Key events in EMEA and Latam next week

It's central bank frenzy next week, but don't expect any changes to monetary policy. Plus, we get a new set of macroeconomic forecasts from Poland as well as inflation data from Hungary, Turkey and Russia

Central bank of Turkey: Quiet despite swap curve suggesting otherwise

We expect the central bank of Turkey to keep rates on hold next week at 24%. The Bank continues to be cautious in signalling any rate cuts and is focusing on macroprudential policies for the time being, despite aggressive easing priced in by the swap curve until the end of the year.

On the inflation side, following a decline in short-term CPI momentum - which brought the annual figure down to 20.4% in January from its October peak, we estimate the February reading to be at a similar level, with the annual change to be pulled down to 20.0%. Still, upside risks remain in the near-term given the marked deterioration in pricing behaviour and volatile food prices.

Hungary: Inflation pressures could encourage a March rate hike

Investors following Hungary face a busy week, but the most important data could be inflation. We see both headline and core figures accelerating - the latter reaching 3.4% year-on-year, which should push the National Bank of Hungary to change its monetary policy stance in March.

Economic activity data is expected to show a soft patch for growth - especially due to work stopping at an Audi factory in January, which is likely to translate into weak industrial data. Retail sales are expected to increase further - albeit at a slower pace, and we see the budget balance remaining well in surplus due to a net inflow from EU projects.

National Bank of Poland: Flat rates, new macroeconomic forecasts

The monetary policy committee is expected to keep rates flat on Wednesday. The National Bank of Poland will also publish new macroeconomic projections. We expect a material downward revision to its CPI forecast for 2019 - from 3.2% to approximately 2% YoY on the back of lower energy prices.

The November release assumed no government intervention in the electrical energy market, which effectively lowered price levels in January. According to central bank governor Adam Glapiński, some comment on upward revisions to the 2019 GDP forecast (3.6% YoY) is also possible. The March economic projection is unlikely to incorporate the effects of fiscal stimulus related to recent PiS leader pledges.

National Bank of Serbia to stay on hold at 3.0%

Both year-end and average 2018 inflation came in at 2.0%. Core inflation has been even better behaved, averaging 1.0% for the year and confirming the benign inflationary environment. Assuming quasi-constant oil prices, we see headline inflation inching marginally higher towards 2.4% in the first quarter of 2019 mainly due to base effects, and then to return and hover around 2.0% for the rest of 2019.

We expect no change from the National Bank of Serbia at the 7 March meeting.

Czech Republic: 2018, a pretty picture for wage growth

As usual, February's unemployment rate is supposed to decline slightly due to seasonal reasons. Average wage growth should remain solid, but based on fourth quarter GDP data, we think the slowdown will be closer to 7%, compared to the CNB's forecast of 8% in nominal terms after an 8.5% reading in the 3Q18. With inflation averaging 2.1% in 4Q18, real wage growth should reach 5.0%. Still, average real wage growth for the whole of 2018 will exceed 6% for the first time since 2002.

Russia: Will CPI peak in February? We think it still has some way to go

In February, Russia continued to experience the consequences of the VAT hike, meaning CPI likely increased by 5.3% YoY vs 5.0% in January and 4.3% YoY at the end of 2018. While the initial spike is fading, it is too soon to tell at what level CPI will peak.

We remain on the pessimistic side of the consensus, expecting inflation to continue crawling up towards the 6.0% mark in 1H19 due to persistent pressure from the PPI side - especially in the oil downstream sector. The likelihood of a rate hike in March remains well above zero.

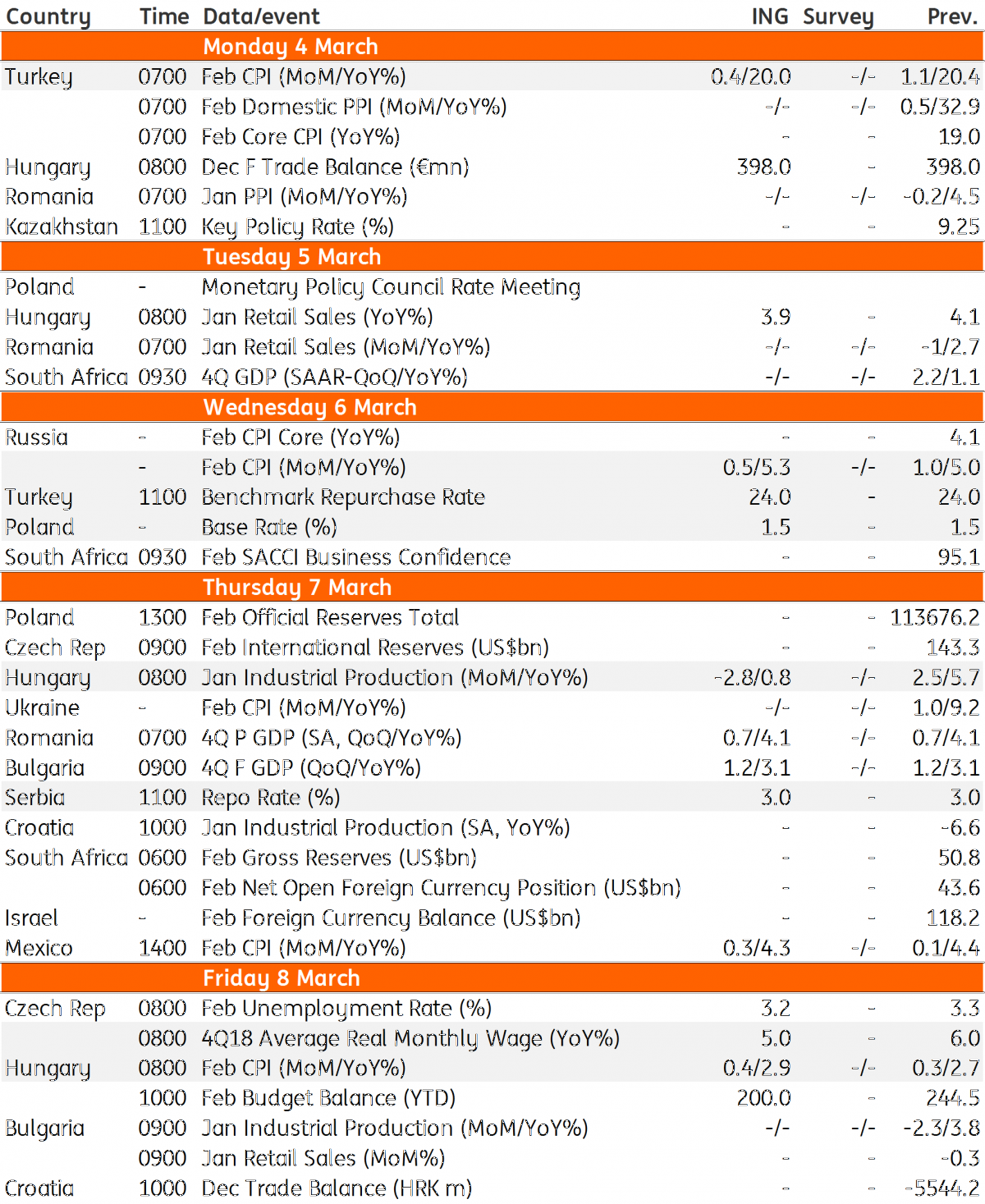

EMEA and Latam Economic Calendar

Download

Download article1 March 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more