Malaysian elections: Too close to call?

We expect the ruling coalition to lose some ground to the opposition but retain overall control at the upcoming elections. Expect the Malaysian ringgit to remain among Asia’s outperforming currencies this year

Our base case assumes a continuation of Prime Minister Najib Razak’s ruling Barisan Nasional coalition, but as the wave of electoral surprises around the globe in the last two years have shown uncomfortable coalitions cannot be ruled out. So it wouldn't be a total surprise if Malaysian voters took the same route on 9 May.

What does all of this mean for the markets?

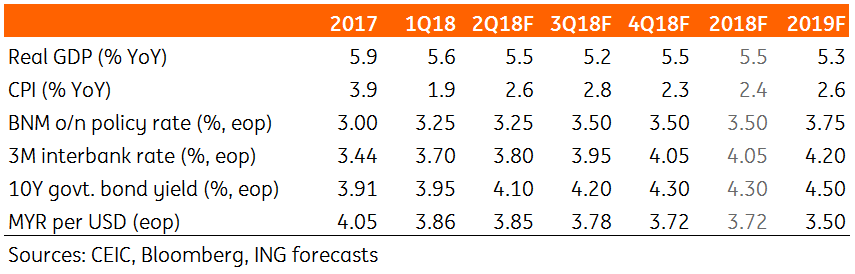

We believe that strong domestic demand supported by election spending and the positive terms of trade shock from rising global commodity prices will sustain the economy on a strong footing in 2018 and beyond. But until a clear direction from these elections emerges, the Malaysian ringgit (MYR) will remain in a narrow range trading around 3.90.

We reiterate our forecast of one more Bank Negara Policy rate hike to 3.50% in the third quarter, once political uncertainty lifts, and we forecast the USD/MYR ending the year at 3.72. (spot rate 3.89, the consensus for end-2018 3.84).

14th general elections

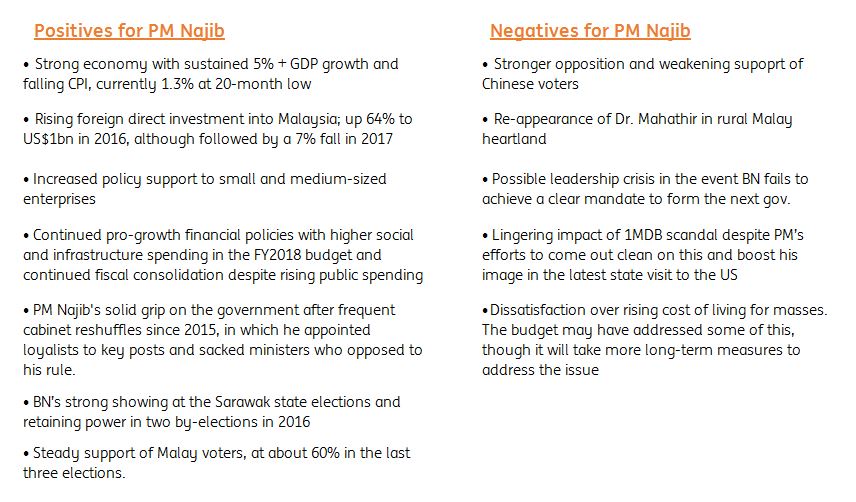

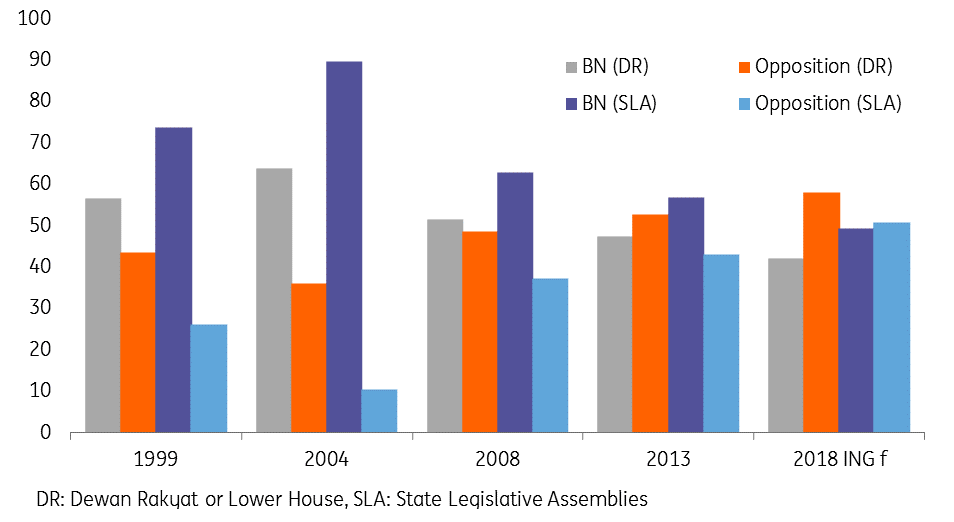

Prime Minister Najib Razak’s ruling Barisan Nasional (BN) coalition faces a stronger opposition than it has done in previous elections. The BN lost its two-thirds majority at the 12th general election in 2008, and its performance continued to deteriorate to the lowest number of parliamentary seats at the following election in 2013 due to falling support of Chinese voters (14% down from 35% in 2008 and 75% in 2004).

The contest this time is against the opposition coalition, Pakatan Harapan (or Alliance of Hope), led by former Prime Minister Dr Mahathir Mohammad who led the country for over two decades until 2003. The third big player is the Pan Malaysia Islamic Party (PAS), which traditionally has been a dominant party outside the opposition coalition, and could be the king-maker in the event of a stalemate.

Formed in September 2015, the Pakatan Harapan coalition is comprised of four political parties, which include:

- Democratic Action Party (DAP)

The second largest political party after PM Najib’s United Malay National Organization party - Peoples Justice Party (PKR)

Formed by jailed opposition leader Anwar Ibrahim who served as the Deputy Prime Minister and Finance Minister under Dr Mahathir but was ousted and jailed in 1999 - National Trust Party (Amanah)

Formerly Malaysia Workers’ Party - Malaysian United Indigenous Party (PPBM)

Dr Mahathir’s newly formed political party

The political economy

The backdrop of a solid economy places incumbent PM Najib in a strong position in the upcoming elections as the economy delivered a highly respectable 5.9% rate of growth in 2017 and is projected to grow by 5.5-6% this year.

Administered price rises have caused inflation to spike to about 4% in 2017 amplifying the rising cost of living, one of the political issues for this election. But the effect has waned in 2018 with inflation dipping back below 2%. We expect it to settle close to the low end of the official 2-3% forecast range for 2018.

The Malaysian Ringgit (MYR) has been among Asia’s best-performing currencies appreciating 11% against the USD in 2017 and a further 4% appreciation so far in 2018. Even though the unit’s advance has been halted recently, possibly due to re-pricing for increased political uncertainty through the vote in May, we expect it to remain among Asia’s outperformers this year.

Too close to call

However, it’s still a tough call whether the ruling coalition BN will retain power, giving PM Najib a third term in office. Despite the current strength of the economy, the united opposition front will most likely contest the election on an economic agenda ranging from the rising cost of living and goods and services tax to corruption under the current administration, most notably, the 1MDB saga.

In three cabinet reshuffles to oust opponents since 2015, PM Najib consolidated his position for this year’s vote and appears confident of winning another term. The fact he's called an early election ahead of the scheduled deadline of August 2018, seems to suggest that's the case. Recent fast-tracked passage of the “Anti-Fake News bill” is alleged to be silencing the opposition campaign against the Najib administration.

The 1MDB issue could still be an important factor influencing voter decisions even though PM Najib himself seems to have come out clean from this scandal. Najib has also continued to raise his image in local and international politics – for instance, his recent trip to the US portrayed Malaysia as a global player. But the outcome will depend on how the BN coalition performs relative to the last election in 2013 which itself was a disappointing outcome for BN. Fewer parliamentary seats than it currently holds could trigger a BN leadership crisis threatening PM Najib’s position.

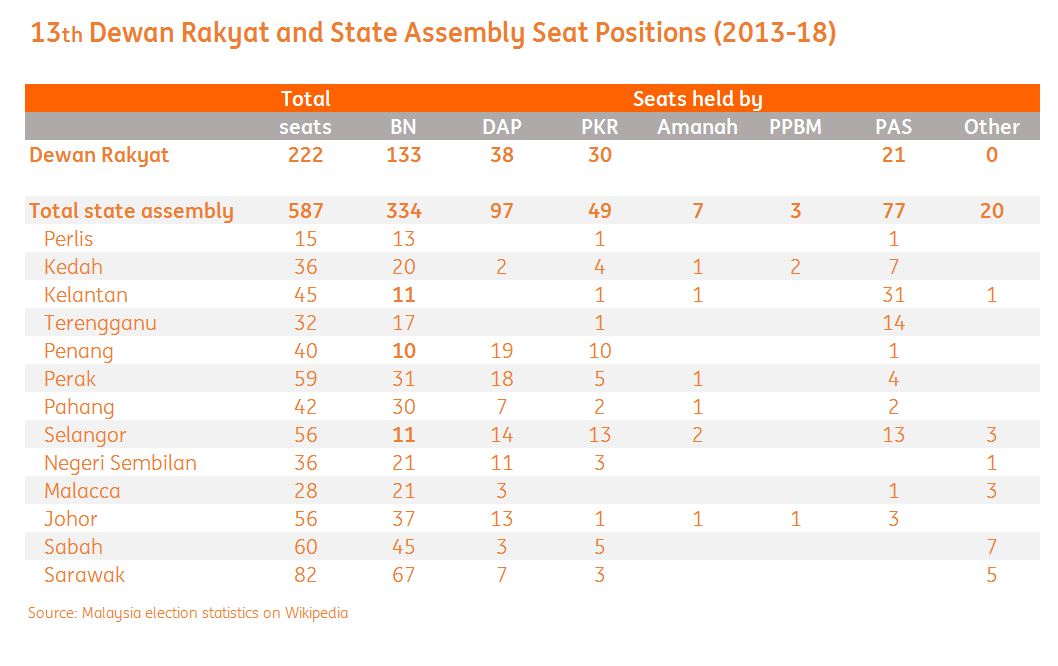

The BN held 129 of 222 Lower House (Dewan Rakyat) seats in the last parliament dissolved on April 6. And its latest standing in the State Legislative Assemblies was 334 out of 587 seats (or 57% of total seats) with ruling in 10 out of 13 legislative assemblies. The BN is most vulnerable in four state legislative assemblies (Kedah, Terengganu, Perak, and Negeri Sembilan) where they hold only a few more seats above the simple majority. The vulnerability in Kedah and also in Johor stems from Mahathir’s party (Malaysia United Indigenous Party), which currently holds one seat each and may gain more ground. The Pakatan Harapan coalition currently dominates in two legislative assemblies (Penang and Selangor), while the PAS rules Kalantan state.

Why is this such a close election?

Possible outcomes

This election could go one of three ways:

- A clear mandate for the BN coalition;

- A standoff or hung-parliament, or;

- An end of BN rule altogether.

A clear win for BN is likely to be the most market-friendly outcome ensuring that political and economic policies continue. A standoff could mean stretched-out political wrangling to form the next government, which could destabilise the economy and the markets for some time.

Dwindling voter support for Barisan Nasional

We think the third scenario of a complete election surprise is the most unlikely outcome and is largely being ruled out by markets currently. But a surprise new government led by Dr Mahathir would inherit a strong economy as a launch pad to consolidate power for the future, possibly paving the way for his son, Mukhriz Mahathir, to be his successor. Mukhriz was forced out after a short stint as chief minister of Kedah and could regain that post if the opposition gains control of this state.

Having ruled the country for two decades, Dr Mahathir may provide strong leadership, to begin with. However, Dr Mahathir’s old age (92 years) and potential political cracks with key allies especially his former rival Anwar Ibrahim, could cast a shadow on the stability of any Mahathir administration.

Key Economic Forecasts

Tags

MalaysiaDownload

Download article

19 April 2018

Good MornING Asia - 19 April 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).