Philippines: Entering a lower growth trajectory?

At the beginning of 2020, the Philippines' economy was amidst its 84th quarter streak of growth, but since, household spending has collapsed as shell-shocked consumers are still not buying. This is why we expect a protracted downturn and this scenario traces a bumpy L-shape, translating into a new growth trajectory of 3.7% over the next two years

New normal means new trajectory

For the Philippines, the Covid-19 health pandemic strict mobility restrictions didn't just mean knocking out economic activity but also side-lining the economy’s greatest asset - household spending, for five months.

Government officials have conceded that growth in 2020 will contract with the economy suffering a recession from the second quarter. However, finance secretary Carlos Dominguez has promised a sharp 'bounce back' in growth suggesting the economy would grow between 7.1-8.1% resembling a V-shaped recovery.

We now expect a protracted downturn, and this scenario traces a crooked or bumpy L-shape, translating into a new growth trajectory of 3.7% over the next two years

Previously, we had pencilled in a gradual 'U-shaped' recovery with the economy returning to robust growth by the end of 2020, but with the continued rise in cases and a less-than-substantial fiscal response, we now expect a protracted downturn with the economy not returning to pre-Covid19 momentum in the near term.

This scenario traces a crooked or bumpy L-shape and would mean that the rebound translates to a new growth trajectory of 3.7% over the next two years - a far cry from the 6% growth expected before the pandemic.

With the Philippines relaxing some restrictions in June to kickstart the economy, how quickly can it recover and return to pre-pandemic form?

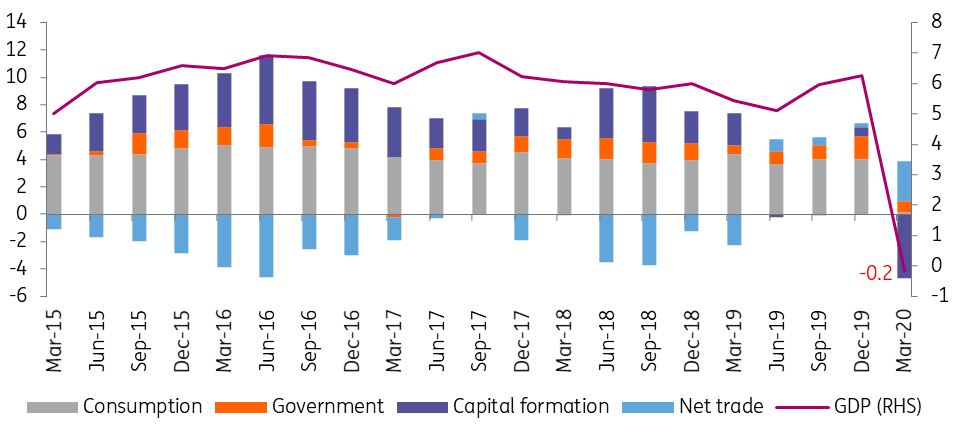

The Philippines' gross domestic product and forecasts

Filipino consumer shell-shocked as job losses mount

The Philippine economy was in the midst of an 84-quarter streak of growth entering 2020, posting strong GDP numbers, driven in large part by robust household consumption.

A relatively young and growing population drove the spending binge with the country enjoying a demographic dividend since 2015. Household spending was further assisted by consistent overseas Filipino remittances, enhancing peso purchasing power to drive the average GDP growth of 5.6% over the past three years before contracting in 1Q20.

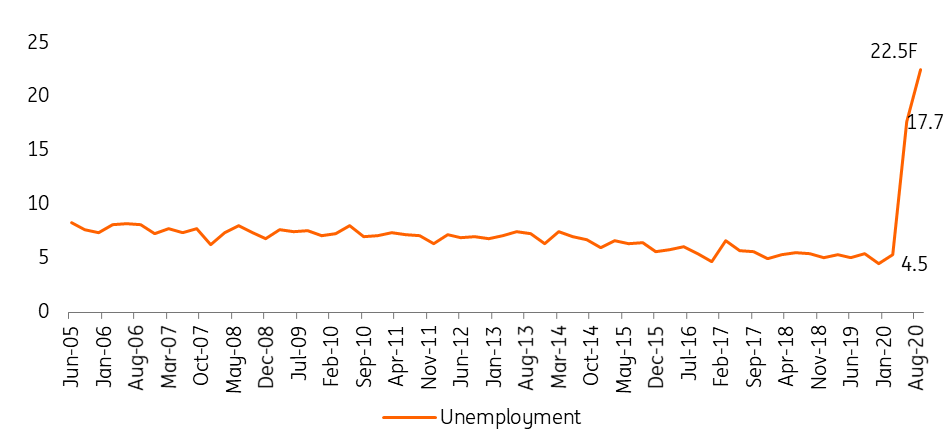

Covid-19 lockdowns crippled the once vibrant consumption patterns by hitting labour markets hard with the unemployment rate skyrocketing to 17.7% in April. Overseas Filipinos also face dire job prospects with up to 300,000 estimated to return to the country after losing their jobs in host countries.

Consumption, once the consistent performer in terms of GDP performance was nearly non-existent in 1Q (+0.2%) with expectations for even worse numbers in 2Q.

As job losses mount and economic prospects dim, households are likely to cut back further on discretionary spending and instead build savings. In the absence of a vaccine, can we expect the Philippines to revert to 6% growth or has the great lockdown of 2020 knocked the economy down to a lower trajectory?

Philippine GDP (contribution to growth)

Don’t bet on a quick return to pre-Covid-19 form

Apart from the base-effect induced bounce expected in 2021, we don't expect the economy to return to pre-pandemic growth anytime soon as household consumption remains weighed down by social distancing measures and anxiousness about a second-wave.

In the absence of a vaccine and with Covid-19 daily infections still elevated, we can expect consumption of non-essential items and services to remain subdued, especially where social distancing is difficult to implement. Hotels, retail shops, restaurants and leisure companies are likely to cut back on staff and we forecast the unemployment situation worsening as major airline and logistics companies announced layoffs last month.

Meanwhile, given the deteriorating economic outlook, it will be difficult to expect households and corporations to make investments in durable equipment or capital goods as they look to preserve cash given the real threat of another lockdown. With consumption hobbled and job prospects bleak, a quick return to 6% GDP growth won't be as swift as government officials claim.

Philippine unemployment (rate and forecast, %)

Investment renaissance on hold...for now

A big reason for the recent streak of GDP growth was the investment boom driven both by corporations and households.

The underlying reason for this resurgence, however, was traced back to consumers. However, households will no longer be in a position to take on investment projects in the near term given the state of the job market while others may be hard-pressed to continue making payments on existing loans. Demand for credit by corporations will also be constrained given the economic environment, even after the central bank slashed policy rates by 175 basis points in 2020.

We don't expect investment momentum to return anytime soon and a return to pre-pandemic investment expansion will only happen once the job market heals and consumption reverts to pre-Covid-19 levels.

The Philippines capital formation

Fiscal recovery plan lacks punch

With the economy reeling, authorities have rolled out a fiscal recovery plan worth PHP 643 bn to replace lost income, support struggling small firms and enterprises and shore up the country’s healthcare system. After the initial round of cash outlays, government officials, appear wary of approving a congress-sponsored fiscal plan calling for an additional PHP 600 bn in the second half of the year citing issues of funding and fiscal sustainability.

Currently, on-budget spending totals roughly PHP 523 bn - a mere 2.7% of nominal GDP which will not be enough to plug gaping holes in the economic engine.

The strong peso - a symptom of declining potential output

The currency has surprisingly been an outperformer in 2020, appreciating 2.4% year-to-date, making it the best-performing currency in the region.

Initially, there were concerns about the fallout from weaker remittance flows and the potential exodus of foreign investors but the peso has managed to remain resilient. We trace the strength of the peso to the imploding demand for dollars manifested in severely contracting imports, which fell by 40.6% in May. And although traditional sources of foreign exchange such as exports and remittance inflows are expected to remain subdued, a more pronounced drop in imports will support the peso in the next few quarters.

However, the peso’s strength is a symptom of declining potential output with imports of capital machinery, raw materials, fuel and consumer good all posting double-digit declines suggesting weaker consumption and investment momentum ahead.

The Philippines' trade balance and the peso

The Philippine economy headed for a bumpy L-shaped recovery?

The pandemic has severely impacted household consumption. Shopping malls are empty, restaurants limited to partial capacity and vacations are on hold. More than 4.8 million Filipinos have lost their jobs since January and the job market will take some time to heal, clouding the economic recovery.

The outlook for weak consumption and the fractured labor market also points to subdued capital formation over the next few quarters. Government officials are hopeful for a quick rebound in growth, pointing to a bounce in GDP to 7.1-8.1% by 2021, but a modest fiscal outlay will hamper recovery efforts.

Meanwhile, the strong peso suggests that potential output will take a hit as import demand drops substantially, impairing GDP momentum further. Thus, we do not expect a quick recovery with growth momentum not expected to return to the pre-pandemic pace of 6% in the near term.

After the initial bounce in early 2021, we expect growth to average 3.7% throughout to 2022 - a sharp deceleration from the recent 6.4% average.

ING forecast table

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more