Rates: Steady climb is best

Market rates have been on the rise, but there's been no significant negative reaction in risk assets

Mild uplift in market rates is tolerable

The ratchet higher in market rates has been both persistent and impressive, but not aggressive. We note the following trends in market flows:

- Risky assets have shown a calm reaction to date, with emerging markets, in particular, continuing to see decent inflows.

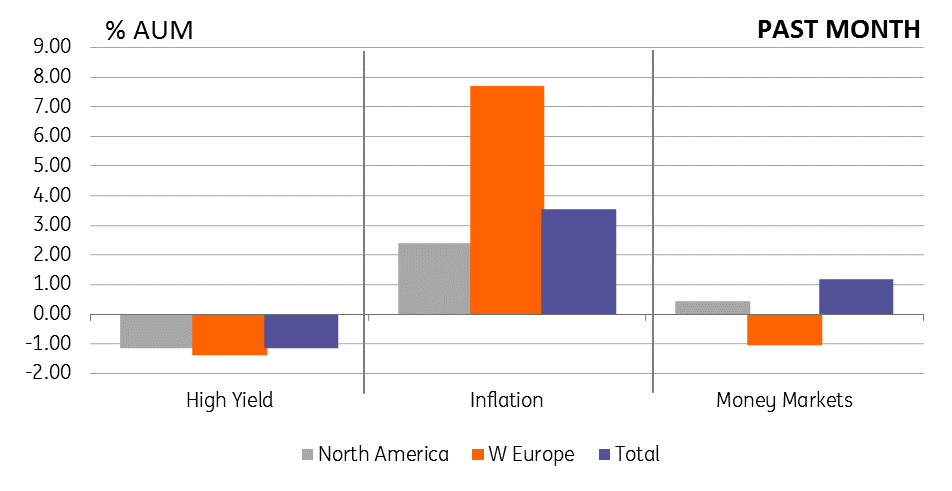

- Flows into inflation funds indicate a reflationary tendency, and no doubt will be welcomed by the likes of the ECB.

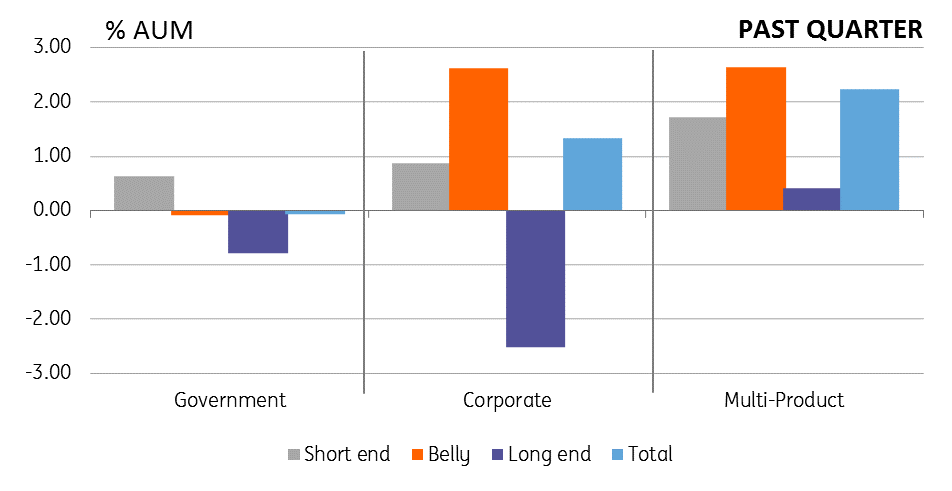

- Outflows from long end funds gel with this theme, as this reflects a reduction in nominal interest rate exposure (positioning for higher rates).

Bottom line, the market discount is for more inflation and higher rates; but not too much, as too much would prove disruptive for core rates and, by extension, emerging markets, and that has not been the case so far.

Outflows from long end funds and inflows to inflation funds

The inflow to inflation in the past month contrasts with the ongoing outflow from developed markets high yield (Figure 2). The other notable flow has been out of long end funds. There has been a slow but steady trickle out of long end government funds since the turn of the year, which is code for a silent build in duration shorts. More recently there have been some large liquidations seen on long end corporate funds (Figure 1).

In the Eurozone, we note mild outflows, stretching across all markets. There has been no particular core/periphery story to tell here. There is a suspicion of relative value in play here, as Eurozone rates have come under pressure, leaving investors with a combination of low rates and tight spread to contend with.

Figure 1: Changes in assets under management - Jan 2018

Figure 2: Changes in assets under management - Jan 2018

Relative calm can persist if the US 10yr yield stays below 3%

The overall sense from these market flows is one of a new and likely structural theme of higher market rates, and this in fact makes the delivery of rate hikes from central banks that bit more in sync with a growing reflationary discount. Provided the rise in the 10yr Treasury yield is capped by 3% there should not be a big negative reaction from risk assets. This is our central expectation.

Break towards 3.5% for the US 10yr yield would stoke concern

However, in a scenario where the 10yr yield were to break above 3% and threaten a move to 3.5%, we would then move into a less palatable set of circumstance for both equities and emerging markets. But for different reasons – for equities, dividend yields would begin to look rich versus bond yields, while for emerging markets, the concerns would be performance and worries over re-funding costs and/or for a dollar bounce (not our central view). Steady is best, and a cap at 3% would calm nerves.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more