Deflation returns in Malaysia after nearly a decade

The deflation spell looks transitory, but we don’t see any significant build-up in price pressures for the rest of the year. But even then, we don’t think the central bank will ease policy in 2019

Will the central bank consider easing policy?

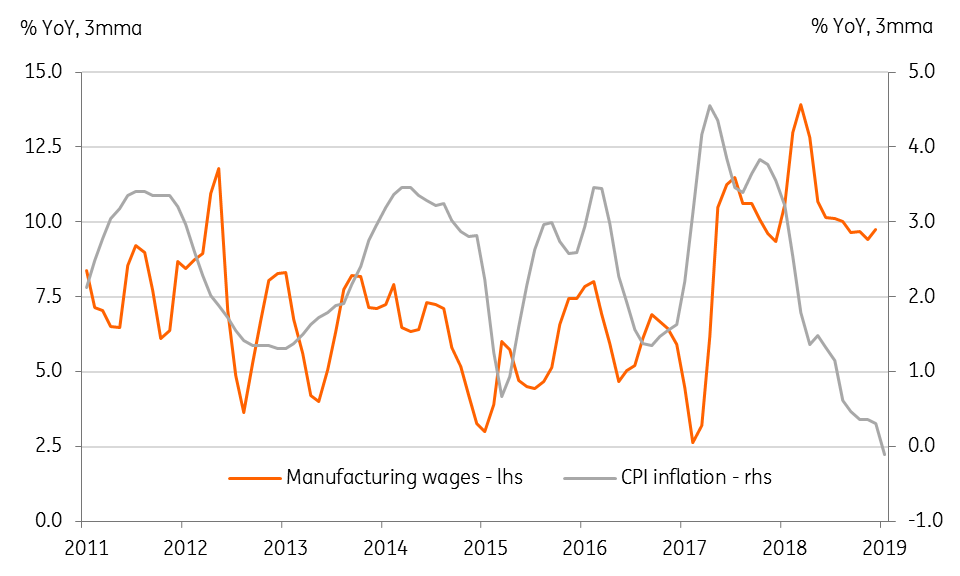

The current negative trend in consumer prices is the result of supply-side factors – such as the administrative cut in domestic fuel prices, so there is little monetary policy can do about this. A counter-argument to ease policy would be the lack of demand-side pressure as can be seen from the wage growth – manufacturing wage growth has been running around 10% year on year on the back of steady employment in the sector.

We believe the central bank will see through the latest CPI data and leave policy on hold this year.

Decoupling of wage growth and CPI

| -0.7% YoY |

CPI inflationJanuary |

| Worse than expected | |

Lower fuel prices dent CPI to deflation

Low fuel prices exacerbated the downward spiral in Malaysia’s consumer price inflation as we started in 2019. The 0.7% year-on-year CPI fall last month was the first negative reading since the 2007-08 global financial crisis, coming off the 7.8% fall in the transport component for which the administrative cut in fuel price was responsible. The authorities adjust domestic fuel prices weekly according to the movement in global oil prices.

Lower transport costs more than offset the uptick in food prices, while most other CPI components changed little from their levels in December. The core-CPI inflation of 0.2% YoY slowed from 0.4% in December.

Pass-through of lower global oil prices to domestic transport prices

Benign inflation outlook ahead

This reinforces a weak start to consumer prices in the year that’s already reeling under the removal of the 'Goods and Services' tax in June 2018. However, we expect deflation to be short-lived and return to inflation within the current quarter. Global oil prices are creeping upwards and will transmit into domestic fuel prices, but there is unlikely to be a significant pick-up in inflation until the GST impact moves out of the base by mid-2019.

We see inflation rising to 2% in the second half of 2019, though the full-year average rate is likely to be shy of the central bank’s 2.5-3.5% forecast for the year. It will take a significant thrust from either the demand or the supply side to hit the central bank's forecast, and neither of these scenarios is our base case.

Download

Download article

25 February 2019

Good MornING Asia - 25 February 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).