Riksbank preview: Tapering complete in Sweden?

The Swedish economy is doing well. If current trends continue, policy tightening is on the way but we think the Riksbank will remain cautious.

QE is coming to the end of the road

The Riksbank’s asset purchases are set to run until the end of the year and seem unlikely to be extended further. Three members of the MPC voted against the previous two increases in the asset purchase programme. And although Governor Ingves and First Deputy Governor Af Jochnick (both doves) recently had their appointments renewed, strengthening their position on the committee, a further extension seems difficult to justify given the objectives of the programme have largely been achieved.

A final decision on extending QE may not come until December

That said, the Riksbank will be wary of getting too far ahead of the ECB, which, awkwardly, will announce what it plans to do just a few hours later on Thursday. So the policy statement and Governor Ingves’ news conference remarks will likely aim to strike a balance between acknowledging continued solid data and the need to consolidate inflation gains before tightening policy. This would leave open the option to extend QE purchases in December, should the ECB surprise on the dovish side.

The forecast for interest rates is likely to remain largely unchanged (first rise in mid-2018), as there has been relatively little news since the September meeting. The committee may also extend the delegated mandate for currency intervention (which hasn’t been used but has some signalling value).

Any further asset purchases would be very small

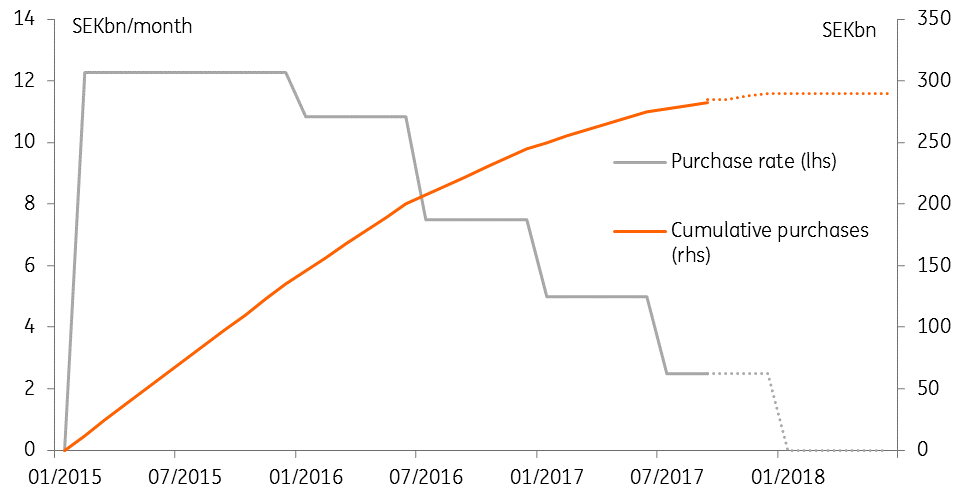

By the end of the year, the Riksbank will have purchased SEK290bn of government bonds, or about 8% of Swedish GDP. While this is less than half the ECB’s and Fed’s QE programmes, as a share of output, it accounts for a larger proportion of outstanding government bonds because Sweden’s public debt is relatively low. The Riksbank now owns nearly 40% of outstanding eligible bonds.

Sweden has no explicit constraints on bond purchases, so this isn’t a problem in the way it is for the ECB. And even if purchases were extended for another six months at the current SEK 2.5bn per month, the impact would be relatively limited.

Another option, should the Riksbank wish to maintain a dovish stance without adding to QE purchases, could be to commit to reinvesting coupons and redemptions for an extended period (e.g. until the end of 2018). Such a decision would more likely come at the December meeting rather than this week.

Riksbank QE purchases on track to end in December

The domestic data continues to strengthen

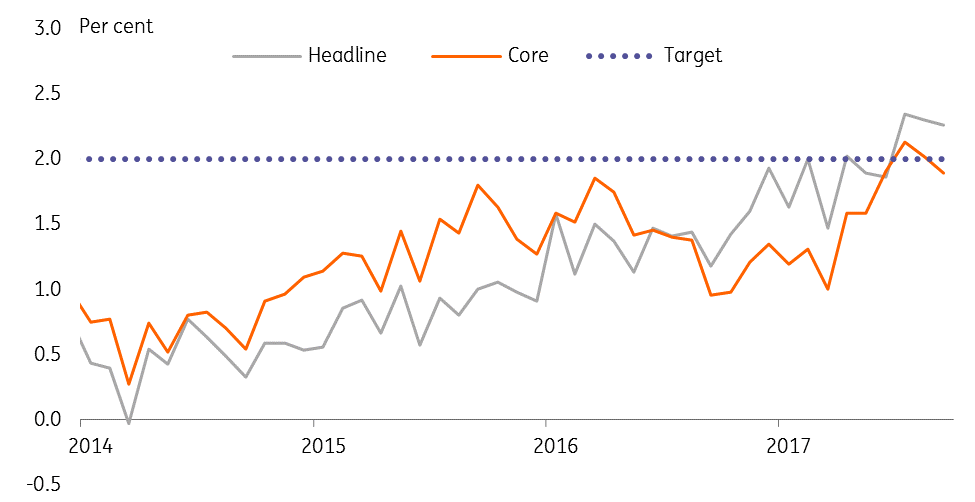

Inflation has risen above the 2% target for the past few months. While headline inflation is set to fall back a bit as base effects in energy drop out, core inflation has strengthened substantially in 2017 and is expected to keep inflation close to target.

As in many advanced economies, wage growth in Sweden has been puzzlingly low in recent years. The 2017 wage bargaining round resulted in a moderate increase in wages for the industrial sector. And with the unemployment rate now close to pre-crisis levels, and measures of capacity utilisation also suggesting the economy is close to or above potential, wage pressure could start to pick up.

Output has grown sharply over the past couple of years. Q2 GDP came in very strong (1.3% quarter-on-quarter), with residential investment, in particular, contributing significantly to growth. House prices and household borrowing continue to grow strongly; the housing market is likely to support growth in the near-term, though potentially unsustainable indebtedness creates medium-term risks.

In addition, the government has proposed an expansionary budget in advance of elections next September. The economic arguments for fiscal stimulus are limited, given the Swedish economy is already growing well. But a looser fiscal stance will boost near-term growth (helping the government's prospects next year) and would add to the case for a tighter monetary stance.

Inflation has come back to target

The external environment has also improved

Concerns about external factors pulling down on Swedish inflation is the key factor behind the Riksbank’s accommodative stance. With the oil market closer to supply and demand balance and the ECB tiptoeing towards the QE exit, these concerns are receding. Relative to the September meeting, oil prices are up by around 5% and the KIX trade-weighted currency index is down by 1%. At the same time, growth in Sweden's major trading partners -- in particular the euro area -- continues to be strong, supporting export demand.

Bottom line

As the domestic data continues to improve and the major central banks inch towards tightening policy, an extremely loose monetary stance in Sweden looks increasingly hard to defend. But, having succeeded in bringing inflation back to target, the Riksbank remains worried about a rapid appreciation of the currency, which could bring inflation down again. So communication is likely to remain dovish, and a final decision on extending QE may not come until December.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).