Key events in EMEA and Latam next week

A data-heavy week expected in EMEA and Latam. Look out for improvements in Czech data and a mixed performance from Hungary and Serbian central bank meetings

Czech data to strengthen

After somewhat weaker March data, April statistics should come in positive again, partially due to the calendar bias and a low base from April last year. Still, wage dynamics should accelerate further, with real wage growth above 6.5% year on year, the strongest in the previous 15 years. This suggests that household consumption will remain the main growth factor this year.

Taking into account the weak Czech koruna lagging behind the Czech National Bank's expectations, solid data and inflation likely to be above the 2% target in May, a June hike scenario is becoming more and more likely.

Turkish inflation pressures to intensify

We expect May inflation to come in at 1.7% month on month, pulling the annual figure up to 12.2% from 10.85%. This stems from intensifying inflationary pressures with the recent Turkish lira depreciation weighing on the outlook for core goods, energy inflation and the upward pressure from domestic PPI.

For the June MPC, we don't rule out a measured 50bp hike in the 1-week repo rate at 16.5% after the simplification by the central bank.

Serbia: Key rate on hold at 3%

Inflation is likely to have reached its lowest point this year in April at 1.1% YoY, but this was not enough to convince the National Bank of Serbia (NBS) to cut key rate further at the last meeting.

We look for a no-change decision at next week's meeting as going forward inflation should slowly resume its upward trend while the external environment also warrants caution. The Serbian dinar appreciation pressures could be among the few factors calling for a cut, but in our view, this is not enough.

Hungary: Action-packed start to June

We are facing an action-packed start to June with economic activity slightly mixed in April. Retail sales may strengthen further on the back of one-offs and due to the increasing wage bill. Industrial production may slow down further if we believe soft indicators.

The statistical office will release the details behind the surprisingly strong GDP data in 1Q18. We expect consumption and investment to be the main drivers, with more momentum on the consumption side.

The budget balance could deteriorate further. We might even see the bottom in May as the Ministry of Finance recently announced that “Hungary needs deficit cuts in response to market risk”. Last but not least, we see headline inflation accelerating on the back of the oil price shock, in line with Europe.

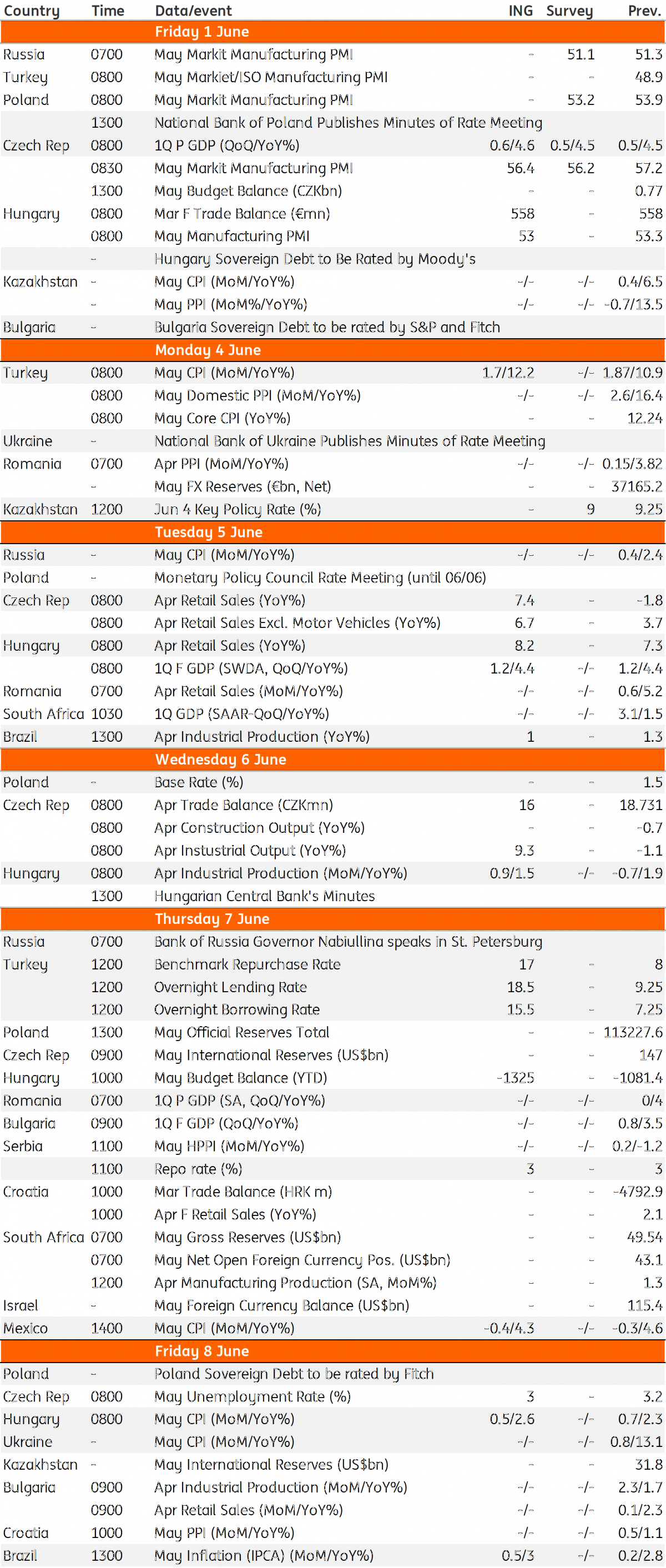

EMEA and Latam Economic Calendar

Download

Download article1 June 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more