Malaysia: The doors open for central bank policy easing

We are revising our view of Bank Negara Malaysia monetary policy from one of no change this year to one 25bp policy rate cut as early as next quarter (2Q19). There are no forceful arguments for easing just yet, but a pre-emptive easing to support future growth won’t hurt when there is room for such a policy change now.

Increased scope for pre-emptive BNM easing

We believe the latest consumer price data showing inflation at -0.7% YoY in January, the first negative reading in nearly a decade, has opened the door for a more accommodative monetary policy setting.

There are no forceful arguments for policy easing just yet, but a pre-emptive move to support growth won’t hurt when there is room for such a policy now. We now see the central bank (Bank Negara Malaysia) moving to cut rates at the next policy meeting in early May 2019, a shift from our earlier forecast of no policy change this year.

Balance of risks is tilted toward growth

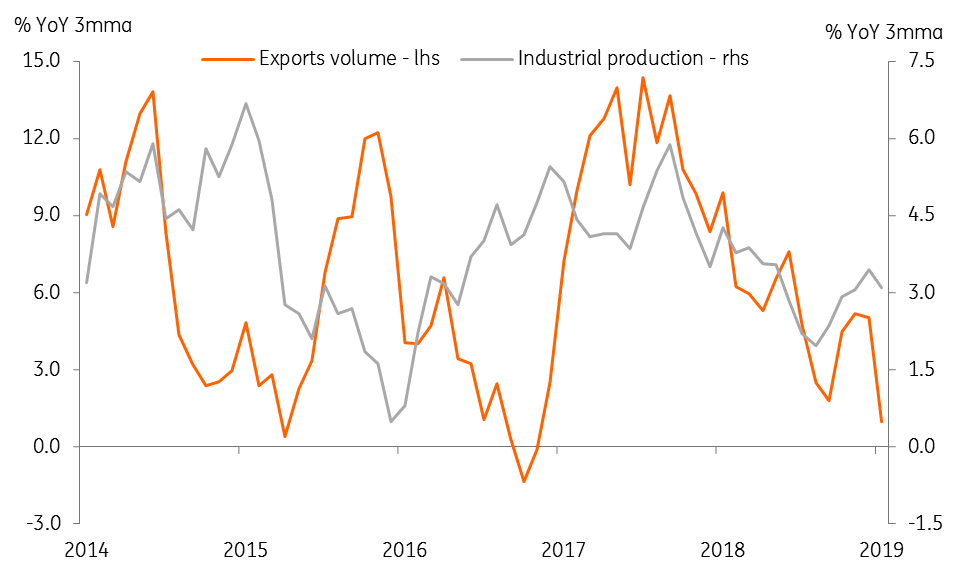

Following on from the surprising return to deflation in January, both exports and manufacturing growth came in on the softer side, so undermining growth prospects.

Released today, industrial production growth slowed to 3.2% year-on-year in January, from 3.4% in December. The outcome was better than expected (ING forecast 3.0%, consensus 2.3%). An IP slowdown squares with that in the export sector (at 3.1% growth vs. 5.1%). Among the other activity indicators released alongside the production data, manufacturing sales growth eased slightly (to 7.0% in January vs. 7.5% in December). Employment growth in the sector picked up (to 2.0% vs. 1.7%), but salary and wage growth slowed (to 8.9% vs. 10.1%).

The balance of economic risks is tilted toward growth. Exports and manufacturing drive GDP and their slowdown in January foreshadow a further GDP slowdown in the current quarter. We expect GDP growth to slow further - to 4.2% in 1Q19 from 4.7% in 4Q18. This is in line with the Bloomberg consensus forecast of 4.3% growth in the current quarter.

External uncertainties from trade tensions, weak global demand, and oil prices will all weigh on GDP growth over the rest of the year, amid anaemic investment spending at home. On the flipside, the favorable base effect and accommodative economic policies should prevent a sharp GDP slowdown should these risks intensify.

Slowing exports and manufacturing

| 4.2% |

ING forecast for 1Q19 GDP growth

|

Why might BNM ease?

Besides the downside growth risk, there are other reasons why we think BNM should cut the overnight policy rate by 25bp to 3.0% in May:

- Subdued inflation: January’s slide into negative territory is likely to be reversed in February (with data due next week, on 20 March). Despite steady strong employment and wage growth, the demand-pull pressure on prices has been absent. Administrative measures – including the low price ceiling for fuel prices until mid-2019 – are keeping cost increases contained.

- We see inflation remaining below 1% through the first half of the year. The impact of the Goods and Services Tax (GST) elimination moves out of the base in June 2019 and this is likely to push inflation to about 2% in the second half of the year. This would deliver a full-year average inflation rate of 1.4%, far below the 2.5-3.5% official forecast range as in the 2019 budget.

- High real interest rates: The recent disinflation trend has pushed real interest rates higher. Investment spending was the weak spot in GDP growth in 2018, especially after increased scrutiny by the Mahathir government of key infrastructure projects undertaken by his predecessor.

- Better now than later: Being ahead of the curve should allow sufficient time for the impact of monetary easing to trickle down to the real economy, thus preparing the economy to ride the slowdown trend. It won’t hurt that there is scope for easing now.

- Mature tightening cycle: Based on recent BNM policy history the current tightening cycle appears to have matured. Previous BNM tightening cycles have sometimes been short-lived and we think this could be another short one, particularly given prevailing growth-inflation dynamics.

- Market re-pricing for an easing: We infer from the greater than 20 basis point drop in the 10-year local government bond yield to the current 3.85% that the market has been re-pricing for a rate cut. Meanwhile, a sound external payment position is keeping the currency (MYR) among Asia’s outperformers this year. In a soft USD environment, this supports BNM easing now, rather than waiting to cut later.

High real interest rates

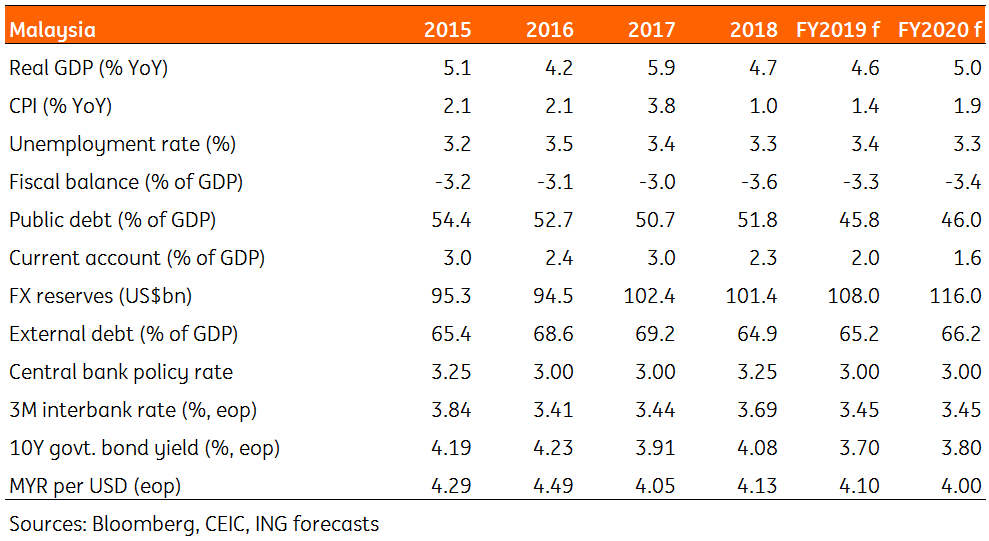

Malaysia: Key economic indicators and ING forecast

Download

Download article

15 March 2019

Good MornING Asia - 15 March 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).