Petro-currencies lose their mojo

Despite Brent crude pushing to nearly US$65/barrel, G10 oil exporting currencies have yet to receive much of a boost. Perhaps investors doubt the sustainability of crude's rally

Brent near US$65/barrel shines a light on petro-currencies

When oil prices rally FX market participants typically turn to currencies with large exposures to the crude story. During periods of price rises, some investors like to take positions long the RUB (oil-exporter) versus short TRY (oil-importer). And in fact (or coincidentally) the RUB has rallied about 6% against the TRY since crude prices started accelerating higher in early October.

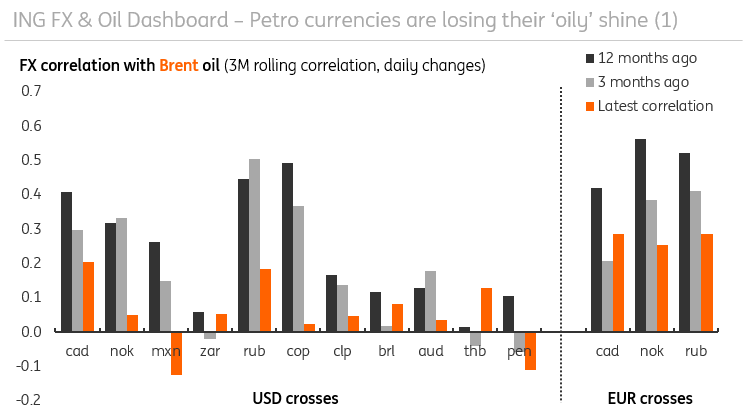

In the G10 FX space, petro-currencies in focus during periods of big oil price moves are typically the CAD and NOK. But as our charts show below, the correlation between petro-currencies and crude has dropped markedly over the last twelve months.

Petro FX correlation with crude softens over the last twelve months

NOK in particular has lagged

For some reason NOK, in particular, has been unable to enjoy the rally in crude, with EUR/NOK only trading in line with oil prices around 25% of the time today versus over 40% in August.

That break-down in correlation may owe to general fatigue with Scandi currencies. Both the SEK and the NOK are frequently seen as under-valued. Both currencies are occasionally chased by investors on the view that the local central banks will be forced into tighter policy. And both unashamedly dovish central banks perennially disappoint investors.

NOK loses interest in crude

So what next for petro-currencies?

Our commodities team have published their 2018 outlook for crude oil prices. They’re bearish on crude into 2018 on the view that:

i) OPEC may struggle to maintain compliance to quota cuts,

ii) non-OPEC supply (particularly the US) will continue to rise, and

iii) IEA predicts global oil demand growth to slow. Our team looks for Brent crude to sink back towards US$50/bl in 1Q18.

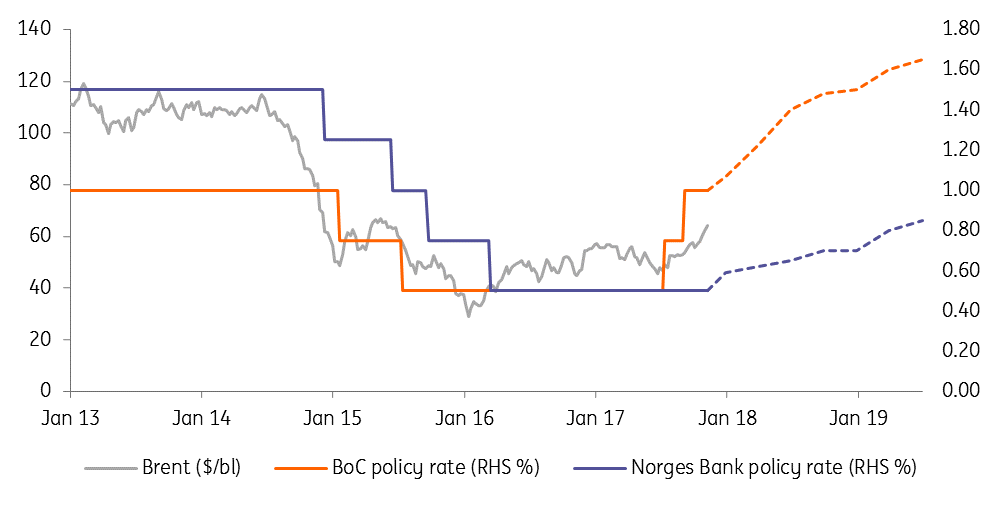

If crude oil prices do indeed turn lower into 2018 it could spell trouble for the likes of the RUB or perhaps the CAD, where market pricing of future rate hikes looks quite aggressive right now. For the NOK, however, market pricing of future rate hikes look reasonably conservative. And if crude doesn’t turn lower as quickly as our team believe, the market could start to re-price the Norges bank tightening cycle – asking the question: ‘If the recovery in crude helped the BoC take back its 2015 50bp easing cycle, what would it take for Norges Bank to do something similar?’

Norges Bank does have the cover of very low inflation to stay dovish (core inflation is now at 1% YoY). Arguably though so did the BoC and that didn’t stop them hiking 50bp over recent months on the view that the economy had weathered the oil-induced business investment shock in 2015.

NOK has struggled to make headway this year, but of all the petro-currency stories at present, we prefer NOK to out-perform. Our 3m and 6m forecasts for EUR/NOK are 9.20 and 9.10 respectively.

Crude, BoC and Norges Bank

BoC and Norges Bank cut rates when crude collapsed, BoC have reversed cuts and markets expect more BoC tightening

What about the oil importers?

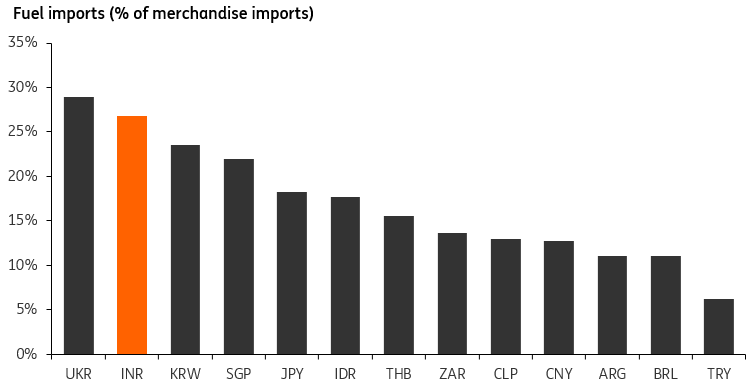

On the other side of the equation, which currencies would look most vulnerable if crude prices stayed bid or even pushed higher if new risks emerge (for instance, if there were fresh sanctions on Iran)? Our team would probably highlight India here and Turkey. Unlike Brazil, Turkey has struggled to rein in its current account deficit much below the 4.5% of GDP area. Surging crude prices is the last thing the TRY needs right now.

Fuel importers ranked

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more