Key events in EMEA and Latam next week

One main question in EMEA and Latam next week will be why Hungary's 3Q18 GDP was so surprisingly strong? Russian CPI will be watched closely too, as it could nudge our base case to a hike in December

Hungary: Why 3Q18 GDP was surprisingly strong

We expect manufacturing PMI to continue its rebound and in line with this, we see industrial production bringing positive momentum in October, along with a pick-up in retail sales growth.

The statistical office will release the detailed GDP figures, so finally we will have evidence behind the surprisingly strong 3Q18 GDP growth. We expect strong readings in consumption and investment activity. The budget deficit will improve on an expected inflow of HUF 100bn from Brussels and one-offs, as the government has already paid the October public wages and family allowances, improving the cash-flow in November.

Turkish inflation past its peak?

We think inflation peaked in October, so will likely record a decline of -0.8% month on month in November. This is on the back of tax cuts on certain goods and a decline in energy prices, which should pull the annual figure down to 22.4% from 25.2% a month ago. However, inflation is still set to remain in the 22-25% range in early 2019, before falling more rapidly in the second half.

A December hike could on the cards for Russia

The November CPI reading will be an important one for the upcoming central bank meeting in December, which currently fluctuates between a hold at 7.50% and hike to 7.75%.

Further acceleration in CPI growth vs. October’s 3.5% YoY is inevitable, and for the most part, accounted for by the market and the Bank. However, steady -0.15% week on week inflation seen in the last three weeks suggests that even our above-consensus expectation of 3.9-4.0% YoY for November could be exceeded, as overall local prices are catching up with the rouble depreciation of 12-13% year-to-date and the recent pick up in gasoline prices.

For now, it would be premature to consider a rate hike a base case scenario

But having said that, the recent deterioration in households’ 12-month CPI expectations from 9.3% to 9.8% coupled with increased likelihood of restored FX purchases on the market since January 2019 - which were indicated recently by the CBR governor and corresponds to higher currency liquidity, should mean that a 4.0%+ CPI reading for November (and the corresponding risk of December CPI exceeding the 4.2% central bank target) would increase the arguments in favour of a rate hike, regardless of the external backdrop.

We also note that even if the central bank proceeds with FX purchases in January 2019, it will not necessarily weaken the rouble from the current levels. First, the expected current account surplus of $25-30 billion in 1Q19F would be enough to cover the likely $10 billion FX purchases and the $5-10 billion net corporate foreign debt redemption. Second, the return of FX interventions will take place only in case of no deterioration of the external environment. We continue to expect USD/RUB to be in RUB 63-65 range at the end of the year and 1Q19F on balance of payment fundamentals provided no new external shocks take place.

Potential slowdown will keep National Bank of Poland on hold

The next central bank meeting in Poland is likely to be a non-event as governor A.Glapinski should maintain dovish rhetoric as CPI inflation is likely to undershoot the lower boundary of the Bank's inflation target (1.5% YoY) in the forthcoming months. No change in policy is also supported by the potential activity slowdown.

The PMI reading should fall further, close to the 50 pkt recession threshold. Sentiment deterioration mainly reflects doubts regarding the weaker activity of the western EU countries.

Still a strong story for Czech wage growth

Wages in the third quarter should remain strong, but due to the base effect related to increasing public wages a year ago, we expect a slowdown to 8% YoY from 8.6% YoY in the previous quarter. Given the average inflation in 3Q18 is 2.4%, real wage growth should reach 5.5% YoY.

Retail sales will continue to be affected by new emission norms hindering sales of new cars. But retail sales excluding cars should solidly reach above the average YTD-growth, supported partially by the calendar bias.

Serbia's central bank to stay on hold at 3%

The minor uptick in inflation from 2.1% in September to 2.2% in October will not be a reason for the National Bank of Serbia to change its policy stance at the December meeting. Moreover, core inflation remained muted at 1.1% for the third consecutive month. Hence, we expect another neutral communique pointing to evenly distributed balance of risks.

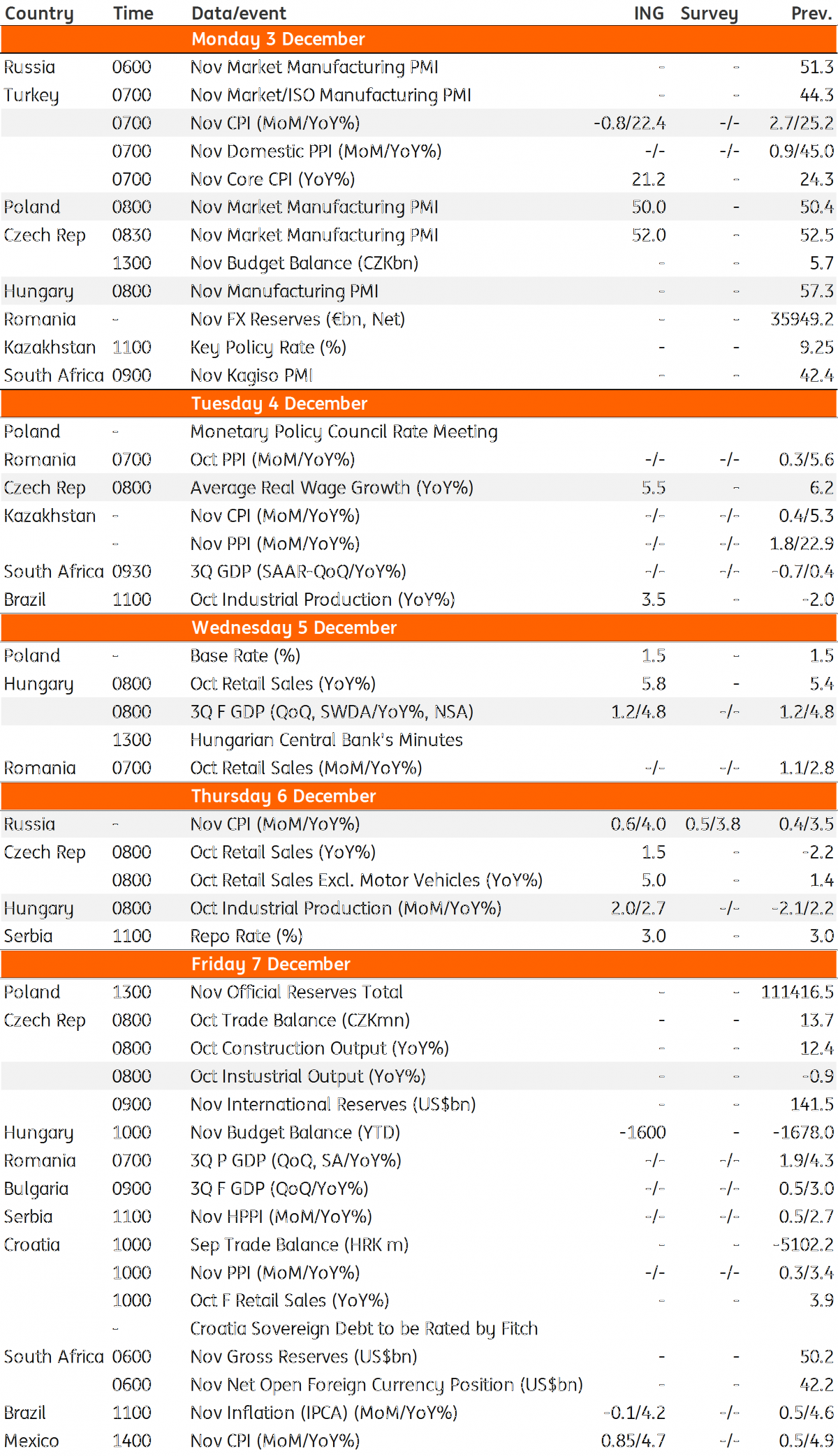

EMEA and Latam Economic Calendar

Download

Download article30 November 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more