Historic drop in Swiss GDP

Swiss GDP fell by 2.6% - the largest ever quarterly contraction seen since the series began in 1980, but the worst is yet to come. This obviously makes the Swiss central bank's work more complicated while it continues to intervene in FX markets. But the risk of being labelled a currency manipulator by the US Treasury might eventually put a stop to it

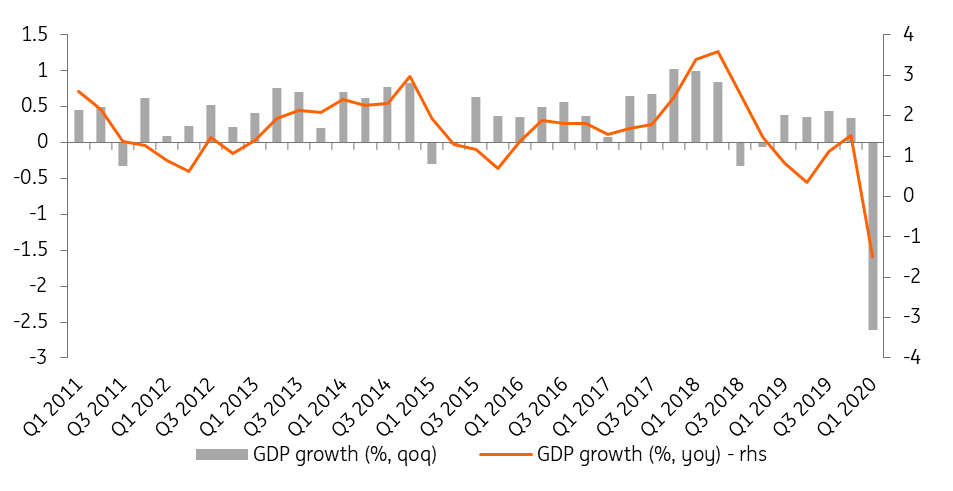

An historic contraction

Swiss GDP contracted by 2.6% quarter on quarter in 1Q20 due to adverse effects of the coronavirus pandemic and the lockdown measures.

This is the worst quarterly GDP contraction since the data series began in 1980. The contraction is stronger than that observed in neighbouring Germany but weaker than what has been observed in other euro area countries such as France and Italy.

According to the State Secretariat for Economic Affairs, value-added has fallen in all sectors of the economy. Hotels and restaurants are the most affected sectors (-23.4% qoq), given the decline in the number of foreign tourists since the beginning of March, but trade (-4.4%) and transport (-5.1%) have also been strongly affected, due to the closures of shops since 17 March. Containment has led to a collapse in private consumption (-3.5%) and investment in capital goods (-4.0%).

Accelerated exit from the lockdown

Lockdown measures began easing in Switzerland towards the end of April, and more strongly from 11 May, which implies the Swiss economy is likely to contract much more in the second quarter than in the first quarter of 2020. In terms of economic figures, the worst is therefore still to come.

Nevertheless, we expect the start of a recovery in 3Q20. Indeed, the disease seems to be under control at present in Switzerland and the authorities have accelerated the deconfinement schedule.

In terms of economic numbers, the worst is still to come

From 6 June, gatherings of up to 300 people will be allowed and all infrastructures can reopen, while borders will re-open from 15 June.

In addition, some damage to the economy has been avoided thanks to the emergency plan by the authorities - support for certain sectors, guarantees, compensation for temporary unemployment... all in all, almost 9.3% of Swiss GDP.

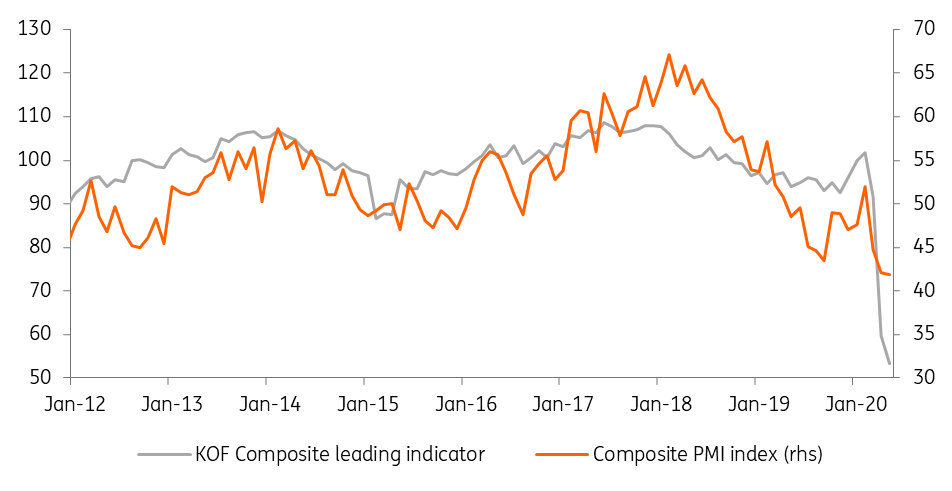

Nevertheless, the recovery will be slow. Confidence indicators are still at historically low levels, and the PMI indicator for the manufacturing sector is the only one that began to rise in May. The economy is expected to contract by more than 6% in 2020, and it will take a few years for the Swiss economy to return to its pre-crisis level of activity.

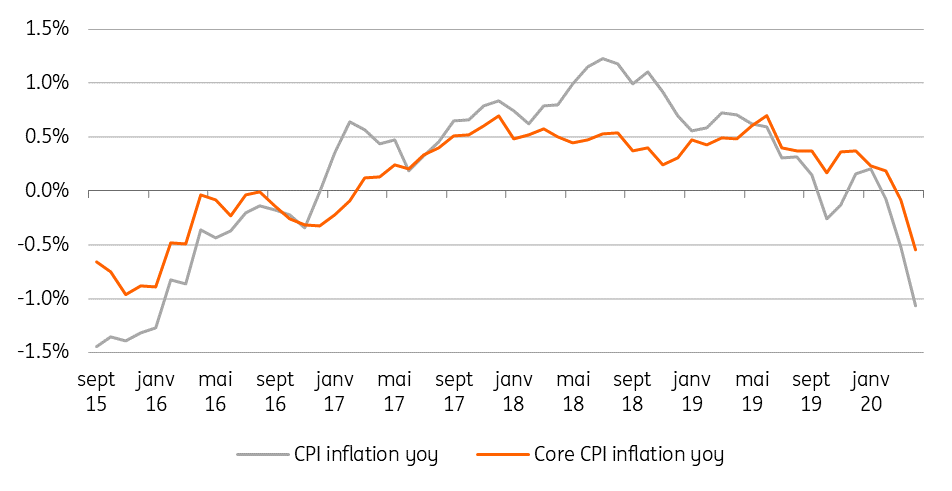

Switzerland in deflation again!

Already before the coronavirus crisis, consumer price inflation in Switzerland was very low and entered negative territory in October and November 2019. The coronavirus crisis, the economic crisis and the fall in oil prices have not helped, and price growth is now sinking into negative territory. Inflation reached -1.1% in April and core inflation -0.5%.

The Swiss economy is therefore once again in a deflationary zone. We expect consumer price inflation to be no higher than -0.4% for 2020 as a whole. In 2019, it was 0.4%.

All of this makes the Swiss central bank's work complicated

The economic crisis, negative price growth and the appreciation of the Swiss franc, considered a safe haven by investors, is forcing it to maintain a very accommodative monetary policy. For the time being, the SNB has not lowered its interest rates, which are already at -0.75% - the lowest in the world.

Nevertheless, since the beginning of the crisis, the SNB has been intervening heavily in the foreign exchange markets to prevent the Swiss franc from appreciating too much. We expect the central bank to continue intervening in this way in the coming months. The SNB has already indicated on several occasions that it is prepared to reduce interest rates further.

We believe the Swiss central bank will continue to intervene heavily on the foreign exchange market over the next few months, which will result in a sharp increase in its balance sheet

In our view, it would really prefer to avoid this and would only cut rates if absolutely necessary (e.g. if the ECB were to cut rates and it became impossible to avoid an excessive appreciation of the Swiss franc). This is therefore not our base case. On the other hand, we believe it will continue to intervene heavily on the FX market over the next few months, which will result in a sharp increase in its balance sheet.

This type of intervention has become the SNB's main tool and we think it will remain that way, though the risk of being labelled a currency manipulator by the US Treasury could ultimately put a cap on forex intervention.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more