Key events in EMEA and Latam next week

In a relatively quiet week, a few things stand out; Polish retail sales for March will likely be soft, though that shouldn't be interpeted as a sign of a weakening trend, and while central banks' of both Russia and Turkey are likely to keep rates steady next week, cuts could be on the horizon

Bank of Russia to ease rhetoric but unlikely to cut the 7.75% rate on 26 April

Monetary authorities are likely to acknowledge that near-term inflation risks have dissipated, with CPI apparently peaking at a lower-than-expected rate of 5.3% YoY. Policymakers are also likely to discuss the improved sentiment in financial markets and ways to compensate producers for the local gasoline price freeze, which could be extended beyond the currently agreed 1 July.

At the same time, we don’t think the Central Bank of Russia (CBR) will be in a rush to cut the key rate at the upcoming non-core meeting, due to persistent mid-term risks, including:

- PPI growth at 10.9% year-on-year, significantly outperforming CPI over the last two years. This may mean that the CPI’s return to the 4% CBR target may take longer-than-expected - especially if consumer demand recovers throughout the year.

- Inflation expectations of households and corporates- though off their peaks- remain elevated.

- Russians don't seem to find RUB rates attractive for savings, as RUB deposits were down 1% - or RUB200 billion - in 1Q19, while FX deposits were up 7% - or $6 billion.

- The recent foreign policy narrative from the US highlights the persistent risk of wide range of sanctions.

That said, should the abovementioned risks fail to materialise, our current call of no key rate cut before 4Q19 will become too conservative.

Poland: Easter to soften retail sales

We expect a softer retail sales reading in March but this should reflect calendar effects related to Easter, rather than shifts in consumer spending. The overall trend actually remains stable and we anticipate that April should post a strong reading, with calendar effects actually helping this month.

Central Bank of Turkey: Rate cuts? Any signals will be given with caution

In the rate setting meeting on 25 April we expect the Central Bank of Turkey to remain on hold and keep the 1-week repo rate at 24%, given macro uncertainties and recent currency volatility. We think the bank will remain cautious on signalling any rate cuts, if anything, don't rule out a more hawkish message in the accompanying statement.

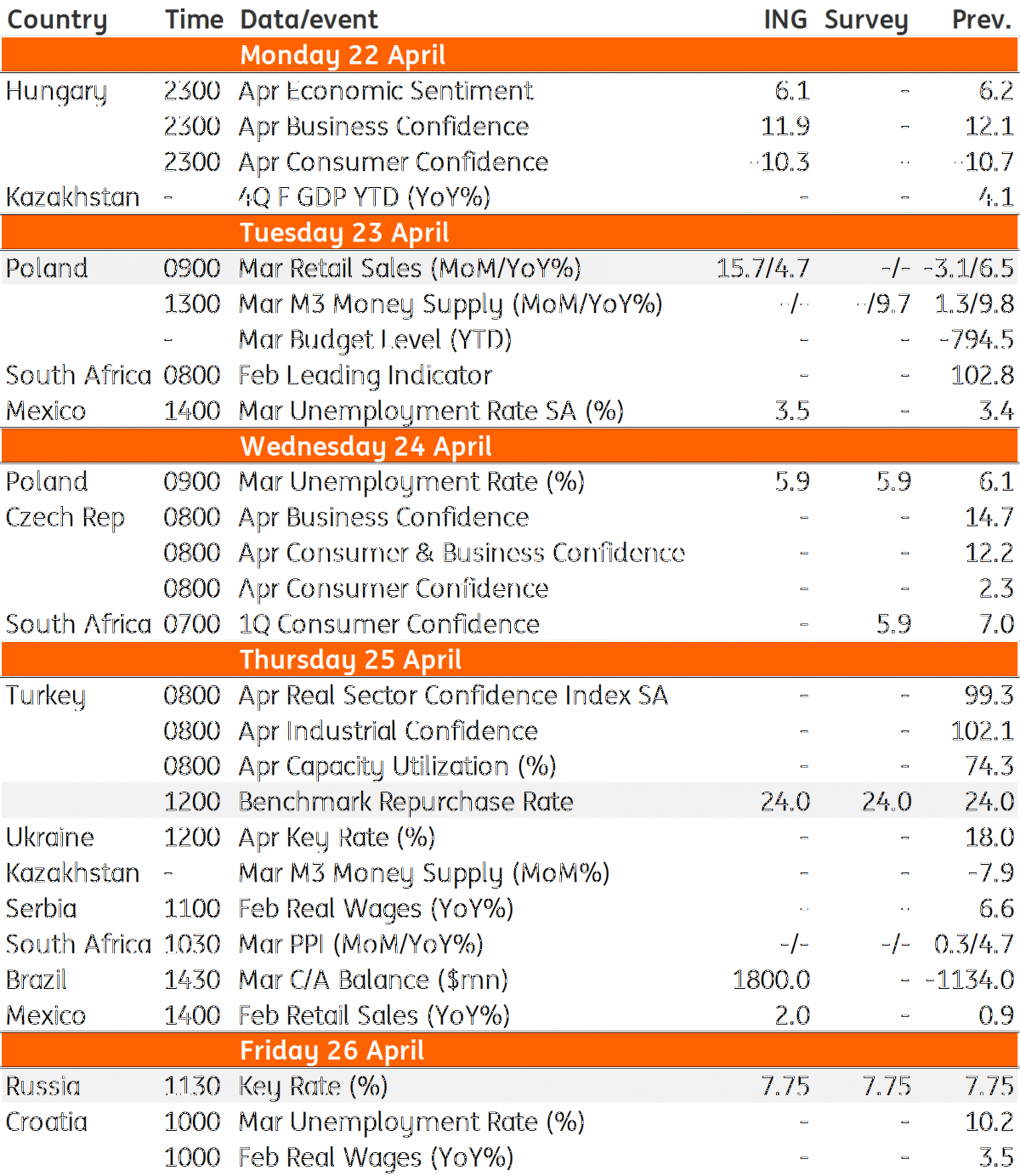

EMEA and Latam Economic Calendar

Download

Download article18 April 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more