Russia: activity weakens in March

March macro statistics confirmed the slowing of consumer and producer activity in Russia. While unlikely to affect the central bank's cautious stance, weak growth may put the tight budget policy in the spotlight

| +1.6% YoY |

March retail trade+1.8% YoY for 1Q19 |

| As expected | |

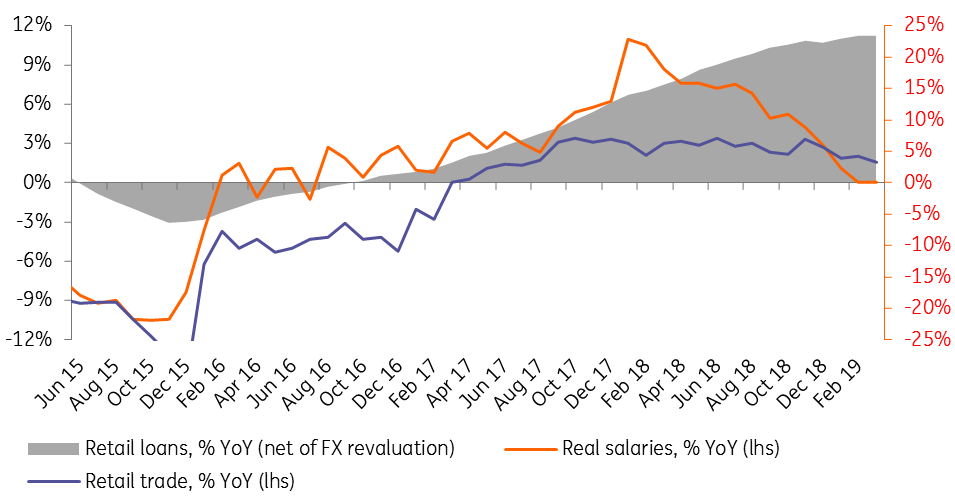

Consumption growth decelerates, while retail lending accelerates

March consumption statistics confirmed our call on a weakening in retail trade growth amid households' increased reliance on leverage.

Retail trade growth decelerated from 1.9-2.0% in January-February to 1.6% year on year (YoY) in March, which is in line with consensus and marginally better than our 1.5% YoY expectations. At nearly full employment (the unemployment rate dropped from an already low 4.9% to 4.7%) the real wage growth was reported at zero for the second month in a row (initial February estimate has been downgraded) after a very modest 1.1% YoY in January. This deceleration took place both due to the acceleration of CPI growth from 4.3% YoY last year to 5.3% YoY this March and deceleration in nominal salaries growth from 9.9% YoY in the electoral 2018 to 5.6% YoY in 1Q19.

Meanwhile, the preliminary banking statistics indicate that the slowdown in retail trade took place amid a slight acceleration in retail lending growth to a 5-year high of 24% YoY and a deceleration of the retail deposit growth to a 4-year low of 6% YoY (net of FX revaluation effect). This points at the continuation of the trend evident from the beginning of this year - consumption is now increasingly financed by savings and accumulation of household debt.

Key indicators of the Russian consumer trend

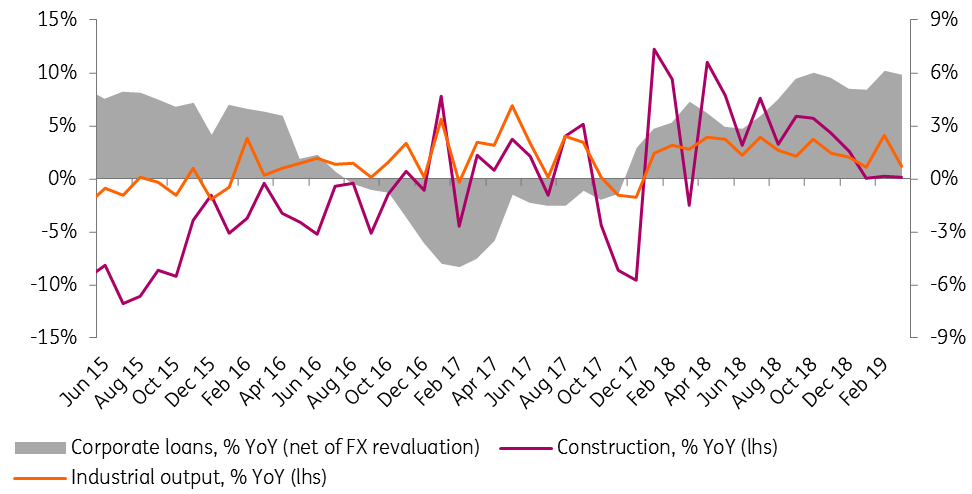

Producer trend remains anaemic

On the producer side, the earlier released below-consensus 1.2% YoY industrial output growth is supplemented by a 0.2% YoY increase in construction volumes, which together with a 3% YoY drop in imports and persistently low 6% YoY (net of FX revaluation) increase in corporate loan growth point at a weak investment activity following a relatively strong 4.3% YoY investment growth seen in 2018. With new big-ticket projects planned in the "National projects' still in the early stages, we are not optimistic regarding the near-term producer trends.

Key indicators of the Russian producer trend

The weakness in the overall GDP growth in the 1Q19, which according to the preliminary government estimates was only 0.8% YoY, below our 1.1% YoY expectations, corresponds to our cautious view of 1.0% YoY GDP growth in 2019.

We do not see it as a challenge to the monetary policy, which is likely to remain cautious due to mid-term inflationary and other risks, expecting the key rate to remain at 7.75% in the near term.

Meanwhile, we reiterate that the budget conservatism, favoured by international investors, may become increasingly challenged. With an above-expected budget surplus of RUB550 billion in 1Q19, the demand for budget stimulus for consumers and producers may increase. So far, additional social policy measures announced by the president were estimated at an extra RUB120 billion per year, and the current freeze in gasoline prices is also taking place at the expense of the budget at RUB60-200 billion pa. The already budgeted infrastructural part of the 'National Projects" requires financing at the amount of 2.5% GDP pa, but historically the capex volumes for the state-sponsored projects tended to increase over time. Further news on the budget policy will be the litmus test of the government's preferred policy response to the growth challenges.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more