US: Hints of a V, but don’t get carried away

We have revised up our near-term economic assessment on the back of some very encouraging data in several key parts of the economy, but social distancing, consumer caution, domestic tensions and the threat of a return of the virus means nothing can be taken for granted

Re-opening triggers a recovery

While it is true that the US economy is re-opening, it is very uneven.

Google mobility data suggests that states such as Montana and Idaho have virtually returned to “normal” in terms of visits to retail, restaurants and museums. However, in Michigan and Illinois visits to those locations are still down 25-30% while in the most populous coastal states, such as New York, New Jersey and California, visits are still down 40-50%.

Nonetheless, some of the recent data has offered very positive signals. Mortgage applications for home purchases have risen for eight consecutive weeks and are well above anything seen through 2018 and 2019. Falling mortgage rates have boosted affordability, while we have to remember the average age of a home buyer in the United States is 47 years old. This means interested parties are more affluent, have better credit history and less likely to work in retail and hospitality than the young who are typically renting.

Most of these purchases are likely to be investment properties or second homes, which is still good news for the broader economy as encourages construction, which promotes jobs and is typically correlated with higher spending on garden equipment, furniture, home furnishings and building supplies.

Car sales too are rebounding, which is again tied to demographics. The typical car buyer is around 50 according to JD Power. So again they are older, more affluent with better credit history so better able to take advantage of some of the great deals available relative to a younger person working in hospitality or retail and who has recently lost their job.

As V-shaped as you can get... mortgage approvals and car sales

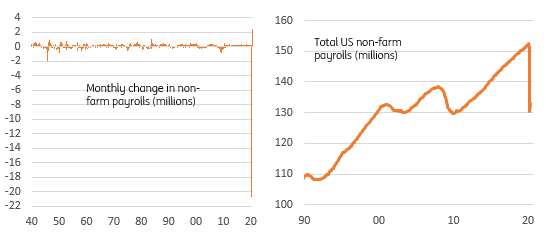

Jobs market springs back into life

Even in the jobs market, there are signs of encouragement.

All economists were caught out by the surprise rise in employment in May. The weekly claims data has suggested firings continued in their millions while historically credible demand indicators such as the ISM employment indices and the ADP payrolls suggested no real pick-up in demand for new workers. Instead, the jobs appear to have originated in the small business sector, which flew under the radar.

All economists were caught out by the surprise rise in employment in May, which seems to have originated in the small business sector, which flew under the radar

The paycheck protection program has been credited as a key driver of this. This $669bn business loan program provides retrospective incentives for rehiring. A small business that fired workers early on in the crisis has until the end of this month to rehire for those positions in order to benefit from the ability to convert the loans to grants. The NFIB small business survey showed a modest pickup in hiring in May and according to the NFIB 75% of small businesses applied for the loans and 93% have received the money.

This has helped to generate an air of optimism about the prospects for recovery and looking at US equity markets you could be forgiven for thinking, “what crisis?” The S&P 500 is now up 11%YoY and is within touching distance of its all-time highs. Yet you look at the bond market and interest rate futures and the sense here is that there is still a lot that could go wrong.

But the headwinds are strong

Firstly, we simply do not know what path the virus will take.

States that have started to re-open early have seen some evidence of a pick-up in cases versus those that have stayed under lockdown. Should the number of cases increase this could see calls for containment measures to be reinstated. Moreover, we remain concerned about a potential for the virus to regain a foothold as we head into winter and conditions are more conducive to transmission. With little to indicate a vaccine is imminent it is far too soon to relax about the potential health and economic costs.

Then there is the general social distancing, consumer caution and travel restrictions that will prevent a return to pre-Covid 19 “normality”. If restaurants, bars, gyms and retailers can only have a limited number of customers many may find they are simply not economically viable and close with jobs losses resulting. Indeed, retailers and hospitality venues in major cities will struggle given office workers are set to continue primarily working from home for some time to come. With global demand remaining weak, hiring in manufacturing and service sector could remain depressed.

At the same time, many businesses that are trying to re-open can’t afford to hire given the boost to unemployment benefit payments. Benefits are average nearly $1000 per week with the University of Chicago estimating that 68% of claimants have more income than when they were working.

Employment has a long climb ahead of it

A long list of challenges ahead

Then there is the fraught political backdrop in the US right now. The death of George Floyd has set off a wave of protests, some that have ended in violence. Heightened political tensions have created a sense of entrenched division that will make reconciliation challenging. This too could have negative feedback on economic sentiment and economic activity at a time when employment is still 19.5 million lower than in February.

The medium-term risks suggest a full V-shape recovery is unlikely with a return to pre-Covid-19 activity levels many quarters away

Corporate debt defaults an equity market correction and heightened trade tensions also are all threats we have to be cognisant of. So, while we have revised up our near-term economic assessment, the medium-term risks suggest a full V-shape recovery is unlikely with a return to pre-Covid-19 activity levels many quarters away.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more