Precious Metals: Funds have commitment issues post Valentine’s rebound

After yesterday’s hawkish Fed minutes, gold is trading back at levels seen during the equity market collapse. After a fleeting Valentine's rebound, funds have shied from building commitments amid a bottoming in the USD and pre-Fed nerves

Valentine's was just a rebound to the funds

In our last precious note, we were disappointed by gold’s performance as a safe haven during the equity correction. Funds apparently preferred to park flows into the dollar and even sell off gold allocations since Comex open interest slid 15% from the January peak to the equity trough. Through the following whipsaw above $1350 and back down again, open interest is still down by 6.8Moz pointing to a fleeting short covering response with few fresh allocations. ETF holdings are also down 412koz since January but are still near multi-year highs, as longer-term concerns for the USD and fiscal policy remain intact.

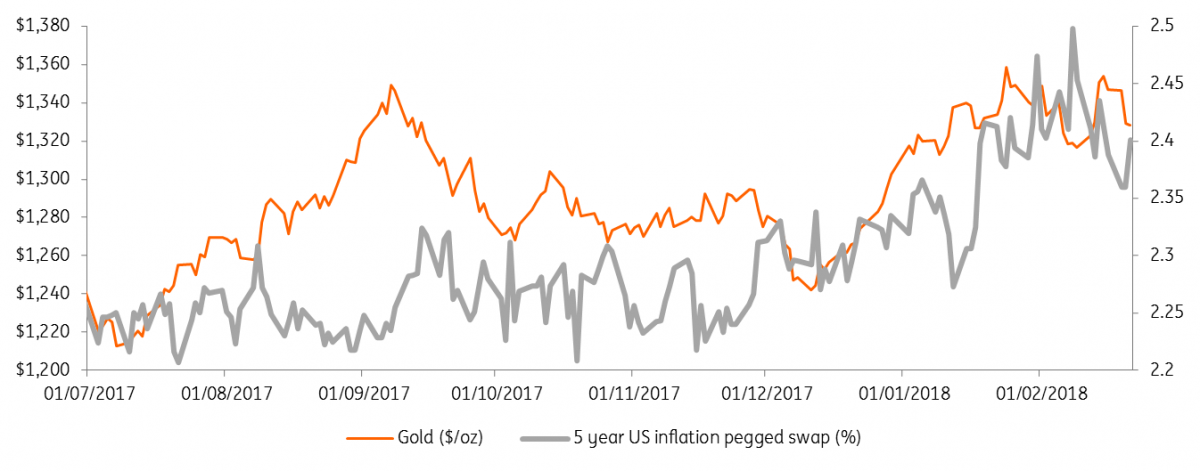

As our FX strategists have said, “’with the theme of the US twin deficit in focus (fiscal and current account deficits), market participants continue to demand concessions in both FX and higher yields for holding US treasury bonds’’. The former has clear upside for gold, and whilst the latter was being negated by inflation, the price for real yields (inflation-linked swaps) has now also settled in higher. Gold’s appeal as a non-yielding asset might be losing some shine but our call for USD/EUR at 1.3 by year-end suggests upside in dollar-based gold holdings. Rising themes of trade protectionism (e.g. section 232) could well escalate a rotation out of US assets in the near term and further out there are risks of a fragile political backdrop going in to the midterm elections. Only statements by the Fed seem able to stem the dollar decline.

Yesterday's Fed minutes were decidedly hawkish with expectations for economic growth being upgraded and the markets still buzzing as to the meaning of “further gradual increases” used in the January statement. The dollar index jumped 0.5% after the release; the fourth consecutive day of gains for the greenback and corresponding declines for gold. A March increase is now 100% priced in and the debate centres on whether it will be three or four this year. Today, markets will also look to the release of ECB minutes though this should be a non-event. Aside from the USD weakness, the EUR is actually flat on a trade-weighted basis so we don’t see much cause to aggressively counter expectations of QE tapering.

It might have eroded recent moves but the greenback's demise remains the entire source of gold’s returns this year with the metal trading in the red in EUR, GBP and JPY terms.

Higher inflation-linked yields to pose headwinds?

Silver to play catch-up

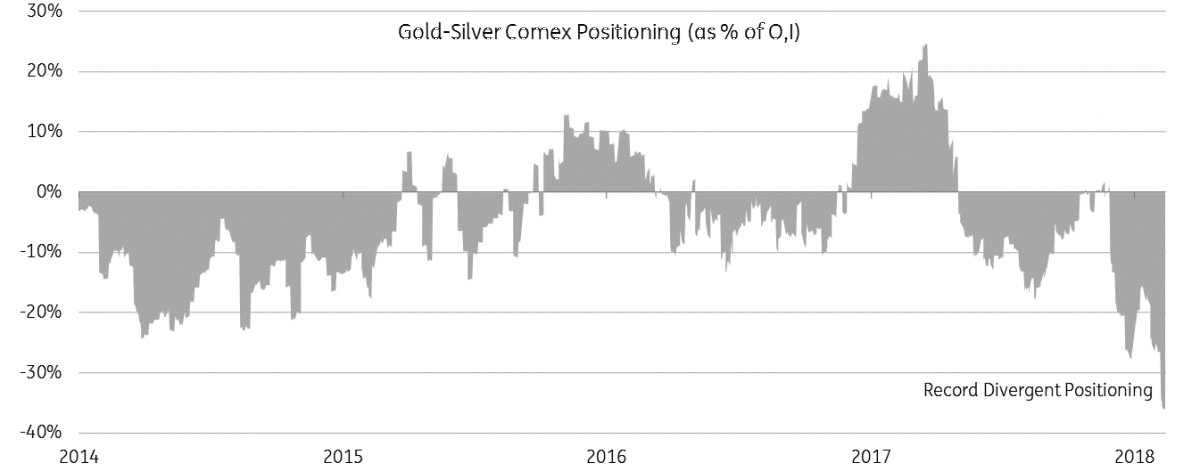

Silver did not share in gold’s bounce after the equity sell-off and is trading 3% in the red this year. However, after reaching a peak above 81x on Tuesday, the gold-to-silver ratio sharply sold off yesterday below 80x. The Fed minutes eroded some of that progress as silver's inherent volatility has directed more selling pressure, but as the dust settles, we expect the ratio to continue falling. Silver ETF holdings actually bottomed out at the end of January and are the only precious metal to see inflows month-to-date. The CFTC data showed that net fund positioning in silver was negative last week for only the third time since 2013, and the widest spread from the gold positioning since pre-2000. Given the divergence and the fact that negative silver positioning doesn’t typically last long, the market has been looking prime for a reversion in the ratio.

Silver - Gold Positioning at Record Divergence

PGM fundamentals put palladium on top

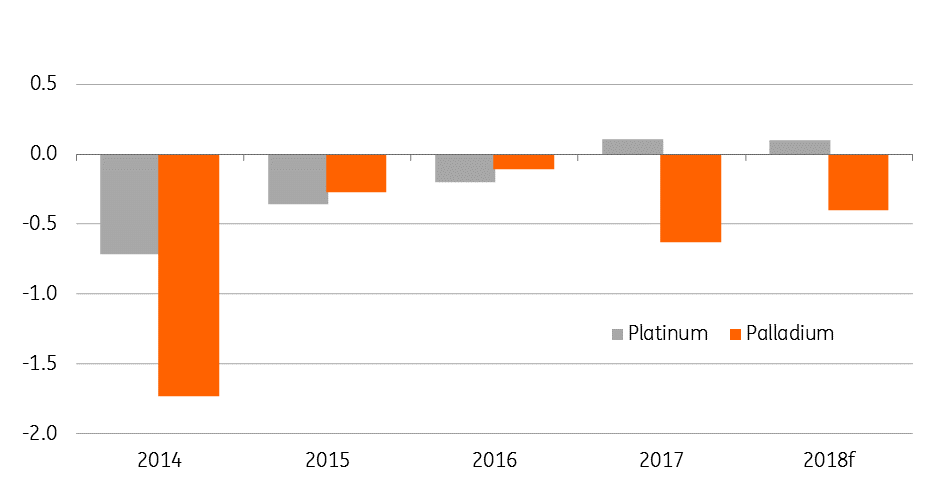

Largely overlooked during the equity crash was that for just over one day, platinum was trading back at a premium to palladium. On February 8th, the vicious sell-off in palladium pushed prices lower. But by 2pm GMT the following day, the new normality had been resumed. In the first weeks of February, the forward curves were pricing an overtaking by the end of the year but now they see palladium’s superiority remaining the status quo. We understand that palladium's backwardation is deterring investors shorting the ratio so even though Comex palladium longs collapsed 42% in four weeks, the shorts are staying low. We forecast Palladium prices to stay above Platinum basis tighter fundamentals which were made evident in the latest Johnson Matthey (JM) report.

According to JM, after five years of sustained deficits, the global platinum market reported a modest surplus of 110koz in 2017 and is likely to be in a moderate surplus again this. On the other hand, palladium had a deficit of 629koz in 2017, the sixth consecutive year, and the largest since 2014 after consumption rose 8% YoY on the back of surging autocatalyst demand.

With mine supply looking largely flat across the two metals, the key component has been demand. For platinum, the biggest drop actually came from investment demand as Japanese buyers ended two years of strong buying. Assuming this has now levelled off, the demand outlook for 2018 is vulnerable to lower auto-loadings in Europe as diesel loses market share to gasoline and new Euro 6d Temp legislation (effective Sept 2017) could increase the adoption of non-PGM catalytic reducers. On the other hand, there are positive developments for usage in EV fuel cells, especially in China and potential for jewellery demand to increase on the back of a rebound in Japan. Palladium’s biggest headwind this year could be supply should ETFs continue to sell off holdings and metal recoveries increase from scrapped catalyst converters.

ING is bullish on both platinum and palladium given a respective narrower surplus and continued deficit. In addition, both metals will benefit from the appeal of an inflation hedge and dollar weakness that will support precious metals more generally.

Johnson Matthey PGM Supply-Demand

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).