Key events in EMEA in Latam next week

Central bank decisions from Romania and Serbia, inflation data from Hungary and unemployment figures from the Czech Republic are among the highlights next week

Hungary's industrial production set to show positive signs

In Hungary, we expect industrial production to show some promise despite the start of the holiday season in June. But the real fireworks are likely to come in July, which was when Audi finally started production of electric vehicles. As EU funds are still not coming from the bloc, we expect the budget balance to remain deeply in negative territory. However, the highlight of the week comes on Wednesday, 7 August with the July CPI reading when we'll see another jump in fuel prices and therefore project headline CPI to accelerate to 3.3% year-on-year, a new five-year peak.

We call for an out-of-consensus hold by the National Bank of Romania at 2.50%

The reasons behind our call for the NBR to stay on hold at the 6 August meeting are:

- A tighter policy stance is already in place due to higher ROBOR and a stronger Romanian leu

- The output gap is likely to be revised and we'll then see a subsequent shift lower in the core inflation outlook

- The dovish NBR Board needs more time to assess mixed-to-weaker soft data

- More details are needed on the upcoming budget revision

- There's no sign of a credit-driven asset price bubble.

We attach a 20% probability to a 25 basis point hike, as policymakers could be swayed by the consensus view, which calls for a hike.

Romanian CPI to fall on base effects

Large base effects (such as the hike in electricity prices from July 2017 dropping out, a cut in regulated electricity prices, a stronger Romanian leu and lower fuel prices) are all expected to push July 2018 CPI down by 0.6 percentage points to 4.8% year-on-year. We expect core inflation to be flat at 2.9% YoY.

Serbia's key rate on hold at 3%

The 9 August Executive Board meeting should be a non-event, with headline inflation at 2.3% in June and 2Q18 GDP growth strong at 4.4%. We see inflation expectations as well anchored in the 3%±1.5ppt inflation target band, while economic growth could surprise quite sharply on the upside in 2018.

Czech Republic: Unemployment on the rise

While the unemployment rate will increase slightly due to typical seasonal factors, namely graduates entering the labour market, retail sales (excluding motor vehicles) should remain strong on the back of solid wage growth and the record-high confidence of households. Industrial production will be affected by the working-days bias, a high base and subsequent slowdowns in the automotive segment. We expect a figure of 2% YoY, below the year-to-date average.

In month-on-month terms, food and fuel prices have stagnated, leading us to forecast a deceleration for July's CPI reading after a better-than-expected June CPI result at 2.6% YoY.

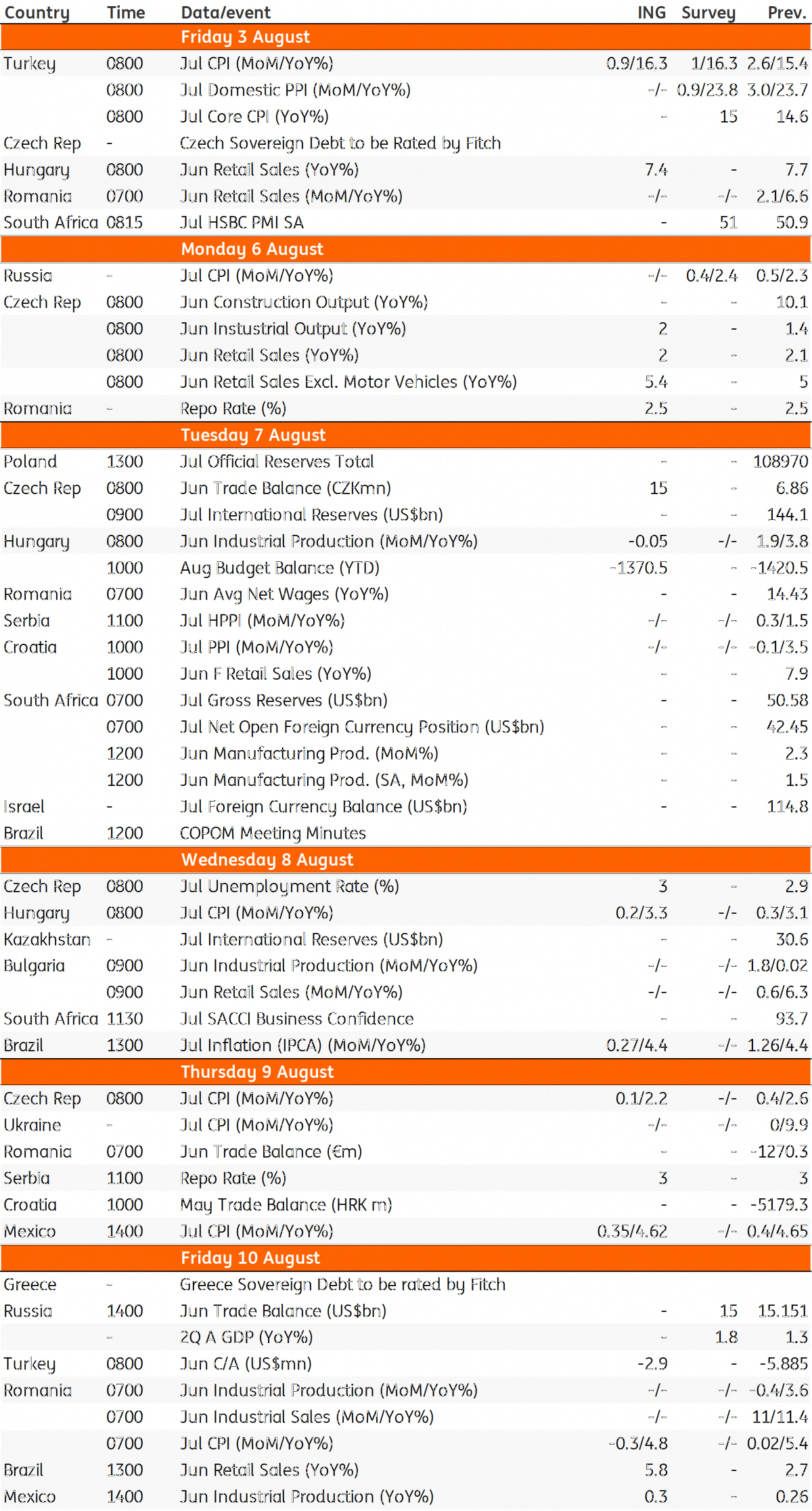

EMEA and Latam Economic Calendar

Download

Download article3 August 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more