Precious metals curbed by USD short squeeze

Gold looked so close to breaking higher, but the hard work has been undone as a short covering rally in the USD has caused gold's dollar price to drop back to the lows of its trading range. Things may get worse before they get better, which is why we have pushed back our forecasts

Gold prices can’t catch a break

As we have argued previously, Gold wanted to break free as it trended towards the upper bounds of its strict year-to-date trading range ($1311-1358) and such a break was likely to tempt fund holdings off from the sidelines. Our anticipations were cut short however as a sharp surprise rally in the USD undid all the hard work by dragging gold below $1320 nearer the lower range-bounds. This weakness has been solely relative to dollar strength with gold prices almost flat in EUR, JPY and CHF terms for the last two weeks.

Our FX strategists identify that a short squeeze drove the 2.6% surge in the US dollar index through the second half of April. The exodus was intensified by the rise in short-dated yields and their impact on US hedging costs. Three month USD overnight indexed swaps priced one year forward, for example, have risen 20bps this month rendering short dollar hedges very expensive. Currency futures meanwhile have reached the highest net short position against an aggregate USD for five years which renders the market prime for what we are expecting to be a short-lived and shallow rebound.

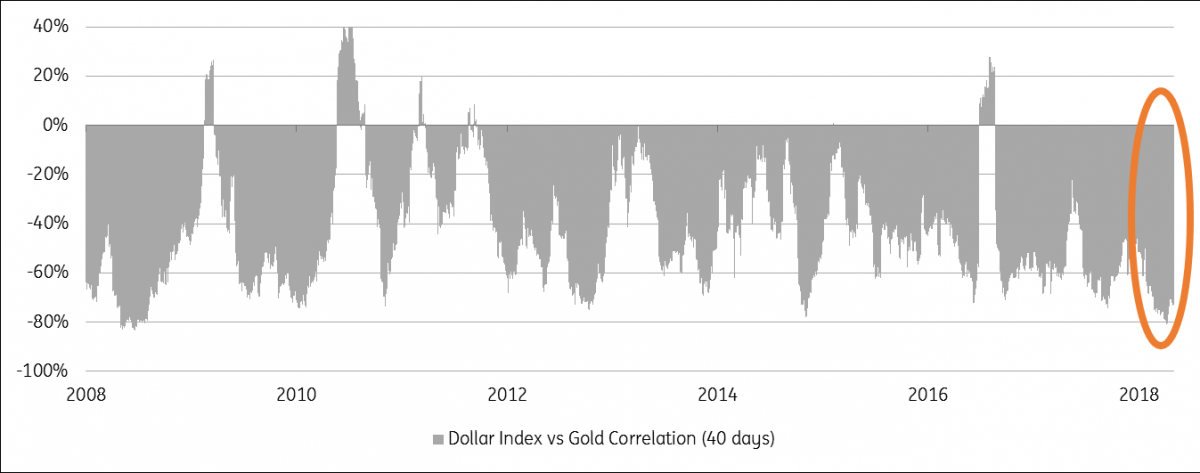

The extent of whether this dollar rally rolls over the short covering runs its course or entices new fundamental/long allocations will determine the potential for Gold to recover its former promise. Gold’s own 10-week high short position is still fairly subdued in absolute terms so is unlikely to offer much in the way of its own short covering momentum. The currency will very much remain king for precious metals, continuing the dollar index’s negative correlation to gold that is already tracking close to 80% this year, the strongest relationship since 2008

Given the active calendar this week we might expect more pain for gold should strong US releases could spur more short covering for the greenback. This starts today with the Fed's preferred PCE inflation measure that jumped to 2% YoY. While, on the one hand, this is a boost for gold friendly inflation the market will more likely focus on the prospects for Fed tightening which weighs negatively on all non-yielding assets.

For Wednesday, the FOMC meeting is expected to stick to the status quo, but following today's PCE print, any hawkish surprise would bring augmented pressure to precious metals. Topped off by a strong labour report on Friday, the 10-year yield is likely to re-challenge 3% with any leg up potentially accelerated by the extreme speculative short positioning that is also present in treasury futures (-429k non-commercial short contracts on CBOT as of Tuesday 24th). Should the US Treasury’s quarterly refunding announcement (on Wednesday) direct more issuance to the short-end of the curve then the yield increases could even be more pivoted to those tenors most popular with short US hedges.

The good news is that our FX team remains unconvinced that any fundamental rally emerging in the USD and the short covering will roll over. The lack of impetus in the array of weak USD drivers right now is creating an opportunity for the overstretched short positioning to adjust but those drivers will re-assert downward pressure on an overvalued US dollar over the coming quarters.

In particular, we're looking out for fresh concerns over burgeoning twin deficits and US policy/political uncertainties, that only need a fresh bought of tweets or policy news to re-emerge. As the dollar eases, it will be game on for our bullish gold view given our expectations for inflation to pick up substantially this year. As our breakout expectations, for Gold have been derailed we are revising down our Q2, and Q3 expectations but are still forecasting an average of $1375 in Q4 2018, and touching into $1400/oz in 2019.

The USD is everything for Gold. Correlations are at 10-year highs

The Silver surfer gets only a short wave

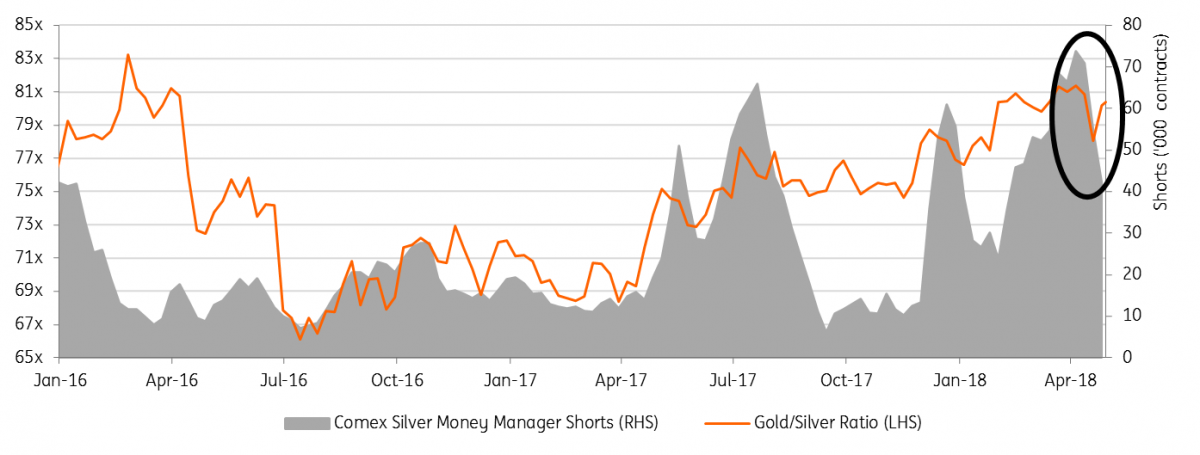

For all our disappointment in gold as it approached a break out it was the drag-on silver that surprised us the most, even following an extreme bought of short covering. Ending nine consecutive weeks of a rare and even record net speculative short position on silver prices had briefly touched above $17/oz and reduced the Gold-Silver ratio to 78x only for the progress to be quickly undone.

CFTC data shows silvers money manager shorts have almost halved through April so that positioning returned to a slight net long last week. But as the USD weighed across precious metals silver fell hardest to return the gold-silver ratio to the 80x levels seen during the global financial crisis. With the short momentum in silver seemingly spent we are revising up our projections that the ratio to end the year at 77 (vs 74) and revise down silver prices for the year.

Gold-Silver Ratio stays high even as silver shorts cover

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).