Malaysia: Trade growth ends 2017 on weak note

Malaysia’s December trade surprised on the downside but 2017 was still the best year for exports since 2011

December trade growth misses expectations

Malaysia’s December trade surprised on the downside with Malaysian ringgit (MYR)-denominated export growth of 4.7% year-on-year and import growth of 7.9% against the consensus forecasts of 12.7% and 13.6% respectively. The high base effect has begun to affect the year-on-year trade growth. The trade surplus narrowed to MYR 7.3bn in December from MYR 9.9bn in the previous month. Electronics and oil-related products remained the main trade drivers.

| 15% |

Export growth in 2017Among best performers in Asia |

Positive terms of trade shock

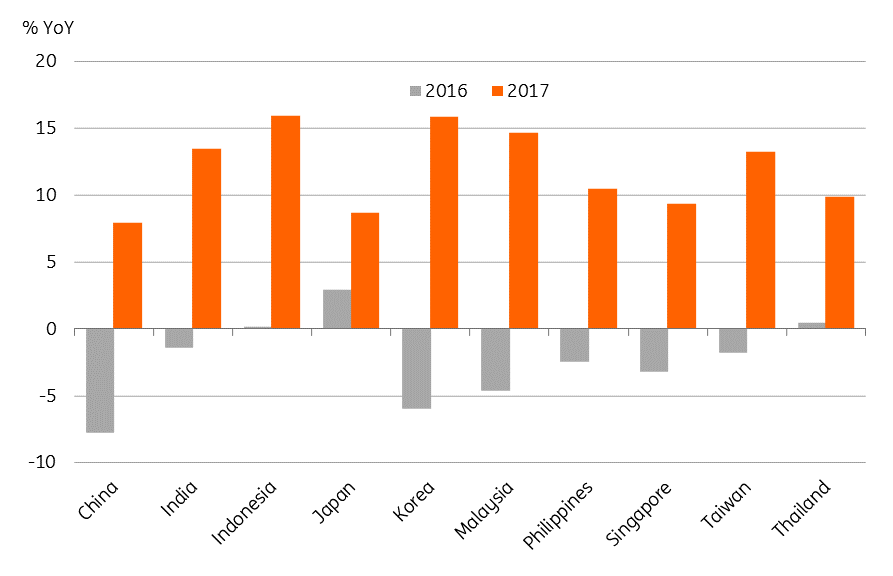

Despite weak December growth, 2017 was the best year for Malaysia’s exports since 2011. Although 2017 export strength across regional countries was partly a function of 2016 weakness, the terms of trade were more favourable for Malaysia than for other Asian countries, thanks to a recovery in global oil prices, an upturn in the global electronics cycle and an undervalued MYR.

The 15% US dollar-denominated export growth was a big positive swing from -5% in 2016, the second best in Asia after Korea. However, unlike Korea whose export strength was narrowly based due to its concentration in semiconductor exports, Malaysia’s export strength was broad-based. Non-oil exports contributed 12 percentage points to the 15% headline growth, of which semiconductor contribution was only three percentage points (in Korea, half of 16% total export growth was from semiconductor exports).

Asian export performance

Widening external surpluses

The high import content of exports and strong domestic demand supported imports with USD-value growth of 16% in 2017, up from -4.2% in 2016. The annual trade surplus of USD 22.7bn was slightly wider than USD 21.3bn in 2016. The trade surplus drives the current account surplus and we forecast a current surplus of 2.9% of GDP in 2017, up from 2.1% in 2016 (consensus 2.7%).

Outlook for 2018

The recovery in global commodity prices should continue to support Malaysia’s trade in 2018. While MYR’s 10.8% appreciation against the USD in 2017 has it approaching fair value, Malaysia’s strong economic fundamentals and weak USD environment mean the currency should remain on an uptrend this year. We forecast another 5% MYR appreciation against the USD this year to 3.72 by end-2018 (spot 3.91, consensus 3.85).

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).