Korea: The central bank hikes policy rate by 25bp

Today’s rate hike resets the Bank of Korea’s policy for yet another long pause, possibly throughout 2019. We are reviewing our forecast of one 25bp hike in the third quarter of 2019

| 1.75% |

The BoK policy rateUp by 25bp today |

| As expected | |

A 25bp BoK policy rate hike

The Bank of Korea’s Monetary Policy Board voted to increase the Base Rate by 25 basis points (bp) to 1.75% at their meeting today. The rate hike doesn’t come as any reprieve to the Korean Won (KRW) from its recent underperformance vis-à-vis Asian currencies. Despite the rate hike, the USD/KRW spiked above 1123 in early trading today, though as of this writing the pair had retraced to Thursday's closing level of 1119.4.

The worsening export prospects as signalled by the recent rout in global technology shares will likely cap the upside for the currency while the rate hike won’t be conducive for growth when inflation remains well-anchored around the BoK’s 2% comfort level and is likely to track the global oil price lower. That said, the risk to our view of the USD/KRW spiking to the 1150 level in the near term remains skewed to the downside.

Not a unanimous decision

The rate hike, coming after a year-long pause, was widely expected, though we were sceptical of such a policy move just yet on grounds of anaemic growth and low inflation. These trends are likely to persist through 2019 amid intensified global trade tensions and lower oil prices. And indeed the decision wasn’t unanimous by all BoK policy board members; two out of seven board members favoured no change to the policy rate.

It appears that financial stability, rather than the current growth-inflation dynamic, was the paramount factor behind today’s policy move. Maybe gaining some policy space to increase accommodation in the event of a significant slippage in growth in the future was another factor.

The financial stability concern arose from the widening rate gap with the US as the Fed continues on the policy tightening path with another rate hike expected in December, albeit recent Fed signals of a more flexible approach towards the policy in 2019. This partly explains the recent underperformance of the Korean Won (KRW) vis-à-vis Asian currencies despite a persistently large external trade surplus.

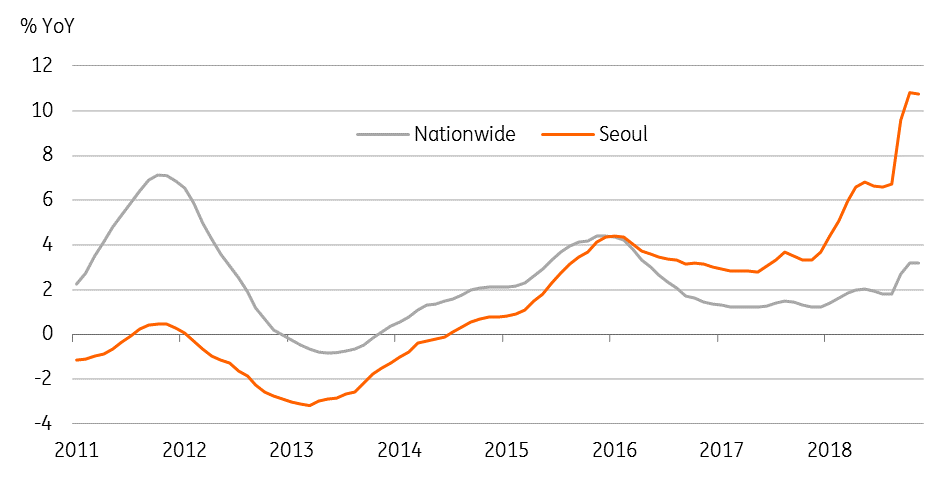

And on the domestic front, the authorities have repeatedly voiced their concerns about high household debt and property overheating in cities as being potentially destabilizing.

Korea: Kookmin Bank home price index

Was the rate hike warranted?

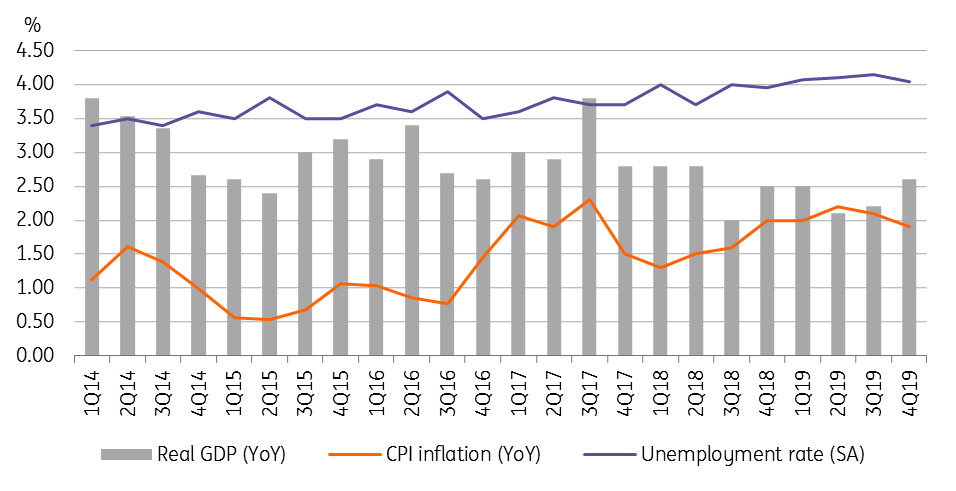

The BoK sees growth around the mid-to-upper 2% range and inflation around the mid-to-upper 1% range. On growth, the policy statement noted that “…domestic economic growth to be generally consistent with the path projected in October, and to sustain a rate that does not diverge significantly from its potential level”.

While the BoK’s forecast ranges for growth and inflation appear reasonable for now, the risk continues on the downside.

We consider the BoK’s growth forecast for the outer years, in this case, 2.7% forecast for 2019 as in the central bank’s quarterly Economic Outlook report published in October, as its estimate of potential growth. Judging by this, the 2% growth print for the third quarter of this year was a far cry, and it had taken the steam out of the rate hike argument. Moreover, growth has been stuck under 3% since 4Q17 and it will take a significant acceleration to at least 3.2% in the final quarter of this year to meet the full-year 2018 forecast of 2.7%. As things stand currently, this looks difficult to us.

At the post-policy press conference, Governor Lee Ju-yeol downplayed risks about a sharp downturn in the chip (semiconductor) sector. Korean electronics exports have outperformed their Asian counterparts (Taiwan, Singapore) this year. However, the recent rout in global technology stocks is a sign of something more than mere moderation in the global electronics cycle on the horizon. If so, the prospects of Korean electronics exports maintaining their current strength into 2019 looks dim.

And on inflation, we believe it’s close to the peak and expect it to retrace alongside the lower oil price.

Korea: growth, inflation, and unemployment

One and done - a start of another long policy pause

We believe today’s rate hike resets the BoK policy for yet another long pause. Governor Lee said that the policy was still accommodative and the policy rate still below its neutral level. However, his remarks about dissenting votes as pointing to high economic uncertainty indicate a persistent headwind for the policy rate to reach the neutral level anytime soon.

We are reviewing our forecast of one 25bp hike in the third quarter of 2019.

Download

Download article

3 December 2018

Good MornING Asia - 3 December 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).