Rates Spark: All I want for Christmas…

...is fiscal stimulus and a Brexit deal. The Bank of England is playing the waiting game. Germany will sell more debt next year, but the ECB will absorb more than net supply.

Overnight: BOJ reviews its armoury

Senate Republican leader McConnell repeated his optimism that a fiscal stimulus deal is within reach but it will require talks to extend over the weekend. The tone was more cautious from EU and UK officials, stressing for instance difficulties on finding a deal on fisheries.

The Bank of Japan left its main policy rates, yield curve control target, and asset purchases unchanged but said it will review the latter two in the first quarter. The Bank also extended the Covid support programme to corporates. Reaction in Japanese government bonds was sanguine.

Government bond futures in other markets rose overnight, confirming the difficulties in printing new highs in yields. This was in spite of a solid performance in stocks in the US session.

BoE: playing the waiting game

As was widely expected, the Bank of England (BoE) stood pat at its ultimate meeting of 2020. Faced with uncertainty as to the fate of an EU-UK trade deal, it choose to simply stress the flexibility embedded in its QE bond purchase programme, allowing it to dial the pace up or down, depending on market conditions.

The meeting yielded no new insight as to the likelihood of negative base interest rates next year, so our stance on the subject remains unchanged: they are unlikely to be implemented except in the worst-case Brexit outcome. The implications for outright rates are fairly limited in our view - price action remains in the throes of Brexit talks, which we expect to conclude positively by then end of this year.

Germany revealed an issuance increase - which is more than absorbed by the ECB

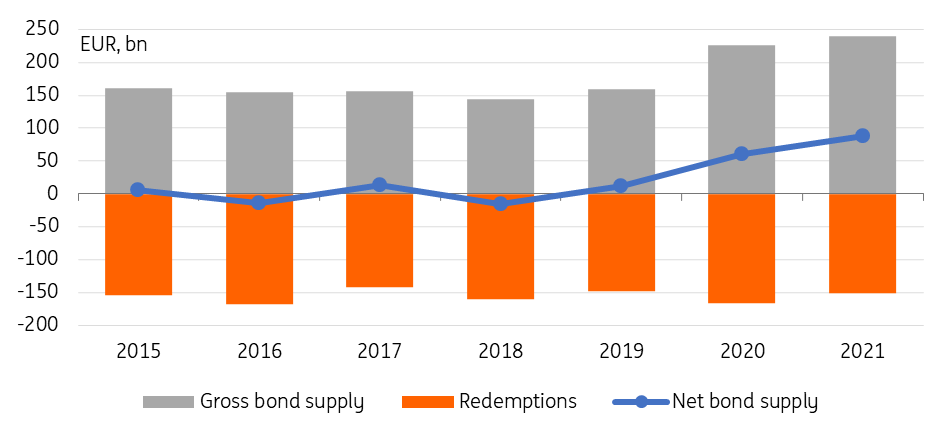

Germany plans to issue up to €240bn in nominal and inflation-linked bonds next year. That figure includes a new 10Y green bond as well as two 30Y syndicated bond deals, one regular- and one green. With €152bn bonds coming due, the plans result in a net new issuance of up to €88bn. The plans are a decent ramp-up versus this year, which saw €226bn gross issuance and €60bn in net terms.

More importantly the German plans give us an important cornerstone of overall eurozone bond issuance plans for next year. The plans so far put us in track for €1.25tn of gross issuance. Given redemptions close to €670bn, the market will face €580bn of net new issuance. But the price means investors won’t be alone in absorbing it.

Being a step ahead, the ECB has expanded its Pandemic Emergency Purchases by €500bn, extending the programme until March 2022. Alongside, the regular asset purchase grogramme will continue to buy €20bn per month. Extrapolating the current shares of asset classes and spreading the remaining purchase volume equally over the duration of the programmes we estimate that the ECB could purchase up to €820bn alone in government bonds next year, some €240bn more that next year’s anticipated net issuance.

And in Germany specifically? The ECB could buy more than €150bn if one strictly applies the ECB’s country distribution target, highlighting that the ECB’s volumes should be sufficient to keep any upward pressure on bond yields, aka financing costs, in check despite increased issuance volumes.

German bond issuance ramped up in 2021

Persistently low rates...

Turning to today’s session, it is possible the December IFO delivers another upbeat message but we suspect the PMIs earlier in the week took the edge off it. Despite hope of positive news on a number of fronts, including US fiscal stimulus and Brexit deal, rates are struggling to make significant headway. The US is quickly tuning into the problem child of the global economy, at least in the near term. Jobless claims published yesterday have reinforced our economists’ view that December might deliver negative jobs growth, hardly a recipe for widespread optimism.

...and some Christmas cheer

Since today’s is the last Rates Spark of the year, all we have left to do is thank our readers for their continued support, and wish them a happy Christmas and winter break. It is going to be a strange one.

It is an already well worn cliché to say that 2020 turned out very differently than most of us expected, but we hope the last weeks of the year will deliver some much awaited presents under our Christmas tree, in the form of a trade deal between the EU and the UK, of fiscal stimulus in the US, and a hiccup-free start to covid vaccination campaigns.

As a reminder, our 2021 Rates Outlook can be found here.

And our research department’s 2021 Macro Outlook here.

See you in 2021,

The Rates Strategy Team

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more