Norges Bank Preview: A hike now, and more to come

The Norwegian central bank looks set to raise interest rates for the first time since 2011. A strong economy, resilient oil price, and a soft exchange rate means the forecast for future rates will also shift upwards

A solid domestic backdrop…

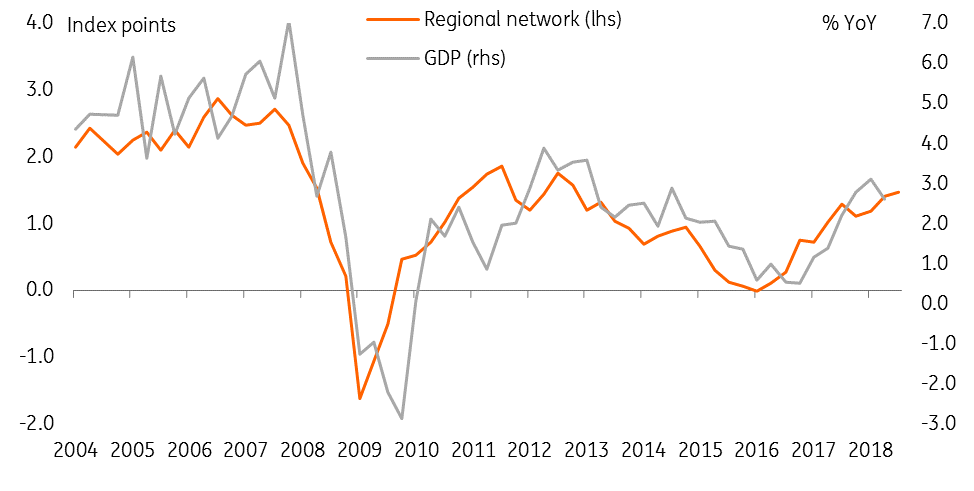

The Norwegian economy continues to pick up. The oil sector remains the key driver, with the latest oil industry survey indicating a further increase in investment is expected over coming years. The latest regional survey also indicates momentum remains strong. The survey indicates growth in the second half of the year is likely to remain in line with Norges Bank's (NB) forecast.

Inflation has increased sharply over the summer, with headline inflation exceeding 3% in both July and August. While this is in large part driven by higher energy prices, core inflation has also risen markedly, hitting 1.9% in August. This is well ahead of the NB’s forecast and suggests an upward revision in the September forecast, which should push up the interest rate forecast.

Norwegian GDP growth vs the Regional Network leading indicator

And a supportive external environment…

Oil prices have risen by around 4% across the curve since the NB’s last forecast in June. This is one of the key factors for the NB’s interest rate forecast and suggests a meaningful shift upwards on the interest rate forecast.

The trade-weighted krone index has been weaker in 3Q than the NB had expected and currently trades around 1.5% lower than the NB’s forecast. This is a third factor arguing for a steeper interest rate forecast.

Foreign interest rates curves are largely unchanged since June, and Norway’s trading partners are growing broadly in line with the NB expectations. While turmoil in some emerging markets and continued tensions in US-China trade relations are a clear risk to the outlook – in particular to the extent that oil prices are affected – we think the NB (in line with the ECB and Riksbank communications on this topic) are not overly worried yet.

Makes this an easy call for a relatively hawkish central bank

Having signalled its intentions clearly, starting from the March policy meeting, there is little doubt the NB will follow through and raise interest rates by 25 basis points to 0.75%. The more interesting question is what signal the NB sends about its intentions for future rate hikes.

Given that developments since June are clearly positive (stronger core inflation and higher oil prices) and domestic financial conditions are unchanged or even slightly looser (weaker-than-expected krone) it is clear that the NB will shift the interest rate path upwards.

The June rate path implies roughly two hikes per year for 2019-2021, with some chance that the second hike comes already in December. Our view is that the September rate path is likely to show a high probability of three additional hikes by end-2019 (taking the policy rate to 1.5%), with the pace of tightening further out a little steeper as well.

We are less sure about the potential for a second hike in December. While the rate path will probably leave the option open, we think the NB is unlikely to hike in two successive quarters even if the mechanical output of its model suggests that it should.

The reason for caution is that the NB is concerned about the high indebtedness of Norwegian households, and has long signalled that rate hikes will be gradual. Like other central banks that have raised rates after a long period of loose policy settings (eg, the US Fed and the Bank of England) the NB is concerned that the first rate hike may have disproportionate effects. Once this uncertainty around the effect of the first rate hike fades, the NB can probably move somewhat faster. We see three rate hikes in 2019 as a realistic prospect.

Overall, we expect the NB’s policy meeting to highlight the relatively hawkish stance it is taking, compared to most other European central banks. This is likely to support the krone and short-term rates in Norway.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).