent around RUB150 bn on National Projects in 2019 (RUB1.60 tr was spent vs a planned RUB1.75 tr), and this sum may be carried over to 2020, adding to the existing plan of RUB2.0 tr.

Figure 3. Key indicators of the Russian producer trend

Figure 4. Companies' local debt and savings, % GDP

Budget policy is important, but not everything

It appears that the new government will be looking to stimulate consumer and investment activity with budget tools. We are awating confirmation in the beginning of February, when the updated budget draft will be released. We do not exclude that additional spending of 0.5-1.0% of GDP may be incorporated into the new plan for 2020, plus around 0.3% GDP of local investments from the National Wealth Fund can be confirmed. This could improve confidence in the state-driven portion of consumption and investments and (partially offset by higher imports) lead to an improvement in the 2020 GDP growth outlook (currently at 1.5% following a preliminary 1.4% estimate for 2019) by around 0.5 percentage points. Meanwhile, confidence in the private sector will remain a factor of uncertainty going forward.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more