Key events in EMEA and Latam next week

The moment of truth arrives next week as 2Q GDP data across EMEA is released next week. We are bound to see some historic drops, but the real question is how big?

Hungary: Expect a large drop in 2Q GDP

Like others in Europe, Hungary won’t have much to cheer about next week as second-quarter GDP numbers are released

We expect a 10.5% year-on-year drop in GDP, posting a new record after the collapse in mid-2009. Unfortunately, the preliminary data release won’t include details about the structure of the collapse. To see this we must wait another two weeks.

Our best guess is that only government spending might contribute positively to the economic activity while other areas on the final use side (mainly consumption and investments) will provide a huge drag on growth.

Before GDP data, July inflation numbers will be released. Excise duty increased on tobacco, end of free public parking, fuel prices increased, draught and a weaker HUF. These are the factors which we see contributing in accelerating headline and core inflation figures.

Poland: Optimism from CA data may be weakened by negative GDP reading

This week we expect another stellar current account reading, for June. Polish exporters were relatively resilient to the pandemic, partially down to their lower share of automobiles in the industry compared to CEE counterparts. Also, investment activity is most likely weak, keeping imports subdued. A lasting improvement in trade balance is one of the key reasons behind the zloty remaining stable despite a very dovish central bank.

Next week, we're also expecting a terrible (but close to the local consensus) flash GDP reading for 2Q20: -9% YoY. This largely reflects the lockdown in Poland, affecting consumption and investment.

The ongoing recovery is likely to prove slow due to worsening labour conditions.

Czech Republic: Inflation to slow down

July CPI is likely to slow down close to 3%, but uncertainty remains elevated. Not only due to food prices, that have developed recently against a typical seasonal path, but also due to many other prices that might have been impacted by the Covid-crisis.

Prices of holiday packages have been increasing substantially during July, and this year might be less pronounced, at least for some types of holidays.

As such, we expect slightly weaker than usual MoM increase this July, leading to some slow-down in YoY CPI, despite the fact that inflation has been surprising on the upside in recent months.

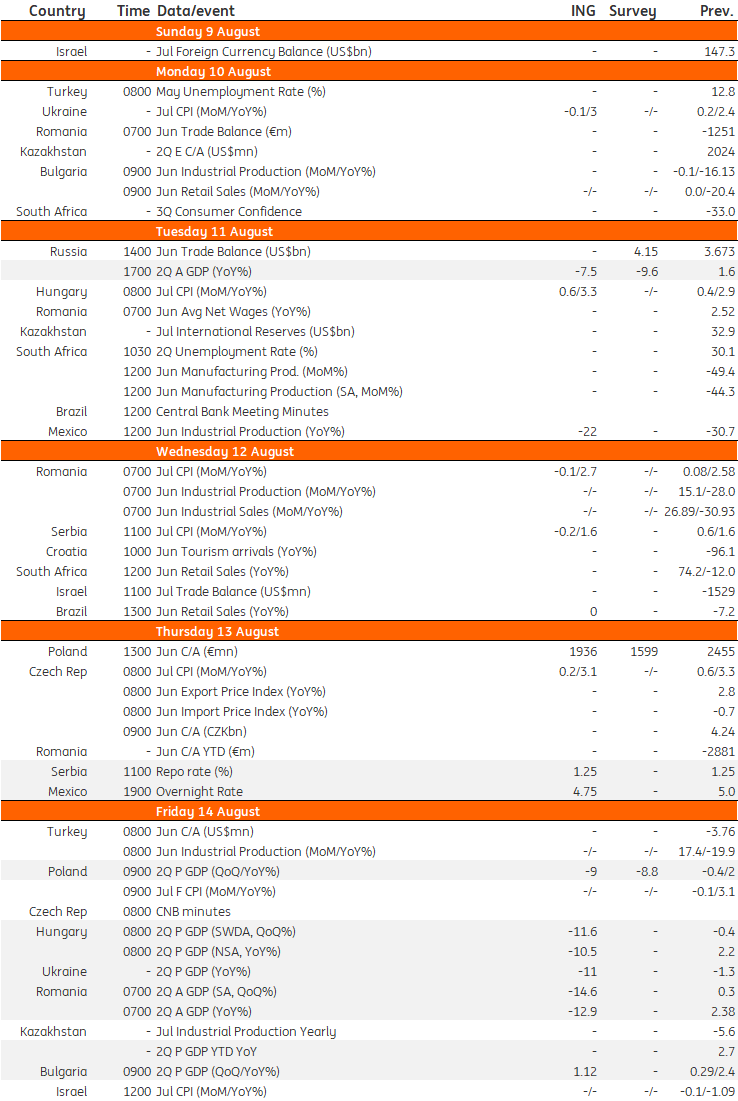

EMEALatam Economic Calendar

Download

Download article7 August 2020

Our view on next week’s events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more