Natural rubber: Where is the love?

The downward pressure in the natural rubber market continues, with TSR20 futures in Singapore falling almost 10% since the start of October. The recent sell-off in oil has only weighed on the market further. There are also growing concerns about how natural rubber demand will play out over 2019

Global output continues to edge higher

Global natural rubber production continues to trend higher, with production gains being driven by Thailand, Indonesia and Vietnam. According to GAPKINDO data, YTD production from these three countries increased by 139kt, 50kt and 52kt respectively. It seems at least for now the low price environment is having little impact on tapping. The Thai government continues to look for ways to support farmers, and recently approved a THB18b (US$564m) aid package for farmers. However, this does little to address the underlying issue as providing subsidies to farmers provides little incentive to push them towards other crops. Earlier in the year, the government announced plans to pay farmers to reduce area by 80,000 acres per year over the next 5 years, however up until now there has been very little information on how this plan is progressing.

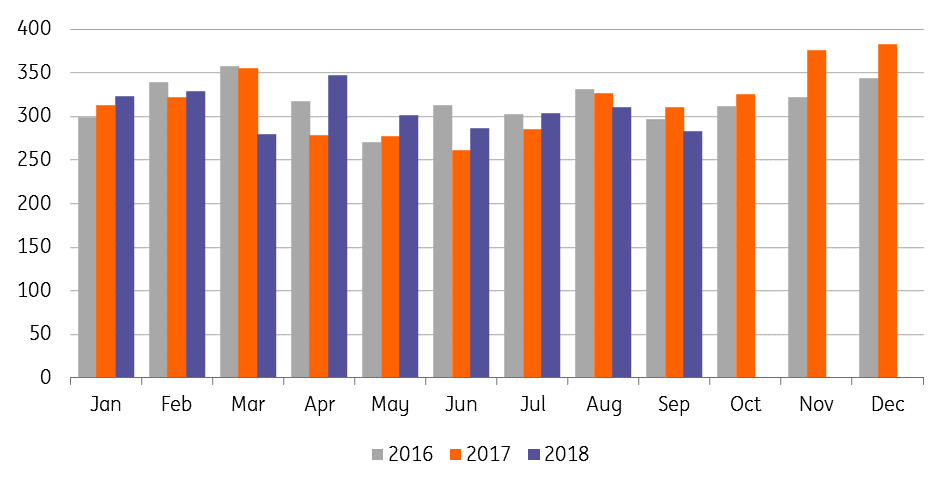

Despite the fact that Thai production continues to edge higher, latest data from the Thai Rubber Association shows that exports from the country have started to trend lower in recent months. Export volumes over August and September were down almost 7% YoY, suggesting that we have seen a build-up of stocks in Thailand in recent months. However, YTD exports until the end of September stand at 2.77mt, up 1.3% YoY.

Thai natural rubber exports edge lower in recent months (k tonnes)

Indian flood impact

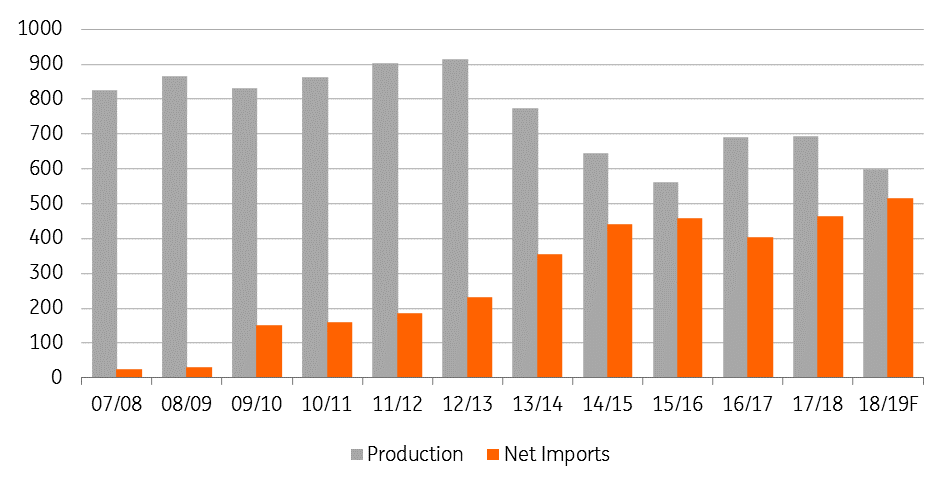

India, however, may offer some relief to the market. Heavy flooding in Kerala over August had an impact on natural rubber output, with the Indian Rubber Board estimating that production over FY18/19 will decline by 100kt as a result. Prior to the floods, India was expected to produce around 700kt, so this is a fairly aggressive downgrade. In recent years, India has become a large importer of natural rubber, and given the expected shortfall in domestic output, this will only increase import demand in the near term. India imported almost 470kt of natural rubber over FY 17/18, and the pace of imports has been stronger so far in 18/19.

Indian natural rubber output set to decline (000 tonnes)

Deteriorating demand prospects

The more recent pressure on natural rubber prices does seem to be largely demand driven. Most indicators suggest a fairly bearish demand story, a trend which is unlikely to change anytime soon.

China is key for the natural rubber market, with the country making up around 40% of global consumption. Imports of natural rubber so far this year have been largely under pressure, with cumulative imports through to the end of September totalling 1.85mt, down 9.3% YoY.

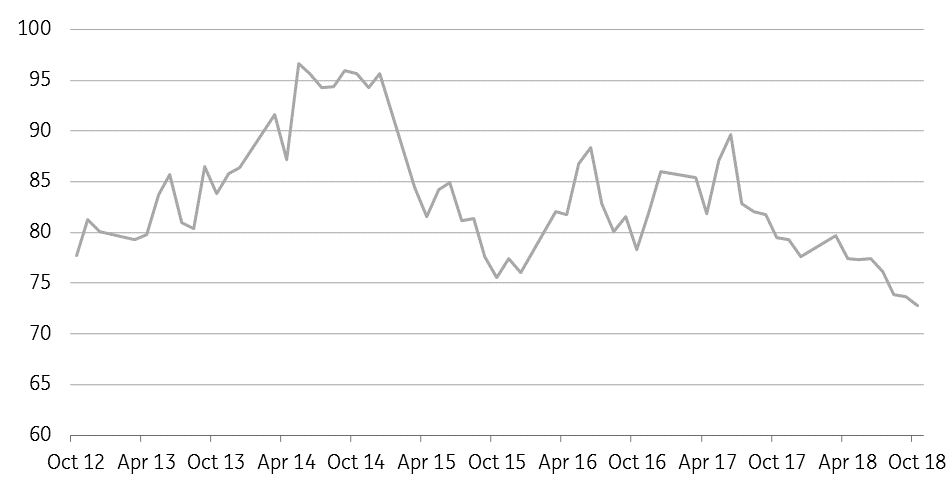

These lower imports shouldn’t come as too much of a surprise when looking at tyre output from the country. Cumulative tyre output over the first 10 months of the year stood at 711.95mt, down 11% YoY. In the near term, there is unlikely to be any recovery with Chinese industry coming under more scrutiny with regards to pollution over the winter.

Vehicle sales are also not looking overly optimistic for the rubber industry. In most regions, we are seeing falling vehicle sales. In China, cumulative passenger vehicle sales for the first 10 months of the year totalled 19.26m units, down 1.2% YoY. More recently we have seen larger declines, with sales over October falling 13% YoY. Meanwhile, in the EU, we saw a second consecutive month of YoY declines in passenger vehicle registrations, with October registrations falling a little over 7% YoY, following almost a 24% YoY decline in September. In the US, passenger vehicle sales over the first 10 months of the year totalled 53.15m units, down 13% YoY. In fact, every month so far this year has seen consistent YoY declines in sales.

Looking ahead, trade tensions are likely to continue weighing on demand sentiment. China’s manufacturing PMI in October fell to its lowest level since July 2016, clearly a sign that the ongoing trade war between China and the US is having an impact. The market will be watching closely developments at the G20 summit later this month, with growing optimism that the two countries are working towards a deal. While a deal would likely be enough to shift sentiment, it still seems as though we are some distance away from a resolution.

Chinese tyre output edges lower (m units)

Chinese stocks remain bulky

While demand is certainly not helping the market, the other concern is the stubbornly large inventory levels held in SHFE warehouses. Stocks currently stand at 569kt, up almost 12% YoY and, in fact, stocks reached a record 592kt at the end of October. Given the more bearish demand outlook, it does suggest that we are unlikely to see a quick drawdown of these stocks, which is likely to keep a cap on the market.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more