Czech: Record high foreign trade

The volume of exports reached a record level in 2017, supported by a strong automotive segment whose share of the total Czech export market reached 29% last year

Record-high export activity in 2017

The latest foreign trade statistics confirm record-high export activity in 2017. Although the foreign surplus itself slightly declined compared with 2016, this was attributed to higher commodity prices in 2017, mainly oil, increasing the trade deficit in the category last year. Total exports in nominal terms reached CZK 3,885bn, which represents an increase of 5.6%. This figure was mainly driven by stronger exports of motor vehicles, which increased by 7.8% in nominal terms and reached a new record volume of CZK 995 billion.

| CZK3,485bn |

Nominal exports in 2017increased by 5.6% YoY |

Car segment gains importance

The share of exports of motor vehicles in total Czech exports reached 29% in 2017. This share has been gradually rising from 23% in 2014 and "only" 20% in 2011, increasing the sensitivity of the economy to the car segment (see the Table). The economy has benefited from this development as the car segment has been performing exceptionally well in recent years. This was driven not only by favourable foreign demand and central bank FX-interventions to weaken the currency but also by newly introduced models, which successfully attracted foreign attention. Skoda Auto, for example, increased production by 12% YoY in 2017, while production by the two other most important car producers stagnated or even slightly declined.

The share of the main segments in total Czech exports (%)

Auto sector also the main driver of industrial growth

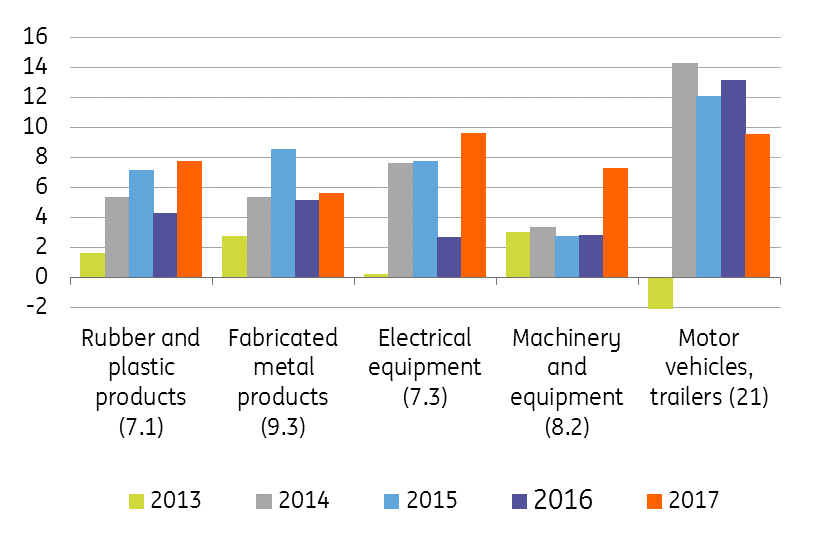

The strong car segment was also the main driver of Czech industrial production, which increased by 5.7% YoY in 2017. This represents the fastest growth rate in the last six years. Not surprisingly, the highest contribution to the YoY growth came from the automotive segment, which picked up by almost 9.5% and maintained its double-digit growth rate for the fourth year in a row. But 2017 was successful for other manufacturing segments, too, as their growth rates accelerated in 2017 (see Chart).

Growth in the main industrial segments (%YoY)

Deceleration in industry is expected

The fast-growing automotive sector brings some concern for the future, and signs of deceleration ahead are starting to appear.

- Firstly, new car registration in the EU is slightly decelerating

- Secondly, new orders in the automotive segment stagnated in 2017 after growing between 10-20% in previous years.

- Last but not least, high capacity utilisation and the tight labour market are constraints, which make it almost impossible to increase production again by10% this year, even if even foreign demand continues to be strong.

- As such, we expect the car segment and also total industrial production to decelerate this year. Industrial production might growth around 3.5%, which given the high base effect, would be still a favourable figure.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).