Riksbank preview: To QE or not to QE

That’s the question the Swedish central bank has to answer tomorrow. We think the answer will be no, but further QE cannot be ruled out and the Riksbank will certainly retain its dovish bias

Mission accomplished?

When the Riksbank started asset purchases back in early 2015, the world economy looked very different. Oil prices were in free fall, inflation around the world was falling close to zero, and the global recovery seemed anaemic. The Swedish central bank joined a wave of central banks loosening policy to stimulate inflation.

The big story in Sweden this autumn has been the sudden sharp falls on the housing market

Today, the situation is very different. The Swedish economy is on track for a third consecutive year of 3%+ growth, inflation is back to target, and the global economy looks much more robust. So the Riksbank will be content with the current outlook and, as Deputy Governor Jansson is likely to take some of the credit for the turnaround in inflation.

But continued caution likely

Perhaps bruised by its experience in 2010-2012, when early rate hikes combined with negative spill-overs from the Eurozone crisis pushed Swedish inflation well below target, the Riksbank’s approach in recent years has been to err on the side of caution. In 2017, it extended its QE purchases twice, even as inflation was picking up and has consistently signalled a continued dovish stance.

Since the last Riksbank meeting, domestic data has been mixed but broadly in line with Riksbank forecasts. 3Q GDP came in a little weaker at 0.8%, and there were minor downward revisions to previous quarters. But forward-looking indicators suggest solid momentum in Q4. Robust growth and a brighter outlook on the US and Eurozone means strengthening external demand will support the Swedish economy in 2018.

On inflation, weak September and October data were offset by a stronger November figure. And while inflation expectations fell slightly in the fourth quarter, domestic prices have continued to rise, oil prices have increased by around 10%, and the KIX trade-weighted index has depreciated by about 3% since October. That means inflation is likely to remain around the 2% target in coming months.

The housing market is a wild card

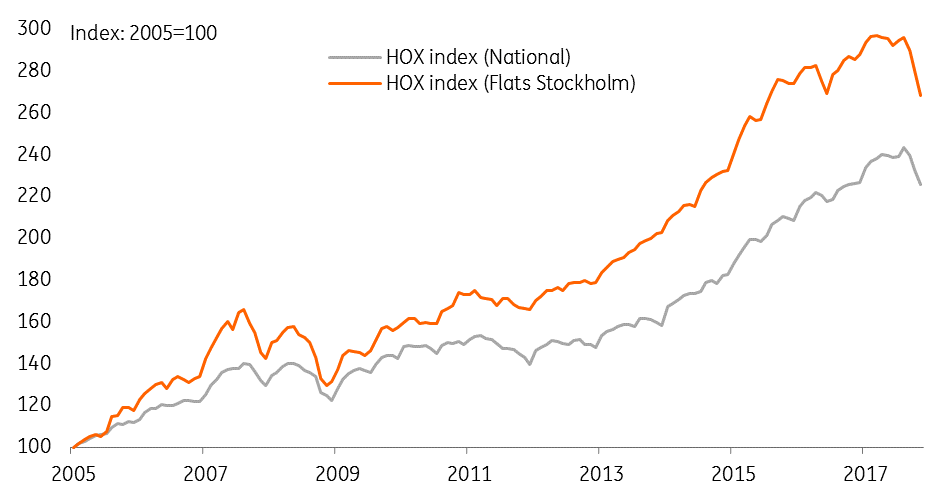

The big story in Sweden this autumn has been the sudden sharp fall in the housing market. Since August, the national house price index has come down by around 7%, and in Stockholm, prices are down by nearly 10%. This has led to concerns about spill-overs to the rest of the economy through lower housing investment and reduced consumer spending.

The Riksbank’s response so far has been relatively sanguine, with Governor Ingves arguing that a correction after several years of rapid price increases is natural and welcome. The October forecast assumed a gradual adjustment to housing investment, and while the Riksbank may have revised down growth somewhat on account of further bad news on housing, it is unlikely to have made significant changes on this account.

House prices in Sweden

So what does this mean for the Riksbank tomorrow?

The policy committee has been divided on the optimal policy path. Three members voted against the previous two extensions of QE, and are sure to oppose an extension now. On the other side, Jansson has consistently been the most dovish committee member and has signaled he would prefer more QE.

So the decisive votes are Governor Ingves (with the tie-breaking vote) and his number two Af Jochnick. Recently, they've played their cards close to the chest, but there is little reason to believe they will deviate from the playbook they’ve used successfully over the past three years. That suggests the most important consideration will be to keep the Riksbank’s policy stance aligned to the ECB so that Swedish financing conditions don’t tighten too fast.

This means a small extension of QE (perhaps another SEK10bn over 1H17) is not out of the question. But we think this is unlikely, especially given the currency has weakened considerably this autumn and the more hawkish members of the committee will be uncomfortable with more asset purchases.

Stylized path of the Riksbank's QE asset purchases

Instead, the Riksbank could use reinvestment policy to make the end of QE a less hawkish signal. With no redemptions due in 2018, we think the central bank will spread out reinvestments over 2018 and 2019, which means the stock of asset purchases will continue to increase in 2018.

We also believe the Riksbank will shift its interest rate forecast back by a quarter, putting the first 25bp rate hike in 4Q18. Given our view on the ECB’s likely normalisation path (a further extension in QE and the first deposit rate hike only in mid-2019), we believe the Riksbank will end up pushing its first hike into early 2019, though this will only become clear once the ECB provides more clarity on its timing.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).