Oil caught up in broader market weakness

Recent developments in the banking sector have spilled over into broader financial markets, and the oil market has been unable to escape this pressure. Oil fundamentals have not been strong enough to support prices. We have cut our forecasts, but where is the floor for the market?

Speculators caught off guard

The risk-off move seen across markets following the collapse of a couple of US regional banks has not spared the commodities complex. This is evident in the aggressive sell-off seen in oil recently. ICE Brent is now down more than 10% so far this year and briefly traded below US$72/bbl - its lowest levels seen since December 2021.

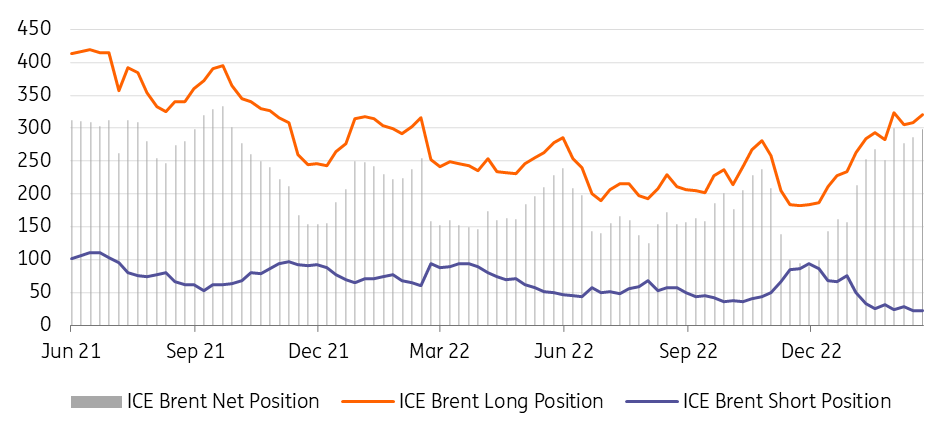

Amplifying the sell-off is the fact that we would have likely seen some significant liquidation from speculative longs. The latest positioning data shows that speculators held a gross long in Brent of more than 320k lots as of 7 March (levels last seen in November 2021), up from around 181k lots back in early December. As the market has come off, it is likely to have hit stop-losses from some of the more recently added longs, leading to an even more aggressive sell-off.

Speculators had been building their long position in the oil market on the back of expectations that we will see a robust demand recovery from China following the reversal of its zero-covid policy, together with the view that Russian oil supply will edge lower.

Sizeable speculative long in ICE Brent (000 lots)

Options market adds further pressure

Covering of option positions has likely added further pressure to the market. As the market falls towards and below strikes, option writers will need to adjust their hedges. So for example, sellers of put options would have sold underlying futures as the market was approaching, and falling below, nearby strikes. Option expiry for the ICE Brent May 2023 contract is fast approaching. More than 500k lots of options on Brent were traded on 15 March (vs 260k lots the previous day) - the day the market fell by close to 5%.

Price forecasts cut on softer-than-expected fundamentals

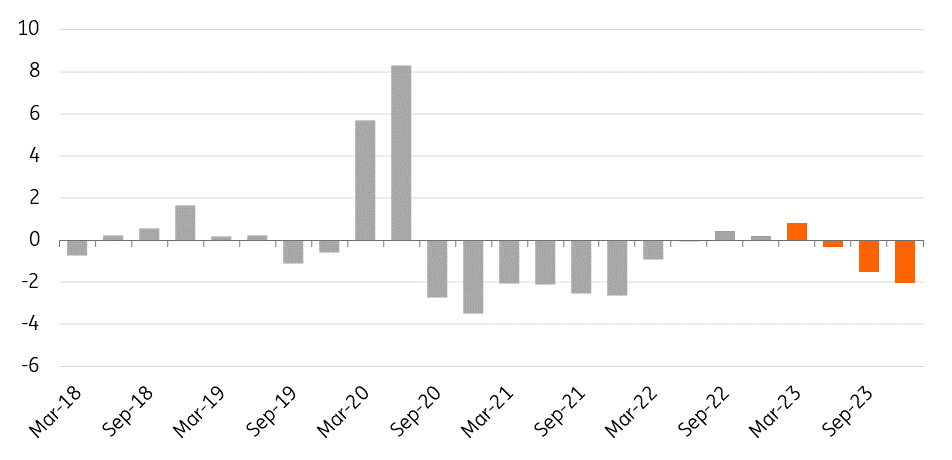

A factor which continues to surprise the market is the stubbornness of Russian oil supply. Exports are holding up better than many were expecting, despite the EU ban on both Russian oil and refined products. Seaborne crude oil exports have been fairly steady, in the range of 3-3.5MMbbls/d. This reflects the willingness of buyers elsewhere to pick-up discounted Russian crude. India remains the stand-out when it comes to this, with purchases of Russian oil growing from virtually zero prior to the war to more than 1.5MMbbls/d recently. It appears that Russian supply will continue to hold up better than expected through the year. We had assumed that Russian oil supply would fall by more than 1MMbbls/d YoY - this is too aggressive. We now assume a 600Mbbls/d YoY decline in Russian supply for 2023. Clearly there is still the risk that even this will be too aggressive. But we should have more clarity on this as we move into next quarter.

Stronger-than-expected Russian supply means that the surplus in the oil market over 1Q23 is larger than originaly anticipated. For 2Q23 the market appears as though it will be more balanced than initially thought. It is only over 2H23 that we expect a significant tightening in the oil market. This is a result of strong demand growth this year (close to 2MMbbls/d YoY), driven by Asia, and will be heavily skewed towards 2H23. It is over this period where we expect to see stronger prices.

However, we now see less upside than originally expected. Recent events will likely question whether the Fed will be able to pull off a soft landing, which raises demand concerns.

In addition, given the larger than expected surplus in recent months, inventories are looking more comfortable. This will leave the market in better shape to handle the deficit expected later in the year.

We have cut our ICE Brent forecast for 2023 from US$98/bbl to US$90/bbl. We see Brent averaging $100/bbl in 4Q23, versus our previous forecast of US$110/bbl.

Oil balance more comfortable over 1H23 but tightens in 2H23 (MMbbls/d)

OPEC+ response

Given the weak sentiment in broader markets there could be further downside in the oil market, particularly given the softer fundamentals in the short term. What could provide a floor to the market?

The most obvious catalyst would be OPEC+ stepping in and announcing further supply cuts in order to try bring some stability to the market. The group is already producing around 1.7MMbbls/d below their target levels. As in the past, if the group were to announce a reduction in production targets, actual cuts would likely be smaller than the headline number. In terms of the duration of any additional potential cut, it would likely only need to run through until mid-year, given the tighter market over 2H23.

The level at which OPEC+ could decide to take action is less clear. But they will be starting to get uncomfortable, particularly given the scale of the move in recent days. We believe they will wait for the dust to settle before coming to a decision.

US SPR refill

The other form of support for the market could come from the US government, with its intention to refill the strategic petroleum reserve (SPR). Previously the US Department of Energy (DoE) said that they would look to refill the SPR if WTI traded around US$67-72/bbl. This was made clear to provide some comfort to US producers, with the hope that they would increase output more aggressively, given the supply uncertainty related largely to Russia.

WTI is now trading at these levels and so we could see the DoE stepping into the market to start filling up the SPR, which is at its lowest levels since the early 1980s.

ING forecasts

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more